No matter what stage you're at in your investing career, you have an ambitious plan for your portfolio to either generate great total returns, enjoy significant capital appreciation, or to provide income -- or a combination of all three.

With that in mind, we asked three Motley Fool contributors to highlight a stock that could achieve the goals any ambitious investor might have set. Below you'll learn how Digital Realty Trust (DLR -1.18%), Starbucks (SBUX 0.74%), and Home Depot (HD -0.93%) fill the bill.

Image source: Getty Images.

A smart way to play the data boom

Brian Feroldi (Digital Realty Trust): Mass consumer adoption of smartphones and other streaming devices has driven up the demand for data storage centers. That's been a wonderful tailwind for Digital Realty Trust, a real estate investment trust (REIT) that specializes in operating data centers.

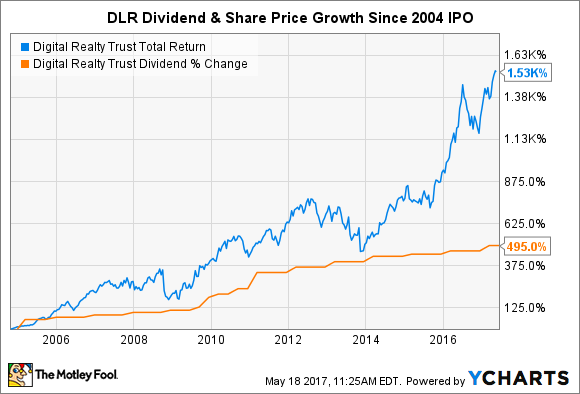

Digital Reality's playbook is to buy or build massive data centers in key locations around the world and then lease out server space to thousands of customers. This simple but effective business model has provided the company with an ever-growing stream of profits that has been passed along to shareholders since its IPO in 2004. Since that time, the company's dividend has grown more than fivefold and its share price has soared.

DLR Total Return Price data by YCharts.

Looking ahead, consumer demand for 4k streaming video and cloud computing should continue to grow as new devices and products come to market. That should ensure that demand for Digital Realty's servers remains robust for years to come. While the company's shares have enjoyed a great run and are a little bit expensive right now, I think that it still makes sense for ambitious investors to give this dividend-paying stock some attention.

Image source: Starbucks.

Caffeinated income growth

Demitri Kalogeropoulos (Starbucks): Even with a base of over 25,000 restaurant-cafes, Starbucks is as aggressive as it has ever been in its plans for global dominance. In fact, the coffee titan sees room to launch a further 12,000 locations over just the next five years.

A big chunk of those gains will come from the Chinese market, where Starbucks could easily accelerate its expansion pace for years into the future. The latest crop of stores in that country just delivered record revenue, return on investment, and profitability. Starbucks also has several promising initiatives that can boost its core U.S. market, including a booming consumer products segment, deeper expansion into tea, and digital ordering and delivery.

Sure, the coffee titan's business is feeling the pain from a weakening retailing industry. Customer traffic was flat last quarter, which left increased spending to deliver all of its comparable-store sales gains. If traffic turns negative as it has for many other global restaurant chains, it's hard to see how Starbucks can justify boosting its store base by 50% over the next few years.

Yet it's more likely that the investments that the company has made in improving its throughput and expanding deeper into high-quality food offerings start paying off through healthier growth in late 2017 and through the years ahead. Its sub-50% payout ratio, combined with a projected 15% to 20% annual earnings gain, meanwhile, should deliver market-thumping dividend hikes for income investors.

Image source: Getty Images.

Building a brighter future

Rich Duprey (Home Depot): As Home Depot's just-reported earnings indicate, the retail market isn't treating all retailers the same. It all depends on where you're targeting your sales. Housing and homeowners? Go right ahead and beat and raise. Apparel companies? Declare bankruptcy at your earliest convenience.

First-quarter sales at Home Depot hit $23.9 billion, up 5% from last year, as comparable-store sales jumped 5.5% -- and were up 6% in the U.S. It reported net profits of $2 billion versus $1.8 billion in the same period a year ago. As a result, the DIY home center raised its full-year guidance to $7.15 a share from $7.13 a share previously.

In comparison to Home Depot's strong performance, Rue21 just declared bankruptcy while bebe announced it was shuttering all its stores and becoming an online-only retailer, following The Limited's decision to do the same. And there is the difference.

Brick-and-mortar retailers are having a tough time competing against e-commerce giant Amazon.com, so they're closing up shop or becoming a shell of their former selves as an online platform for merchandise. Home Depot, though, doesn't really have to worry about competing against Amazon, as lumber and other items in the big-box store's wheelhouse don't easily transfer to an online sale.

We see that with some other businesses that are considered Amazon-resistant, like Costco, Ulta Beauty, and a handful of others. Now that doesn't mean Home Depot doesn't have other challenges, such as if the housing market takes another turn for the worse, but even if prices crumble, homeowners turn to renovation, softening the blow.

Home Depot also comes out ahead against rival Lowe's (LOW -0.65%), which while similarly situated, derives a large part of its revenue from big-ticket purchases such as appliances, which account for 11% of revenue. In contrast, Home Depot's biggest department is indoor garden, which generates less than 10% of total revenues. Between it, paint, and kitchen and bath, Home Depot relies upon a lot of small purchases, which reduces volatility.

Home Depot pays a dividend of $3.56 annually, and it currently yields 2.3%, a respectable and stable payout. Even though its shares are up 20% over the past year, an ambitious investor can still anticipate seeing it build upon those gains.