Meritage Homes Corp. (MTH 0.85%) reported its fourth-quarter and fiscal-year 2016 earnings on Feb. 1, beating analyst expectations for profit. Yet following the company's earnings release and conference call with investors, shares were trading down 5%, because of a couple of things that have created some uncertainty around the company's ability to continue growing sales and profits.

Meritage's long-term strategy includes targeting more first-time homebuyers. Image source: Getty Images.

Let's take a closer look at Meritage Homes' results, and what management had to say about those results, as well as what to expect going forward.

A closer look at the results

Fourth quarter:

| Metric | Q4 2016 | Q4 2015 | Change (YOY) |

|---|---|---|---|

| Home closing revenue | $876.1 | $761.4 | 15.1% |

| Net income (loss) | $51.8 | $52.9 | (2.1%) |

| Earnings (loss) per share | $1.29 | $1.33 | (3%) |

In millions, except per-share data. Data source: Meritage Homes Corp.

Fiscal year:

| Metric | Q4 2016 | Q4 2015 | Change (YOY) |

|---|---|---|---|

| Home closing revenue | $3,003.4 | $2,531.6 | 18.6% |

| Net income (loss) | $149.5 | $128.7 | 16.2% |

| Earnings (loss) per share | $3.74 | $3.25 | 15.1% |

In millions, except per-share data. Data source: Meritage Homes Corp.

The company reported strong revenue and profit growth for the full year, and even though net income for the fourth quarter declined from 2015, it was stronger than the guidance management gave last quarter. When the company reported third-quarter results last October, full-year guidance was for earnings per share between $3.40 and $3.60, far below the final $3.74 the company delivered, while $3 billion in revenue was right in the middle of the guidance range.

Things that bear watching closely

The market's dissatisfaction with Meritage's results seems to be focused on a few things. To start, the company closed on 7,355 homes in 2016, slightly above the bottom end of the 7,300-7,500 units management said it was expecting at the end of the third quarter. However, this was after the company cut its guidance, which had been for a range of 7,500-7,600 for the full year.

At the same time, the company reported a decline in its backlog, which consists of homes customers have put a deposit on. Meritage ended 2016 with 2,692 homes on its order backlog, 2% fewer than it had one year ago. The good news is that the value of this backlog is about the same as last year, because of increases in selling prices for homes on its backlog.

Fourth-quarter sales activity was behind this decline. The company reported 1,493 homes ordered in the quarter, a 5% decline from the 1,568 new orders in the fourth quarter of 2015.

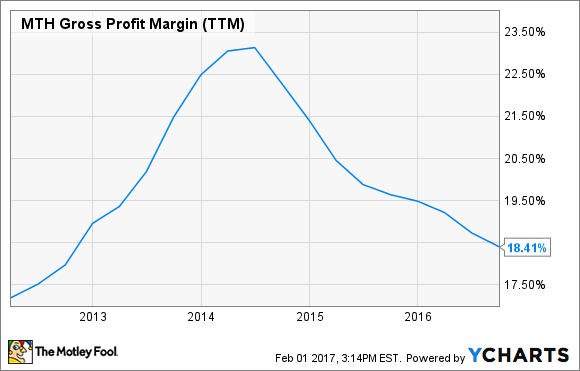

At the same time, gross margin continues to be an area under pressure. Home closing gross margin was 17.9% in the fourth quarter, which was the highest the company reported in any quarter in 2016, though it's well below the 19.3% delivered the year before, and well below the recent peak:

MTH Gross Profit Margin (TTM) data by YCharts

Meritage finished 2016 with home closing gross margin of 17.6%, down from 19% in 2016 and well below the peak in the preceding table.

Management said two things were driving this reduction: land and labor costs. This has been a constant refrain from the company over the past year and is something the entire homebuilding industry has faced. The bottom line is that there are just fewer skilled tradespeople available, and as homebuilding activity has ramped up over the past several years, increased competition for those laborers has driven wages higher. Factor in a spate of extreme weather events in major homebuilding markets in recent years, reducing available building days, and the labor market has been very tight -- and it isn't likely to improve overnight.

At the same time, land costs have also increased in many markets, and often faster than home prices have appreciated, putting additional pressure on gross margin for Meritage.

What management said it's doing about it, and what to expect

Let's talk about the shrinking backlog first. In the earnings release, CEO Steve Hilton pointed out a major driver in the decline in orders in the fourth quarter:

Our ending community count was down year over year as some community openings were delayed, which impacted our order volumes for the fourth quarter and full year 2016. We expect that to translate to slightly lower year-over-year order volume for the first quarter of 2017. However, we expect to open these communities in the first half of the year and are projecting significant year-over-year growth in the second half of 2017, resulting in new home deliveries of approximately 7,500-7,900 for the full year and total closing revenue of $3.1 [billion to] $3.3 billion.

In other words, it looks as if the company will deliver first-quarter results that are a step backward, as the rollout of new communities takes place over the first half of the year. The end result is expected to be full-year sales that are up "only" 3%-10%, and on similar gross margin results as in 2016.

However, Hilton went on to point out that management continues to make cost management a priority, as higher labor and land costs remain a challenge. He said he expects pre-tax earnings to increase 6%-12% for the full year, because of cost management and additional operating leverage from the revenue growth the company is anticipating.

The company also made substantial land investments in the quarter, finishing the year with 29,800 lots, a 2,000-lot increase year over year, giving the company approximately four years' supply of land.

Looking ahead

Most homebuilders continue to face land and labor pressures, and Meritage isn't immune. Factor in unfavorable property development timing that left it with fewer properties to market to start 2017 than it had last year, and the market has turned negative on the company's stock.

But if management can deliver on getting those new communities online quickly, sales are likely to recover -- at least based on the company's history of delivering solid results. At the same time, management has also done a solid job over the past year of managing operating costs to help mitigate higher building expenses, and Hilton is steadfast that this trend will continue.

Hilton also said the company remains on track in its strategic shift to a higher mix of homes targeting first-time buyers. He said Meritage is "well on [its] way to achieving [its] target" of 35%-40% of communities aimed at first-time buyers by the end of 2018.

Meritage may take a small step backward early in 2017, but it looks poised to return to growth in the second half of the year. And while construction costs aren't expected to soften over the next year, better operating leverage and lower operating expenses should help offset that pressure and drive profit higher by year's end.