The rapid growth of e-commerce has hit U.S. department stores hard, as American consumers have been cutting back dramatically on shopping trips -- particularly to traditional malls. As a result, top department store chains such as Macy's (M -1.52%), Kohl's (KSS -2.01%), J.C. Penney (JCPN.Q), and Nordstrom (JWN -2.33%) have all been reporting weak comp sales trends.

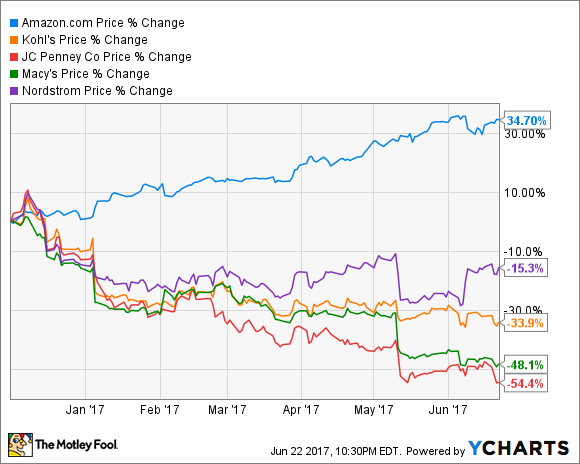

Since the beginning of December 2016, investors have really started to panic about the threat from Amazon.com (AMZN -1.64%). While Amazon shares have soared, department store stocks have plunged, including declines of about 50% at Macy's and J.C. Penney.

Amazon vs. Department Store Stock Performance, data by YCharts.

Department store stocks took their latest dive last week after Amazon unveiled its new Prime Wardrobe service. Yet while Prime Wardrobe will be an attractive option for some consumers, it's not necessarily going to be the game changer that analysts expect.

What is Prime Wardrobe?

In a nutshell, the goal of Prime Wardrobe is to allow Prime members to try on items in the comfort of their own homes with hassle-free returns and discounts for larger purchases. The service is still in beta testing, but Amazon recently released some basic details about how it will work.

Customers will start by picking at least three items from fashion categories such as clothing, shoes, and accessories. Once a customer receives a box, he or she will have a week to try on the items and decide what to keep. Amazon will offer a 10% discount to customers who keep three or four items from their box, and a 20% discount to customers who buy five or more of the items.

Unwanted items get shipped back to Amazon using a prepaid return label that comes in the box. Customers can even schedule a free home pickup, so there's no need to take the box anywhere to ship it.

This isn't exactly revolutionary

The Prime Wardrobe service will make it even easier to buy fashion goods from Amazon.com. As a result, it should certainly help Amazon in its quest to continue gaining market share in fashion. However, it's important to recognize that this is just an incremental improvement.

Prime Wardrobe builds on Amazon's existing fashion offerings. Image source: Amazon.com.

For example, Amazon already allows free returns on most fashion items -- customers just have to drop the box off at an authorized United Parcel Service location. The ability to schedule a free UPS pickup will make the return experience even easier, but it was already possible to try on items at home for free with Amazon.com.

Furthermore, the "box" concept was pioneered years ago by the likes of Stitch Fix and Nordstrom's Trunk Club. Both of those services offer a high-touch experience, with personal stylists picking out items for each box, rather than Amazon's 100% self-service model.

While Stitch Fix and Trunk Club have caught on with some consumers, they are hardly taking over the market. Stitch Fix had $730 million of revenue last year. Nordstrom doesn't directly disclose Trunk Club's revenue, but it was no more than $250 million in fiscal 2016. Nordstrom took a $197 million writedown on Trunk Club last November, due to disappointing growth and profitability in that business.

Amazon's low prices and massive customer base should allow Prime Wardrobe to quickly soar past Trunk Club and Stitch Fix. But there doesn't appear to be huge pent-up demand for this kind of fashion-in-a-box service.

What will the selection be?

Amazon says that Prime Wardrobe will offer more than 1 million items. That may seem like a lot. However, Amazon already had 30 million fashion items on its site a year and a half ago, and that number keeps growing.

Thus, it appears that Prime Wardrobe will include only a small fraction of Amazon's fashion inventory. Cheaper items may not be included in the service. After all, it would be extremely difficult for Amazon to make money on boxes filled with a handful of $10 items given the likely return rate and the cost of offering free pickups for returns.

If that's true, then investors may be overestimating the threat to J.C. Penney, Kohl's, and Macy's. J.C. Penney and Kohl's, in particular, sell lots of cheaper items that are less efficient to sell over the internet.

Additionally, these stores get a large proportion of their sales from private and exclusive brands. Kohl's gets nearly half of its sales from private brands, following a recent push to add more popular national brands. J.C. Penney is looking to get 70% of its revenue from private and exclusive brands by 2019, while Macy's aims to boost private and exclusive lines to 40% of sales by 2020, compared to 29% today.

J.C. Penney relies on private and exclusive brands for most of its revenue. Image source: J.C. Penney.

High penetration of private and exclusive brands is a natural defense against competition, although it is certainly not a panacea. But it allows J.C. Penney, Kohl's, and Macy's to offer unique styles and very competitive prices.

At the other end of the spectrum, customers rely on Nordstrom to find new designers and curate a fashion assortment. So while most of its items are not exclusive, the big brands that Amazon will sell through Prime Wardrobe aren't Nordstrom's main focus.

Prime Wardrobe will probably become a successful part of Amazon's fashion offerings. But it's not radically different from what Amazon already offers. Notwithstanding investors' fears, Prime Wardrobe isn't likely to make department stores like Macy's, Kohl's, J.C. Penney, and Nordstrom redundant.