Many auto industry analysts' eyes were focused on CarMax (KMX 0.63%) Thursday in hopes of gleaning some insights from its fourth-quarter fiscal 2017 report about the direction of used car prices. Those price shifts can impact a wide range of companies, including major automakers and dealership groups. However, to get a feel for where the industry's health is trending, it's also important to look at the long-term trend lines in pricing.

Here's a look at the highlights of its Q4 (which ended Feb. 28), two important long-term graphs, and what to expect from CarMax's growth story now.

Q4 highlights

Starting from the top, CarMax's net sales and operating revenues jumped by a healthy 9.3% to $4.05 billion during the fourth-quarter, higher than analysts' consensus estimate of $3.93 billion, per Thomson Reuters. That was actually a nice uptick in revenue generation: For the full year, the gain was a more modest 4.8% jump to $15.88 billion.

Image source: Getty Images.

Also during Q4, CarMax's net earnings increased 8.2% to $152.6 million with earnings per share rising 14.1% to $0.81. That result was above last year's $141 million ($0.71 per share) and above consensus estimates calling for $0.79 per share.

The theme of the fourth-quarter was that CarMax fueled its top- and bottom-line growth with another substantial increase in units sold, which helped offset pricing weakness.

Consistent unit growth

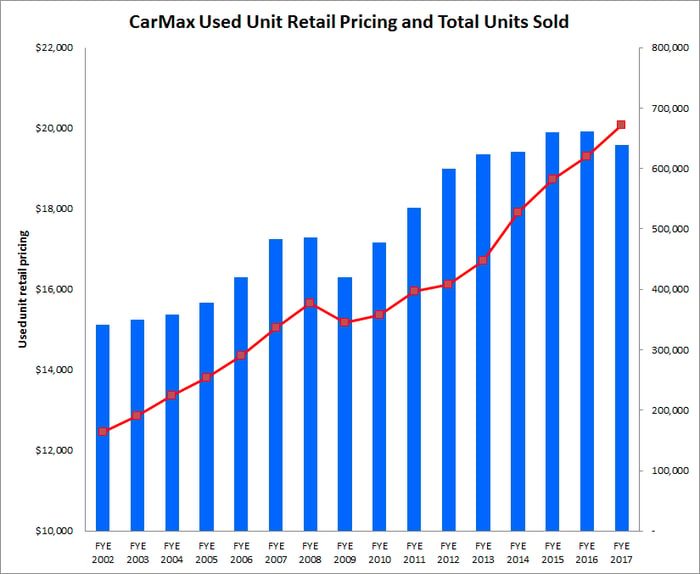

Information source: CarMax SEC filings. Image source: Author.

What's been impressive about CarMax since the last recession is simply its consistent growth, year after year. Even the Great Recession, as it was so thoughtfully named, only slowed the vehicle retailer down temporarily. During Q4, total used unit sales jumped 13.4%, partially thanks to new stores adding incremental sales, but also due to its impressive 8.7% comparable-store sales growth.

As the chart above shows clearly, CarMax's used car pricing plateaued between fiscal 2015 and 2016, before sliding lower during fiscal 2017. The interesting thing to watch will be if lower used car prices actually help boost demand and total unit sales -- it's possible the market hasn't quite hit equilibrium yet between unit sales and unit pricing.

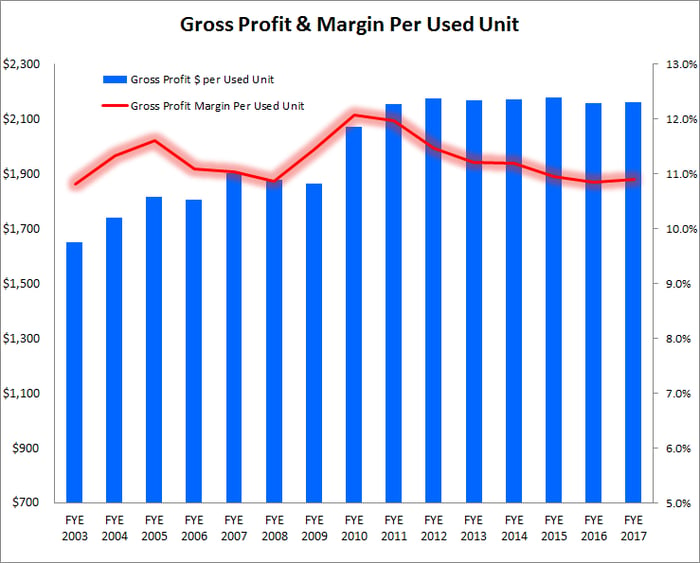

However, while unit retail pricing has only recently plateaued, gross profit per used unit has been fairly stable for the better part of this decade.

Information source: CarMax SEC filings. Image source: Author.

At first glance, one couldn't be blamed for thinking margins are in decline, as well, but that's probably not the case. In my opinion, the cash-for-clunkers program that was put in place during the recession helped spur demand, and supported pricing and margins which have since gone back toward historical norms around 11%.

The road ahead

Sure, investors would love to have consistent year-over-year pricing growth, in combination with total unit sales rising, but that's not how the cyclical automotive industry works. The good news is that CarMax's growth story is far from over. During Q4, it opened the doors on four stores, including two in new markets; that brought fiscal 2017's total new store count to 15, and more are coming.

Management plans to open another 15 stores in fiscal 2018 and from 13 to 16 stores the year after. It will be interesting to see if and when the top-line growth story slows down. Also noteworthy, management admitted that six of the new stores set to open in fiscal 2018 will be in metropolitan areas with populations under 600,000 -- what CarMax defines as small markets. But for now, comp sales remain strong, and the gains in total units sold are easily offsetting some pricing weakness, which is great news for investors.