Online video streamer Netflix (NFLX -9.09%) has never shied away from using debt to fund its growing catalog of original content, which in turn has been helping drive subscriber gains. Shares soared to fresh all-time highs today following a strong earnings report. The company added 5.2 million net additions globally in the second quarter, easily beating its own forecast of 3.2 million, and expects to add approximately 3.65 million in the third quarter.

There are a few reasons why Netflix's rising debt levels are cause for concern for investors (myself included).

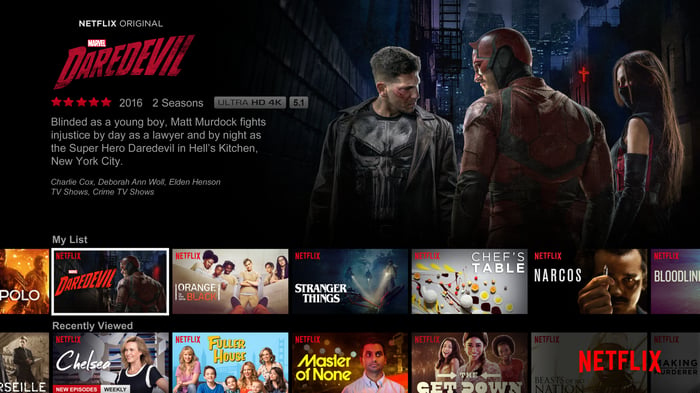

Image source: Netflix.

Interest expense is eating up profits

For starters, Netflix's long-term debt has now ballooned to $4.8 billion, following a 1.3 billion euro bond offering in May. Content costs are rising, which is burning up free cash flow at an alarming rate. Bloomberg Gadfly's Shira Ovide notes that Netflix burns more free cash flow than Tesla, which operates in one of the most capital-intensive industries in the world. This is not a new revelation. Netflix frequently warns investors that negative free cash flow could persist for years, but points to strong subscriber figures as justification.

There's some validity in that argument, but at the same time Netflix is rather nonchalant about the direct costs. Interest expenses continue to march higher, coming in at $55.5 million (43% of operating income) last quarter.

A poor theoretical justification

It's also disconcerting that Netflix justifies its debt strategy with a heavy reliance on financial theory. Specifically, the company referred to "efficient capital structure theory" in its Q1 letter, while noting that its "debt to total cap ratio" was less than 10% at the time. While debt-to-equity ratio is a commonly used metric, Netflix is referring to its debt-to-market-cap ratio, which is somewhat misguided. A company's market cap is determined by market forces and is not accounted for on the balance sheet in any way. In other words, Netflix uses its soaring stock price as justification for taking on increasing amounts of debt, even though the stock price doesn't directly help pay for the costs associated with that debt.

CEO Reed Hastings reaffirmed this justification on the earnings call last night (emphasis added):

And then there's comfort with being able to finance it, and of course, our debt-to-market cap is incredibly low and conservative, so we've got lots of room there. And I think that combination that it's spent well and we can raise it is what makes us very excited. And the irony is the faster that we grow and the faster we grow the owned originals, the more drawn on free cash flow that we'll be. So in some senses, negative free cash flow will be an indicator of enormous success.

If anything, Netflix's soaring stock price means that the company should at least consider the idea of raising equity capital, since it would get a lot of bang for its buck if it conducted a secondary offering at current prices, as dilution costs would be minimal. Netflix correctly points out that using debt capital reduces its weighted average cost of capital (WACC), and using debt to fund growth is not fundamentally inappropriate in itself. Netflix just needs to be more prudent with its debt strategy.

The most obvious flaw with using debt-to-market cap is that if share prices were to fall, the justification fails. At the same time, it's hard to imagine Netflix putting the brakes on debt if its market cap were to pull back, which it implicitly should, given how it rationalizes debt. Netflix is a polarizing stock with a fair amount of short interest (7.5% of float), and it trades at nearly 240 times earnings. A pullback is a very real possibility due to the growth expectations that are being priced in. If one occurs, Hastings will find that "lots of room there" can shrink rather quickly.