Nearly four years ago, I wrote about how Coca-Cola (KO 2.14%) -- one of Warren Buffett's biggest investments -- was turning into one of his worst. Coca-Cola stock surged during the late 1980s and 1990s, as expansion in emerging markets helped to drive rapid growth. However, that growth has petered out in today's more health-conscious world.

As a result, Coca-Cola stock has dramatically underperformed the broader market in the past few years. Since I wrote my initial article back in April 2013, Coca-Cola's total return of 18% has trailed the S&P 500's total return by nearly 50 percentage points:

Coca-Cola Total Return data by YCharts.

Coca-Cola's recent efforts to boost earnings by introducing smaller package sizes and bulking up its non-soda business could lead to somewhat faster growth a few years from now. Nevertheless, Coca-Cola stock remains overvalued relative to its modest growth prospects.

Coca-Cola runs out of gas

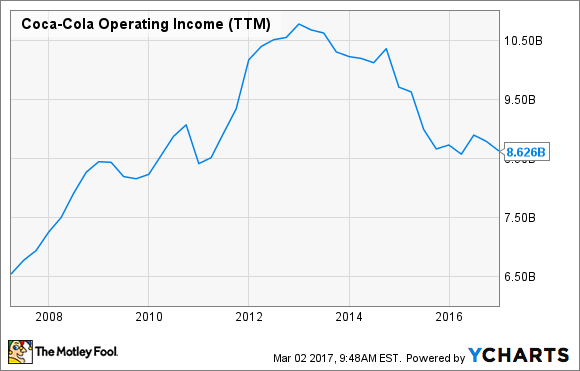

After a brief period of strong earnings growth following the Great Recession, Coca-Cola began to lose momentum in 2012. Operating income peaked that year and has declined significantly since then:

Coca-Cola Operating Income (TTM) data by YCharts.

In short, Coca-Cola's reliance on the stagnant soda market has been too much of a headwind to overcome. The strong dollar has also negatively impacted revenue and earnings in foreign markets since late 2014. As a result, adjusted earnings per share have fallen from $2.01 in 2012 to $1.91 in 2016.

In some ways, Coca-Cola's recent performance has been even worse than seemed likely four or five years ago. That said, by the end of 2012, volume growth was already slowing. (In the fourth quarter of 2012, global soda volumes inched up just 1% year over year for Coca-Cola.) With Coca-Cola stock trading for a generous 20 times earnings in early 2013, it was hard to see the upside for continuing to hold the stock.

The situation is similar today

As noted earlier, EPS has actually declined modestly at Coca-Cola over the past four years. This isn't expected to change in the near future. In January, Coca-Cola forecast that adjusted EPS will decline by another 1% to 4% this year, despite a 3% increase in organic revenue.

Foreign currency headwinds, divestitures, and "structural items" are combining to more than offset Coca-Cola's underlying operating income growth, which is projected at 7% to 8% for 2017. While it's still early, the company expects further structural and currency-related earnings headwinds in 2018.

A shift to selling smaller cans is boosting Coca-Cola's profitability. Image source: Coca-Cola.

Bulls might argue that EPS will start rising again after Coca-Cola gets past the current headwinds related to the strong dollar and the refranchising of its bottling operations. Yet volume growth remains sluggish, at just 1% last year. The move to smaller package sizes is beefing up underlying revenue and earnings growth for now, but this trend can't continue forever. As a result, Coca-Cola's outlook for long-term earnings growth is not very inspiring.

Coca-Cola stock is (still) overvalued

Low interest rates have helped to keep Coca-Cola stock afloat in recent years, despite the company's poor earnings trends. Coca-Cola is a Dividend Aristocrat with a hefty yield of about 3.5% following its most recent dividend increase. With interest rates at historic lows in recent years, investors have paid a big premium for high-dividend stocks in the chase for yield.

However, Coca-Cola doesn't have much room to raise its dividend in the future, having increased the dividend by 45% over the past five years despite falling EPS. The company is now committed to paying more than $6 billion in dividends in 2017, equivalent to roughly 80% of its projected earnings and free cash flow.

Interest rates have already started to rise in the U.S., and the Federal Reserve seems poised to raise its interest-rate target several more times in 2017. As interest rates return to more "normal" levels, investors are likely to dump slow-growth, high-yielding stocks in favor of bonds.

Coca-Cola stock currently trades for nearly 23 times forward earnings. This represents a sizable premium to the S&P 500's multiple of 18 times forward earnings, despite the company's inferior growth prospects. Even after four years of poor performance, Coca-Cola is still a stock for investors to avoid.