This article was updated on Feb. 19, 2018 and originally published on July 12, 2017.

Scientists like to joke that realizing the promise of nanotechnology has been five years away for the last 35 years. That would imply that there isn't a single nanotech stock available to investors. But while we don't yet have quantum lightbulbs or graphene-based water desalination, this list of nanotechnology stocks proves that nanotech products actually touch our lives every day:

|

Company |

Market Cap |

2017 Revenue |

Dividend Yield |

|---|---|---|---|

|

Thermo Fisher Scientific (TMO) |

$83.6 billion |

$20.9 billion |

0.3% |

|

BASF (BASFY) |

$98.3 billion |

$76.3 billion* |

3.1% |

|

PPG Industries (PPG) |

$29.3 billion |

$14.8 billion |

1.6% |

|

Chemours Co. (CC) |

$9.1 billion |

$5.9 billion* |

0.2% |

|

Intel Corporation (INTC) |

$214.2 billion |

$62.7 billion |

2.6% |

*TTM revenue up to September 30, 2017. Data Source: Google Finance.

You may not think "nanotech" when you see the big names in the list above, but a closer look reveals how they're leading the evolution of the field.

Image source: Getty Images.

Is nanotechnology the future?

First, let's start with a simple question investors might want to ask: What is a nanomaterial? There's no universally accepted definition, but regulators around the world have generally defined a nanomaterial as a product that (1) has at least one dimension of 100 nanometers or smaller and (2) gains unique properties from that dimension. The second part of the definition is often forgotten, but it's what gives such tremendous potential to nanotechnology.

Some materials become more magnetic or better able to kill pathogens at the nanoscale, while others can access different physical phases entirely. It all depends on the material, which is what guides applications and product development for the top nanotechnology stocks.

R&D needs to start somewhere

All that research and development needs equipment, reagents, and services -- all of which are provided by Thermo Fisher Scientific. The company is most closely associated with life-sciences research, a growing area of the nanotechnology field. Whether enhancing MRI contrast agents or using DNA origami to build nanostructures that deliver therapeutics to specific locations in the body, the company has played a pivotal role spurring innovation from the earliest stages of research.

In Sept. 2016 Thermo Fisher Scientific boosted its ability to serve the nanotechnology field by acquiring FEI Company for $4.2 billion, incorporating high-powered transmission electron microscopes (TEM) -- the only way to image nanomaterials such as metals, living cells, and semiconductors -- into its expanding empire of analytical lab services. In case investors are wondering how it's going, the segment's sales jumped 31% in 2017 to $4.8 billion.

Nanomaterials behind the scenes

Of course, the point of R&D is to turn discoveries in the lab into real products. How else would companies make money from nanotech? It may not always be obvious, but you use products enhanced with nanomaterials each and every day. Here are a few examples:

- T-shirts, underwear, and socks with odor and moisture protection built in are using silver nanoparticles to keep odor-causing bacteria at bay. The Dow Chemical Company and Fruit of the Loom (a subsidiary of Berkshire Hathaway) have a partnership to do just this.

- Similarly, PPG Industries and BASF include offering several coatings that incorporate nanomaterials. Infusing ceramic nanoparticles can produce self-healing paints that protect cars against minor scratches, while nanopolymer coatings applied on top of car paint can reflect heat to regulate temperature and make air conditioners more fuel-efficient.

- The ingredient in sunscreen that blocks UV (ultraviolet) rays from ravaging your skin is nano titanium dioxide, which is also a useful pigment and coloring agent for industrial applications. It's the most widely produced nanomaterial in the world, with companies such as Chemours leading the way.

- The semiconductor industry relies heavily on nanotechnology, a driving factor enabling Moore's Law(that the number of transistors per square inch on integrated circuits will double every year). Intel Corporation recently launched a 10-nanometer manufacturing technology that will increase the number of transistors per chip by a factor of 2.7 compared to current nanotechnologies.

What does it mean for investors?

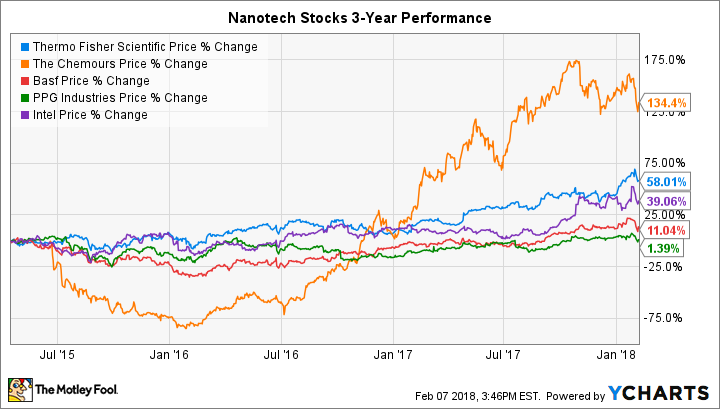

Nanotechnology isn't usually associated with these businesses -- it's just part of the table stakes for competing in today's coatings and microchip industries -- and doesn't comprise a majority of product sales for most companies. Chemours Co. may be the sole exception, as it derived 43% of total sales last year from titanium dioxide, and another 42% from fluoroproducts such as nonstick Teflon coatings -- although those happen to be at the center of serious questions about their impacts on human and environmental health.

That said, these nanotech companies have the size and financial flexibility to make big moves quickly, should major advances allow the field of nanotechnology to deliver on its science-fiction-like potential.