American consumers love their cards. In Total System Services' 2016 U.S. Consumer Payment Study, credit was named the most preferred way to pay for the first time in the study's history (in a close second came debit cards). Between the two types of payments, 75% of those surveyed chose credit or debit cards as their preferred method of payment. In 2018, industry insiders expect the number of domestic credit cards issued to reach a record 500 million, surpassing the record set in 2008 before the financial crisis dramatically altered the landscape.

Given the American consumers' love for plastic, it only makes sense for investors to find ways to profit from this huge trend. One way to do so would be to look closely at companies within the payment processing industry. These are the companies that retailers hire to process credit, debit, and sometimes mobile payments at the point-of-sale (POS) or online checkout. But which payment processor makes the best investment right now? Let's look at three such companies to determine which might make for the best investment in the quarters and years ahead.

Image source: Pixabay.

First look at First Data

First Data Corp (NYSE: FDC) services over 6 million retailer locations and over 4,000 financial institutions with processing solutions. In 2016, the company processed 88 billion transactions for $1.9 trillion in payment volume. The company consists of three business units: Global business solutions, Global financial solutions, and network and security solutions.

Of these, global business solutions is by far the largest, accounting for $971 million, or roughly 56%, of the company's total segment revenue. The global business solutions segment offers retail point-of-sale processing through the company's cloud-based operating system, Clover.

With a price-to-earnings ratio of 29.5, First Data is not terribly expensive and, compared to its peers in the space, it is practically a bargain. The problem is that the company is experiencing anemic top-line growth. In the first quarter of 2017, total segment revenue grew just 2% and no single business division grew revenue by more than 3% (though on a constant currency basis revenue growth was slightly higher).

On top of the slow revenue growth, First Data's balance sheet isn't in great shape, either. In its first quarter earnings presentation, the company stated it had $18.6 billion of gross debt compared to just $503 million in cash. For a company with a market cap of just under $15 billion and reported total annual revenue of $11.6 billion in 2016, that's a lot of debt.

A burgeoning global processing powerhouse

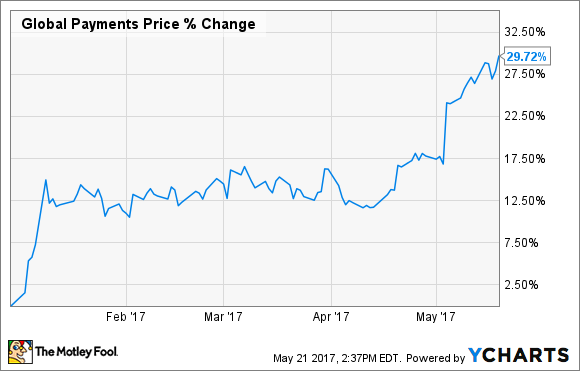

Global Payments Inc (GPN -0.28%) completed its acquisition of Heartland Payment Systems, Inc for $4.3 billion in 2016. That's a huge acquisition for a company with a current market cap of $13.8 billion. Since that time, the company has repeatedly raised its guidance during quarterly earnings releases and recognized significant cost synergies. Even better, beyond seeing the normal increased revenue due to the acquisition, the company is also experiencing double-digit percentage increases in organic revenue. This past quarter was no exception. In the press release, CEO Jeff Sloan stated:

We are off to an exceptional start to 2017, producing double digit organic growth across our markets worldwide in the first quarter. In particular, organic growth in our integrated and vertical markets business accelerated, contributing significantly to our strong performance. We have completed the first anniversary of our Heartland partnership, and our combined results underscore our consistency of execution and position us as the leading provider of technology-enabled, software-driven solutions worldwide.

The optimism seems to be warranted. In 2017's first quarter, adjusted net revenue grew to $804 million, a 68% increase year over year while adjusted EPS grew to $0.85, a 33% increase year over year. Furthermore, the company once again raised its revenue and earnings guidance for the full year. Both metrics are now expected to see a 19% to 22% increase over 2016's numbers. Based on the upper end of management's guidance for adjusted EPS, the stock price is selling for a reasonable forward P/E of 22.8.

The company continues to execute by upping its offerings and services to merchants. Just this month the company launched Xenial, a POS system designed specifically to meet the unique needs of restaurants. According to the press release, the Xenial will help restaurants manage their entire ecosystem, from data analytics and menu planning to ordering and customer engagement.

Worthy of its pricey valuation

By any metric, Square Inc. (SQ 0.20%) is the most expensive of these payment processing stocks. Of course, its valuation is not helped by the stock price's recent meteoric rise. After the jump following the company's huge first-quarter beat and raise, Square's shares are up over 45% year to date. In the past 12 months, the stock price has more than doubled!

After the year's first quarter, Square's management guided for 2017's full-year adjusted EPS to be $0.16 to $0.20. At its current price, this gives shares of Square a forward P/E multiple of just under 100.

Image source: Square Inc.

I still favor Square over the other choices presented here. For starters, the company has demonstrated incredible growth to justify its steep valuation. In the first quarter, the company reported adjusted revenue of $204 million, a 39% increase year over year. Gross payment volume increased to $13.6 billion, a 33% increase year over year.

I believe this growth will continue. First, the company is developing quite the ecosystem for a payment processor, something its competitors are only just now starting to do. Square uses its payment processing services to get into the door of a business, but it doesn't stop selling there. Instead, it offers a variety of profitable services that its customers tend to find invaluable. These extra streams of revenue come from data analytics, microloans to small businesses, instant deposit features, and food delivery services.

Second, the company is just beginning to enter international markets. It is now in Australia, Canada, and Japan, and just announced plans to enter the U.K. If Square can capture market share and upsell its lucrative extra services to customers in international markets as its done domestically, its stock price might have a good way yet to climb.

Final verdict

I recently took a small position in Square. Given its incredible growth, continued innovation, and diversified revenue streams outside of processing, I like its long-term upside more than Global Payments or First Data. Of course, its steep valuation also brings more risks. If the company fails to execute on the international stage as it's done stateside, its share price could fall fast.

For investors who prefer to invest in a more mature payment processing company, Global Payments offers a good alternative. The company has also been growing at a steady clip and has shown it can execute since acquiring Heartland Payment last year. But I would stay away from First Data. Its anemic growth shows its best days might be behind it and that it has a difficult time keeping up with its competitors in today's fast-changing payments landscape.