What happened

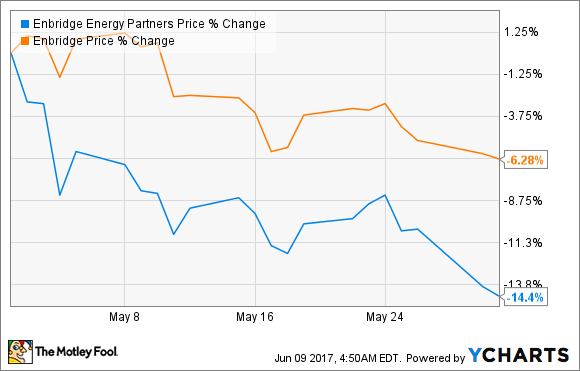

Shares of Enbridge Energy Partners (EEP) declined 14.4% in May. Last month's drop is just another in a string of bad news; the master limited partnership has seen its stock fall more than 36% year to date. The largest driver of this decline has to do with a strategic announcement that came at the end of April.

So what

On April 28, Enbridge Energy Partners' management announced the results of a strategic review of the business. There were several moves related to the funding of its stake in the Bakken Pipeline System and the restructuring of parent company Enbridge's (ENB 1.41%) stake in the business by retiring and issuing several different share classes. The two most important points in that release, though, were the announcement that Enbridge Energy Partners would sell its stake in Midcoast Energy Partners to its parent company and that it would cut its quarterly distribution by 40%.

Image source: Getty Images.

Investors did not respond well to the strategic review. The stock fell when the market opened again on May 1, and shares continued to sink in subsequent days. While the news that it was shedding its stake in Midcoast Energy Partners is a good thing -- it had been propping up Midcoast recently with cash payments to cover distributions -- the large distribution cut wasn't too encouraging.

Enbridge Energy Partners also reported earnings on May 10, and those results didn't exactly help the company's cause, either. The most discouraging aspect was the decline in liquids pipeline volumes. These are the only assets Enbridge Energy Partners will own after the Midcoast sale. The company will likely reverse some of those declines once the Bakken Pipeline System comes online, but it's not too encouraging to see volumes in its existing systems not picking back up with production increases in the U.S.

Now what

Taking the long view, cutting the distribution was the right move. Enbridge's payout was too high. Not only did it eat up all cash coming in the door each quarter, but it also made it prohibitively expensive to issue shares as a way to raise capital. Even after the cut, shares carry a distribution yield of 8.7%. Management expects it will be able to retain a decent amount of cash with this new payout rate, which it can use to fund further projects.

One does have to wonder, though, if this will have an impact on parent company Enbridge's plans. As part of its argument for its merger with Spectra Energy, Enbridge said it expected to achieve an annual dividend growth rate of 10%-12% until 2024. Some of that plan involved distributions and incentive distribution rights payments from Enbridge Energy Partners, but that payout is now much less than it was. It will be worth watching the next couple quarters to see how this dynamic plays out and whether the parent company changes its growth outlook in response to these changes at Enbridge Energy Partners.