When Meritage Homes Corp (MTH 0.23%) last reported earnings to wrap up fiscal 2016, it left investors with reason to be concerned. The company finished the year with strong 15% home-closing revenue growth in the fourth quarter, 19% home-closing revenue growth for the full year, and a 15% jump in earnings per share for the year. Unfortunately, the homebuilder reported that its unit sales, and that its backlog of homes on order, were down from the year-ago period in the fourth quarter -- not a positive metric considering the general strength of the new homes market and the company's success in expanding and growing in recent years.

The company announced its first-quarter results on April 27 and delivered nice improvements nearly across the board, including solid unit sales and orders and modest improvement in its backlog.

First-time homebuyers are driving growth for Meritage Homes. Image source: Getty Images.

Keep reading to learn how Meritage delivered better-than-expected results, and what management says to expect going forward.

A closer look at the results

| Q1 2017 | Q1 2016 | Percentage Change | |

|---|---|---|---|

| Homes closed (units) | 1,581 | 1,488 | 6% |

| Home closing revenue | $660,617 | $595,617 | 11% |

| Average sales price-closings | $418 | $400 | 4% |

| Home orders (units) | 2,135 | 1,987 | 7% |

| Home order value | $892,703 | 804,600 | 11% |

| Average sales price-orders | $418 | $405 | 3% |

| Ending backlog (units) | 3,181 | 3,191 | n/a |

| Ending backlog value | $1,367,844 | $1,346,664 | 2% |

| Earnings before income taxes | $36,769 | $28,885 | 27% |

| Net income | $23,572 | $20,969 | 12% |

| Earnings per share | $0.56 | $0.50 | 12% |

All dollar figures (except earnings per share) in thousands. Data source: Meritage Homes Corp.

As you can see, with the exception of the units on backlog, Meritage delivered strong results.

First-time buyers grew orders faster than expected

One of the more impressive aspects of the company's performance was that orders and the backlog results were stronger than the year-ago quarter, even after management told investors on the fourth-quarter earnings call that they were expecting weaker order activity to start 2017. After all, Meritage started 2017 with less inventory than it anticipated after a strong 2016, leaving it with fewer open communities than expected.

This resulted from the company opening more communities than anticipated during the first quarter. CEO Steve Hilton said that the company increased its community count by 5% in the first quarter, which was amazingly the company's goal by the end of the year:

Image source: Meritage Homes.

This accelerated pace of community openings helped the company deliver better-than-anticipated order growth only a couple of months ago. CFO Hilla Sferruzza pointed out that a significant portion of new orders were from spec inventory -- that is, homes that have started construction without a buyer in place.

Forty-seven percent of orders in the first quarter were spec versus 39% year over year. Sferruzza said this was reflective of the increase in first-time buyers and the company's "LiVE.NOW" communities targeting young and first-time buyers.

Meritage lost this advantage, but it could come back with tax reform

Over the past several quarters, the company's management has highlighted the company's focus on building energy-efficient homes for two reasons. First, there's strong demand for homes that offer more sustainable features -- especially from younger first-time buyers. Second, the company has been generating significant profit gains from a series of tax credits related to energy efficiency.

Unfortunately, those tax credits expired at the end of 2016, and so far, they have yet to be renewed, significantly increasing the company's effective tax rate. In the year-ago first quarter, the benefit of energy tax credits reduced the effective tax rate to 27% versus 36% in the just-ended quarter. That's worth about $3.3 million in lost net income if those tax credits were still in place. On a pre-tax basis, earnings were up more than 27% in the first quarter.

This group of tax credits has been around for a number of years and has historically been renewed at or near year-end. However, with the election of Donald Trump as president, essentially everything related to taxes has been put off until negotiations on broader tax reform are taken up. In other words, it's probably best not to count on these tax credits as part of the investing thesis for Meritage until they're back in effect.

Gross margin improvement strategy (redux)

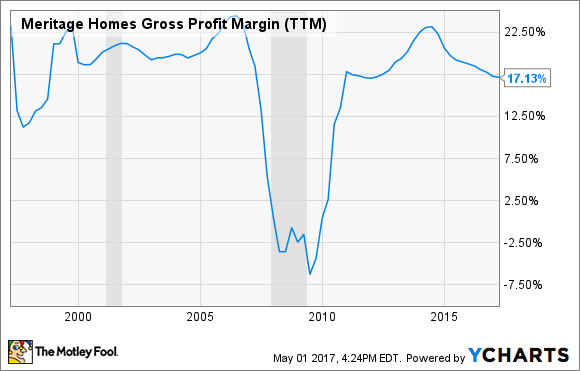

For the past couple of years, Meritage has seen its gross margins get compressed as prices for land, labor, and lumber have all increased at faster rates than home prices in many markets. This has caused gross margin percent to fall below the company's usual levels during healthy housing and economic periods:

MTH Gross Profit Margin (TTM) data by YCharts.

Management continues to make this a priority, and Hilton remains steadfast in his belief that they can regain, over time, the higher profitability that the company has typically enjoyed in the past.

Here's how management intends to regain lost gross margin:

Source: Meritage Homes.

Looking ahead

While the company reached its full-year community count more quickly than anticipated, management said that investors shouldn't confuse that with plans to increase the community count from here. To the contrary, the count should ebb and flow throughout the year as existing communities are sold through and new communities open to replace them. Management also held firm on its full-year guidance of 7,500-7,900 home closings, $3.1 billion to $3.3 billion in revenue, and pre-tax earnings growth of 6%-12%.

The company expects to go backwards a little in the second quarter, however. The guidance calls for home closing revenue to fall as much as 8%, and for units closed to decline 5%-10%, and earnings (pre-tax) to fall 15%-25%. Add it all up, and Meritage management is sticking to its guns on expectations for the second half of the year to be better than the first.

The company also made its biggest quarterly land investment in almost a decade in the first quarter, spending $207 million to acquire 3,600 new lots. This is an important step for the company, making sure it has enough land inventory as it plans its next generation of new communities.