Coca-Cola (KO 0.35%) and Reynolds American (RAI) work in very different parts of the consumer staples sector, but they have a lot in common. They share strong brands, customer loyalty, and solid long-term returns. Yet they've also faced their fair share of difficulties over time. With Coca-Cola dealing with controversy from critics of its namesake sugary carbonated beverage, the beverage giant has to answer some of the same questions that tobacco companies have dealt with for decades. Investors looking to decide which of these stocks is a better play right now should look at key metrics and compare how the two companies fare.

Stock performance and valuation

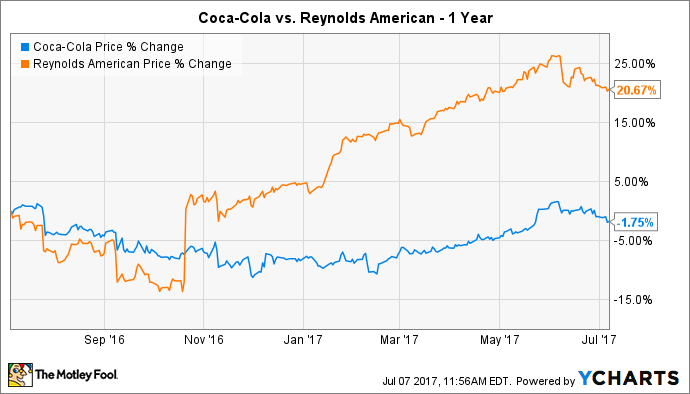

Coca-Cola and Reynolds American have gone in different directions over the past year. Coca-Cola's shares have slumped 2% since July 2016, but Reynolds American has jumped more than 20%.

Despite Coca-Cola's lagging performance, it isn't markedly cheaper than Reynolds American based on simple valuation measures. Looking back at what the two companies have earned over the past 12 months, Coca-Cola currently has a more expensive trailing earnings multiple of 31, compared to just 28 for Reynolds American. The tables get turned when you look at estimates of earnings for the immediate future. Reynolds trades at a forward earnings multiple of 24, and that makes Coca-Cola's 22 times forward earnings look a little more reasonable. Neither stock really stands out as a big bargain at current prices.

Dividends

For dividend investors, Coca-Cola and Reynolds American look a lot alike. Coca-Cola's dividend yield is just a little bit higher at 3.3%, but Reynolds' 3.1% puts it at only a slight disadvantage.

From a dividend growth perspective, it's hard to beat Coca-Cola's performance. The beverage company raised its dividend for the 55th year in a row earlier this year, and even given the pressure that Coca-Cola has been under, the increase of 6% wasn't just a token move. Reynolds American also has a history of dividend increases, but until recently, they haven't been as consistent. Flat periods in the early 2000s and during the recession of 2008 leave the tobacco company just a bit short, even though recent dividend increases have come fast and furious for shareholders. Coca-Cola has a slight advantage based on dividends.

Image source: Coca-Cola.

Growth prospects and risks

The big questions for Coca-Cola and Reynolds American involve their respective futures, and they have very different answers for shareholders.

Coca-Cola has struggled to keep its revenue moving higher in light of a big shift in consumer demand for its products. Coke and other carbonated beverages used to be the dominant product offerings from the company, but more recently, consumers have wanted healthier choices that have helped bolster the beverage giant's bottled water, tea, juice, and sports drink franchises. Coca-Cola recognizes the need for dramatic measures, and that's why it's looking at major corporate moves toward a more attractive long-term strategy going forward. Yet it will take time for new leadership to flesh out and implement those strategies. Until it does, Coca-Cola will have to answer critics if it keeps seeing slumping sales figures and relative weakness worldwide.

Reynolds American has worked hard to fight tough tobacco industry conditions, and its efforts have largely paid off. In its most recent quarter, revenue inched higher by 1%, and total sales volume of cigarette shipments domestically came in down 4.4% from year-ago levels. Reynolds didn't let that stop the company from boosting its bottom line, as adjusted net income climbed more than 10%. Pricing power has helped Reynolds maintain its earnings strength. Going forward, Reynolds investors hope that British American Tobacco (BTI 0.49%) will be able to use the company's assets to its advantage, as their proposed merger has cleared most of their hurdles and is expected to close in late July. After the merger is complete, Reynolds shareholders will get $29.44 in cash and 0.526 shares of British American for every Reynolds share they own. That way, they'll be able to participate in BAT's future, which will include not only Reynolds' U.S. operations but also BAT's existing global business.

Overall, Reynolds American appears to have more upward momentum than Coca-Cola right now. Even though shareholders will have to deal with the exchange transaction for cash and BAT shares, the future of the combined company looks promising. Coca-Cola has further to go before its own restructuring can claim the same success.