When investors think of unstoppable trends, marijuana stocks might rightly come to mind. But in terms of percentage returns, nothing has even come close to cryptocurrency ethereum, which has risen by right around 2,270% for the year, as of July 17, 2017. By comparison, it's taken the S&P 500 roughly 35 years to log a return of about 2,000%.

Off to the races

Ethereum's massive gains, and that of its bigger rival bitcoin, are primarily the result of a weaker dollar and growing media and investor interest in cryptocurrencies.

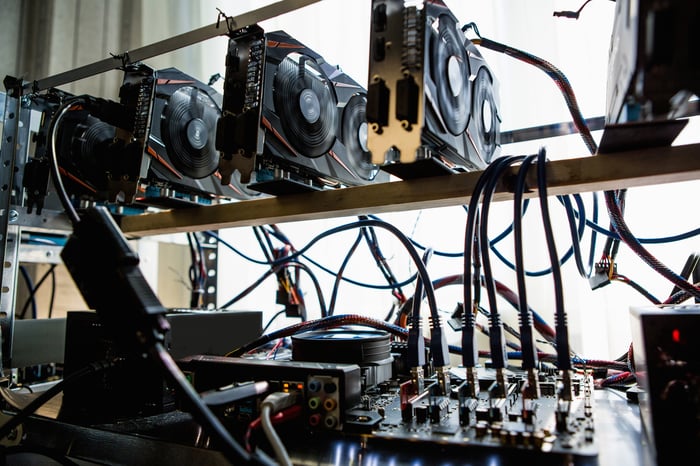

Image source: Getty Images.

For instance, earlier this year, we witnessed Japan make bitcoin a legal form of tender, as long as it complies with the country's anti-money laundering regulations. This nod of confidence comes with a growing list of retailers and service providers, such as Overstock.com and Microsoft, that in some way accept bitcoin as payment. Even select marijuana dispensaries have turned to cryptocurrencies as a bridge between consumers with debit and credit cards and financial institutions that want nothing to do with the cannabis industry.

Weakness in the U.S. dollar, which recently hit a 10-month low, has also fueled buying in digital currencies. Though a weaker domestic currency helps drum up interest in exports, domestic investors typically dislike dollar declines. A devaluation in the dollar usually means investors will seek out a better store of value, which traditionally has been gold. Gold is a finite resource, and thus its scarcity provides the perception of safety and value to investors. However, mined cryptocurrencies like bitcoin also have a finite limit (21 million coins in bitcoin's case), offering the perception of scarcity and value.

The fact that these currencies aren't backed by the government, and that the public still doesn't understand them very well, has also arguably fueled interest and momentum.

But as the old proverb goes, "What goes up must come down."

Image source: Getty Images.

Cryptocurrency ethereum is imploding -- here's why

Following what was a better-than-5,000% run higher in a matter of months at one point, ethereum has seen its value crash in recent weeks. Since touching an all-time high of $407.10 back on June 12, ethereum has given back more than half of its value. As of 7:15 p.m. EDT on July 17, it was going for less than $189 per coin, and it had dipped as low as $130.26 during this past weekend. From peak to trough, we're talking about a 68% loss in value in less than five weeks, or more than $20 billion in market cap erased.

What on earth is going on, you ask? Some of this recent drop could be nothing more than simple profit-taking. Keep in mind that we're talking about an asset that appreciated by around 5,000% at one point this year. Considering how few businesses accept ethereum as payment, investors would have been foolish not to lock in some of their gains. But profit-taking is far from the only reason ethereum has been taken to the woodshed over the past month.

Another issue concerns the uncertain future of bitcoin. On Aug. 1, bitcoin is set to undergo a software update. The issue at hand is that those who are responsible for the upkeep of bitcoin behind the scenes have split into two factions, and are thus planning to adopt two separate and competing software updates. According to Bloomberg, these factions are debating whether bitcoin should evolve as a currency to serve more mainstream applications or remain as a libertarian test to monetary theory.

Though the incentive to reach a consensus and calm investors is obviously high, there remains a very real risk that bitcoin could subsequently split into two separate cryptocurrencies if a consensus is not reached. This instability has carried over to ethereum, which is regarded by some pundits to have a better underlying technology and broader use than bitcoin.

Finally, as CNBC pointed out, start-ups could be behind the recent plunge in ethereum. Sky-high returns have allowed start-ups the opportunity to cash in their ethereum coins for an equivalent amount of U.S. dollars, thus increasing selling pressure on the cryptocurrency.

Image source: Getty Images.

Decentralization: Friend or foe?

Perhaps the biggest issue yet to be decided with cryptocurrencies like ethereum and bitcoin is whether decentralization is a friend or foe.

In one sense, decentralization is a great thing. Having numerous miners across the globe effectively keeps these cryptocurrencies from succumbing to the will of cyberattacks. If there was a central network behind bitcoin, as an example, it could become an easy target for criminals.

Then again, a lack of centralization on cryptocurrency trading exchanges is arguably bad news. Competing exchanges and a lack of trade centralization are what drive volatility and reduce the uptake of these currencies by businesses.

In short, there's a lot left to be hashed out in the coming weeks for bitcoin and cryptocurrencies in general. While they represent an alluring alternative for consumers who dislike the traditional monetary system, use options are still pretty limited, and translating cryptocurrencies into U.S. dollars often has a lag time that can result in losses for investors and businesses. There are numerous issues that need to be tackled before ethereum, bitcoin, or any cryptocurrency for that matter, really has a shot at thriving over the long run. For the time being, I suggest sticking with a tried-and-true wealth creator like the stock market and keeping cryptocurrencies like ethereum out of your investment portfolio.