On May 16, microprocessor giant Intel (INTC -0.38%) put out a press release titled "Intel Shows 1.59X Performance Improvement in Upcoming Intel Xeon Processor Scalable Family." In the press release, Intel talked up the performance benefits of its upcoming data center chips relative to its prior-generation chips.

The most interesting bit of this press release, though, was the company's disclosures around its upcoming 3D XPoint-based memory modules for data center applications.

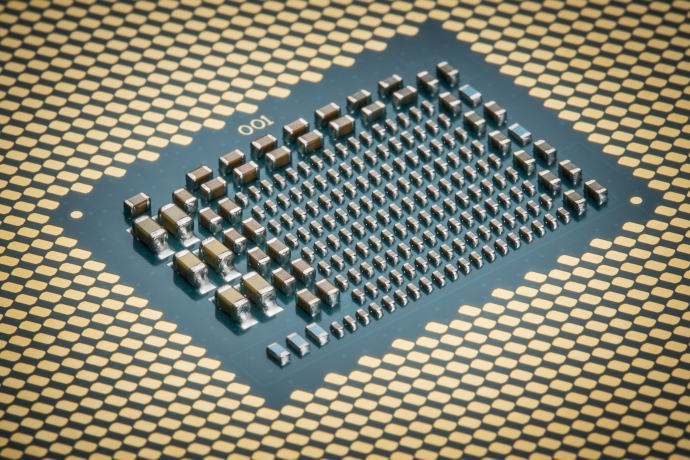

Image source: Intel.

Investors may recall that at Intel's analyst day back in February, the company said that it believes that the total addressable market for such 3D XPoint-based memory modules could be worth approximately $8 billion by 2021.

Those memory modules were supposed to ship this year alongside the Intel Xeon Processor Scalable family mentioned above, but the technology was delayed. In that same press release, Intel says that a refreshed version of its Xeon Processor Scalable family, known as Cascade Lake, will support this technology.

Of course, the fact that Intel intends to refresh its server platform in 2018 is encouraging. But the real story here is that we now know approximately when Intel still start enjoying revenue from 3D XPoint-based memory modules -- something that could help the company reaccelerate growth in its data center group (DCG).

Two ways it can help reaccelerate DCG growth

Intel previously aspired to a 15% compounded annual revenue growth rate for DCG, but it has had a rough time achieving that goal in recent years. The company has indicated that growth in some of the markets that DCG serves, like cloud computing and networking, continues to be robust, but sales of platforms into traditional enterprise servers have slumped.

With the introduction of Cascade Lake and the 3D XPoint memory modules, there are two obvious ways that Intel's DCG could benefit.

The first is that Intel will go from generating no revenue from sales of memory modules into the server market, to generating some positive amount of revenue once it starts shipping those 3D XPoint modules.

At this point, the amount of revenue Intel will be able to rake in from these memory modules is unclear, as Intel hasn't guided such a figure, and any estimate on my part wouldn't be particularly valuable.

However, Intel did indicate at its most recent analyst day that it expects DCG revenue to return to double-digit growth in 2018 and beyond. That acceleration, Intel indicated, will be driven in part by an expectation of a 30% compounded annual revenue growth rate in its non-processor products from 2017 through 2021.

I suspect that a large part of Intel's expected non-processor revenue growth will come from the 3D XPoint memory module opportunity.

There's another thing that could help accelerate Intel's DCG revenue growth. If Intel's 3D XPoint memory modules are as big a deal as Intel claims they will be -- and only the new Cascade Lake platform (and beyond) will support those modules -- Intel could see an uptick in processor/platform upgrade activity among some customers for 3D XPoint.