Helmerich & Payne, Inc. (HP 1.92%) has an impressive dividend record, particularly when you take into consideration that it operates in the highly cyclical oil and gas services industry. The problem for investors, though, is that a dividend decision a few years ago obscures the income story here. This is one stock where the trend isn't what it seems, and a little more analysis is needed to understand Helmerich & Payne's true dividend potential.

44 years and counting

Helmerich & Payne has increased its dividend each and every year for 44 consecutive years. That's nothing short of impressive, putting it up there with companies like Consolidated Edison, Kimberly-Clark Corp, and Wal-Mart. That's rarified air for sure, and it shows a deep commitment to returning value to shareholders. Add in the current yield of roughly 4%, and income investors are sure to be interested.

Image source: Helmerich & Payne, Inc.

But you can't just stop there. You have to look deeper. For example, Helmerich & Payne's dividend streak looks even more impressive when you consider that it operates in the highly cyclical oil and gas drilling services business. To give you an idea of just how volatile that business is, at the end of fiscal 2016, only 25% of the company's drill rigs were being used by customers. At the end of fiscal 2014, just as oil prices were getting set to tumble, that number was nearly 90%.

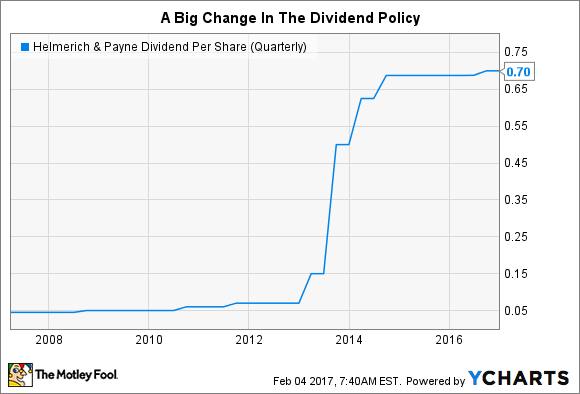

You have to ask yourself how a company with such variability in demand can keep upping the dividend year-in and year-out? The answer is that it doesn't. Helmerich & Payne has historically increased dividends in the middle of a calendar year, which means it can hold the dividend steady for up to 10 quarters and still maintain its annual streak based on nothing more than timing. In fact, it did just that for eight quarters, when oil prices were tumbling in mid-2014. It only started upping the disbursement again in August of 2016.

That doesn't mean you shouldn't own Helmerich & Payne stock; it just means you have to take the dividend history with a grain of salt. Some other reasons it was able to protect the dividend are a conservative culture that favors a low debt load (long-term debt is just 10% of the capital structure) and impressive cash flow. Cash flow, the lifeblood of a company, is worth a deeper look.

HP Capital Expenditures (Quarterly) data by YCharts.

Helmerich & Payne builds expensive drill rigs. It then depreciates those costs over the useful lives of the rigs, a non-cash charge that hits earnings. When demand for rigs is high, the expense of building new rigs offsets the depreciation add back on the cash flow statement. In a downturn, though, the company stops building rigs, and the depreciation add back flows right into the company's bank account -- leaving it with plenty of cash to keep paying the dividend. So, Helmerich & Payne's dividend streak isn't as clean as it looks, but it is built on a solid foundation. The stock really is worth a closer look for income-focused investors.

It's not that big

That said, there's one other metric that needs to be considered, here. Over the past three years, Helmerich & Payne's annualized dividend growth rate is 28%. Over the past five years it's 60%. And over the past decade, the dividend grew at an annualized rate of 32%. If that doesn't knock your dividend socks off, nothing will!

HP Dividend Per Share (Quarterly) data by YCharts.

But somehow, those numbers don't make much sense, particularly when you consider that the dividend was static for eight quarters in a row between 2014 and 2016. Here's what's going on: In calendar year 2012, the company more than doubled the quarterly dividend from $0.07 a share to $0.15. And then in 2013, it increased it again, this time going from $0.15 a share per quarter to a $0.50. Those were huge increases that are unlikely to be repeated. Prior to that span, the dividend was usually increased just a few pennies a year. And since 2014, the dividend has basically been increased just a few pennies a year.

So, the trailing dividend data has to be taken with a grain of salt, too. In fact, the increase over the trailing year was less than 1%. And that low single-digit number is far closer to what you should expect over time than 30% or more.

A great company despite the dividend confusion

None of this is meant to suggest that Helmerich & Payne is a bad company. When it comes to oil and gas drilling services, it's a top-notch name. And despite the oddities, the 44-year dividend streak is truly impressive for a company in such a cyclical industry. However, as a dividend investor, you need to dig a little deeper, here, to figure out what you are buying. On that score, the future likely holds a continuation of the annual streak based on small dividend increases that may or may not happen on an annual basis. That sounds worse than it really is, but it's the truth you need to understand if you are digging into Helmerich & Payne.