Just because a company is classified as a "growth" stock doesn't automatically make it a high-risk investment. In fact, some growth companies boast fundamentals that are so strong, even risk-averse investors should consider giving them a closer look.

Which growth stocks do we feel are good bets for conservative investors to make? We asked that question to our team, and they picked Salesforce.com (CRM 2.54%), Activision Blizzard (ATVI), and Broadridge Financial Solutions (BR -0.56%).

Image Source: Getty Images.

A software company about to pass $10 billion in annual sales

Demitri Kalogeropoulos (Salesforce.com): Growth investors who prize stability should take a closer look at Salesforce. The enterprise-software giant is expanding its sales base at an impressive clip right now, yet its massive scale provides advantages that most industry peers just can't match.

Revenue spiked 25% in the first quarter as the customer relationship management (CRM) market leader benefited from the continued migration to cloud-based subscription services. Gross profit margin ticked down by one percentage point, but was still a healthy 73% of sales. Salesforce generated $1.2 billion of cash -- up 17% over the prior year.

The company has been sacrificing short-term profits to invest heavily in its sales and marketing infrastructure. In fact, marketing accounted for 46% of sales last quarter, which helps explain how the business booked a slight loss for the period. Operating expenses roughly equaled gross profitability, at 73% of sales. As a result, shares appear expensive on a price-to-earnings basis today, given that almost all of Salesforce's profits are being directed back into the business right now.

These investments should power significant profit growth over the long term. But Salesforce's current priority is to lock up as much of the growing enterprise market as it can.

The strategy appears to be working. Management is expecting revenue of between $10.25 billion and $10.30 billion in 2017, which translates into growth of as much as 23% following last year's 26% spike.

The video game cash king

Travis Hoium (Activision Blizzard): Conservative investing doesn't have to mean investors only look at boring stocks. When I think of conservative investing, I think of buying companies that have a solid foundation and a competitive advantage that generates a ton of cash, rather than those that are losing money, or built on speculation of future success. In the video game business, Activision Blizzard is a very strong company fundamentally.

The chart below gives a peak into the company's foundation financially and the growth it's experienced over the last decade. And you can see that free cash flow is now over $2 billion, which can be reinvested in new games, or returned to shareholders. But the chart doesn't explain the competitive moat that Activision Blizzard is building.

ATVI Revenue (TTM) data by YCharts.

In a world of video games that take years and millions of dollars to develop, Activision Blizzard is the industry's clear leader. It has some of the hottest console games in the world, and also owns World of Warcraft, which has been a money-making machine thanks to a slew of expansions and upgrades. And no company has made a faster transition to digital revenue sources and mobile gaming, helped by the acquisition of King Digital, maker of Candy Crush, in 2016.

As the video game industry evolves into more complex games that span the world of the digital devices we use today, Activision Blizzard is going to be an industry leader. It has remained incredibly popular, despite rapidly changing tastes in games, and has found ways to monetize games better than anyone else.

Video games may not seem like a conservative investment, but look at the free cash flow the business spits off each year. Billions of dollars in cash flow is something even the most conservative investor can find appealing.

A mission-critical investor service

Brian Feroldi (Broadridge Financial Solutions): Have you ever wondered how so many public companies manage the arduous process of keeping in touch with their investors? From proxy statements to prospectuses, there's a lot of paperwork for these businesses to keep track of. And yet, if they mess something up, then they could anger their shareholders and run afoul with regulators. That's why thousands of companies choose to outsource this boring, but important, work to an expert like Broadridge Financial Solutions.

Broadridge is the far-and-away leader in providing companies with investor-communication services. The company's market share in the U.S. is above 80%, which speaks volumes about its industry dominance. What's more, Broadridge also boasts a market share over 50% in the rest of the world, thanks, in part, to its knack for making smart acquisitions.

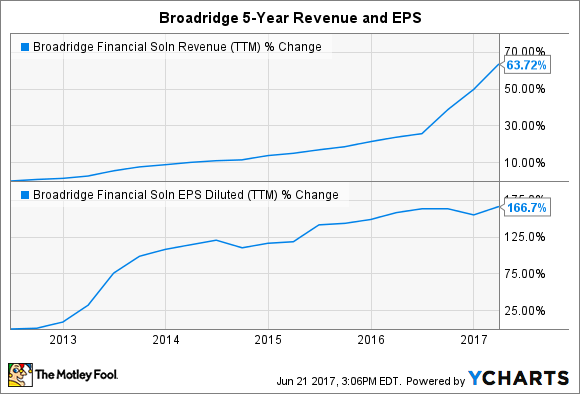

Buying shares of a paperwork processor might sound like a dull way to invest, but the economics of this business are so strong that I personally find Broadridge to be quite exciting. More than 91% of Broadridge's revenue is recurring in nature, and its customer-retention rate is around 98%. In addition, Broadridge's strong competitive position helps it to pass along regular price increases without its clients making too much of a fuss. When combined with occasional tuck-in acquisitions, Broadridge's long-term financial results are a thing of beauty.

BR Revenue (TTM) data by YCharts.

Moving forward, Broadridge's plan is to attract new clients, sell more services to existing clients, raise prices, and use its excess capital to buy back stock and raise the dividend. This is a straightforward plan that market watchers believe will allow profits to grow in excess of 13% annually over the next five years. With shares trading around 21 times forward earnings and offering up a dividend yield of 1.75%, I think that Broadridge is a growth stock that even risk-averse investors can learn to love.