A stock market that keeps hitting new highs invariably starts conjuring in investors thoughts of when the next pullback will arrive, which might lead you to start thinking about getting defensive with your portfolio. But a daring investor would certainly want to keep at least a portion of it dialed into the market's growth components.

We asked three top Motley Fool contributors to come up with a growth stock that a daring investor might benefit from -- but that unquestionably require you to do a risk-reward calculation. They identified Abiomed (ABMD), TakeTwo Interactive (TTWO 0.23%), and At Home (HOME). Here's why.

Image source: Getty Images.

This valuation might cause myocardial infarction

Brian Feroldi (Abiomed): More than 735,000 Americans have heart attacks each year, which is a big reason why heart disease is still the No. 1 cause of death in the United States. Medical device maker Abiomed is on a mission to change the latter fact by helping the victims of heart attacks survive them. The company's solution is a minimally invasive pump that can be implanted directly into the patient's heart. This miniature pump helps to keep a patient's blood flowing after a heart attack or during surgery, which greatly eases the burden placed on the organ. That reduced strain in turn means the heart has a much easier time repairing itself, which leads to better health outcomes.

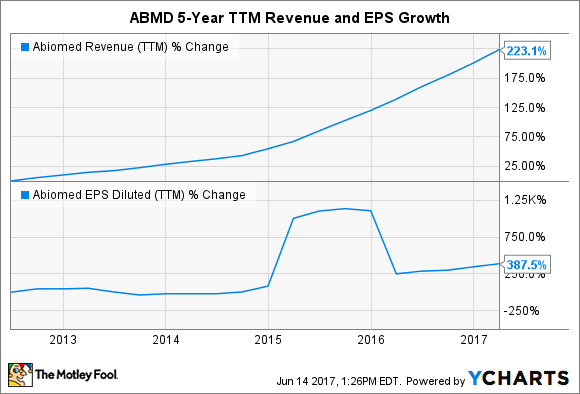

Healthcare providers have largely embraced Abiomed's devices. The company's top-line has grown like wildfire over the last few years as it has launched new products and expanded geographically. What's more, the company has succeeded at translating that rapid revenue growth into profits.

ABMD Revenue (TTM) data by YCharts

In spite of the rapid growth it has behind it, the company still asserts that it has plenty of room left for expansion. Domestically, the company believes that its penetration rate is only about 7%, and far less than that overseas.

Given the company's strong financial history and great growth potential, it is understandable why its shares have appreciated by more than 500% over the last five years. Unfortunately, that momentum has pushed the company's trailing P/E ratio above 122 and also raised its price-to-sales ratio above 13. That makes Abiomed's valuation extremely high.

Yet despite that, the company's growth story might be so good that it is still worthwhile for risk-tolerant investors to buy a few shares.

Image source: Getty Images.

A video game developer set to level-up

Demitrios Kalogeropoulos (Take Two): It takes a strong stomach to step up and open a new position in a stock that has nearly doubled in the past year and soared 22% in the last month alone. Investors have good reasons to feel optimistic about this video game developer's outlook, though.

In Take Two's fiscal fourth quarter, sales jumped 52% thanks to a well-received installment in its Mafia franchise, contributions from its popular 2K sports brands, and continued growth in the Grand Theft Auto online ecosystem. Like its bigger peers, the developer is benefiting from surging popularity for digitally delivered content, including in-game upgrades, expansion packs, and full title downloads. High-margin digital sales just passed 50% of Take Two's business last quarter. Better yet, recurring revenue like subscriptions accounted for half of all digital sales, which injects steadiness into what used to be an extremely volatile, hit-driven business.

Take Two doesn't have as massive and diverse a game portfolio as rivals Activision Blizzard and Electronic Arts. And it doesn't refresh its biggest franchise -- Grand Theft Auto -- at the one-release-per-year pace that helps Activision dominate the annual sales charts with Call of Duty. But this small developer is aiming to boost its intellectual property output over the next few years. If it can produce a solid string of hits, including a few fresh franchises, Take Two will soon start posting the type of sales and profit gains that have made EA and Activision such great long-term investments.

Image source: At Home.

All the comforts of home

Rich Duprey (At Home): The last thing you'd think the market needed was another brick-and-mortar home goods retailer, yet At Home went public earlier this year, and it's showing that despite the commanding presence of Bed Bath & Beyond (BBBY), there's no need to leave the field to the legacy chains.

At Home, which bills itself as a home decor superstore, operates 132 locations in 31 states. The average size of an At Home superstore clocks in at 120,000 square feet, a footprint that's about two-and-a-half times larger than the biggest Bed Bath & Beyond shop and more comparable to an Ikea. The size of those stores would seemingly limit its ability to expand numerically, since one would expect that placing new ones too close existing locations would cannibalize sales, but the home decor specialist still sees room to grow. It estimates the market can handle some 600 stores -- a significant expansion, but a target that would still leave it far behind Bed Bath & Beyond, which boasts more than 1,000 stores in all 50 states.

And there's more competition coming. TJX Companies (TJX -0.34%), best known for its T.J. Maxx and Marshall's chains, also operates Home Goods, a discount home decor retailer; it recently said it was planning on importing its HomeSense brand, which it operates in international markets, to the U.S. While this chain's American foray will begin with just handful of stores, TJX plans on growing it -- and Home Goods -- further.

All of these home decor stores, operating at a variety of price points, would seem to saturate the market. Yet At Home's status as a destination store could give it advantages unavailable to its competition, from pricing power to a full assortment of merchandise. Its capacity to stock more goods in greater varieties ought to be attractive to consumers.

The risk (or one of them) is that such stores are somewhat dependent on the housing market. Real estate has been relatively healthy, which helped At Home post fiscal first quarter earnings earlier this month that beat analysts' expectations, but a downturn could upend its growth plans -- as well as those of the competition.