Data analytics specialist Teradata (TDC 0.95%) reported second-quarter results early Thursday morning. Adjusted earnings came in 69% below the year-ago period's results at $0.22 per diluted share, and top-line sales fell 14% to land at $513 million. Both of these figures were at or below the low end of Teradata's guidance for the quarter, and they also fell short of Wall Street's expectations.

That might sound like a recipe for hurting Teradata investors right in the pocketbook, but that's not what happened at all. Instead, share prices raced as much as 11.6% higher on the news, swinging very close to the stock's 52-week highs.

Crazy, I know -- stocks are not supposed to soar when the company misses its earnings targets. But this move actually makes sense. These three key details from Teradata's earnings report and conference call will show you how and why.

Image source: Getty Images.

1. Accelerating guidance

After dodging full-year guidance in the last two earnings reports, Teradata finally put together a framework for the second half of 2017. It's looking pretty good.

Full-year revenues should come in roughly 9% below the 2016 tally. That's a smaller drop than the 10% seen in the first quarter, and obviously below the 14% plunge in the second quarter. In other words, sales trends should turn significantly more positive in the second half, and Teradata emphasized that the fourth quarter should outperform the third by a wide margin.

This guidance update played a large part in Teradata's sudden stock price boost on Thursday.

2. Subscription revenues

Peeling back one more layer of Teradata's evolving business model, we get to one important reason why sales are stumbling now but headed upward later on.

The company has been offering a new subscription-based pricing model for its enterprise data analytics services for less than a year. In the long run, management would love to move every customer to a subscription plan, because it turns a one-time payment into a long-term contract with smaller fees paid over several years.

Management sees this as a win-win for Teradata and its clients.

"With our simplified pricing tiers and subscription-based licenses, it is easy for customers to get started quickly and affordably and pay as they go instead of working through a long capital approval process," said chief product officer Oliver Ratzesberger in the earnings call, according to a transcript compiled by Seeking Alpha. "We are seeing customers adopt subscription licenses more rapidly than expected and this is building future recurring product revenue for us."

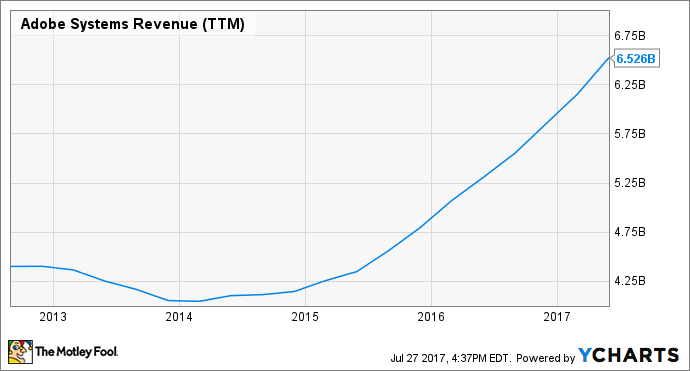

Teradata would not be the first enterprise computing company to move in this direction. Adobe Systems (ADBE 0.89%) headed down that path a few years ago, and the Photoshop maker's revenue chart speaks volumes about how that move is working out:

ADBE Revenue (TTM) data by YCharts

These days, subscription sales account for 84% of Adobe's total quarterly revenues, up from 58% in 2014 and just 15% five years ago. Teradata hopes to follow a similar parabolic curve over the next few years, and is arguably sitting in that uncomfortable revenue trough that Adobe experienced in 2014.

3. The bounce is coming, and soon

CFO Stephen Scheppmann called 2017 a building year, where the company is setting the stage for greater things in the future. Revenue growth is coming back as soon as 2018 as the subscription-based pricing model continues to evolve.

And the company is not afraid to invest in itself while shares are cheap.

"Customers are embracing our hybrid cloud deployment and pricing consumption options, and as a result, we are even more confident in our strategy and plan to acquire up to $300 million of our stock during the second half of 2017," Scheppmann said.

Low-cost buybacks can be a tremendously effective use of cash, assuming that the turnaround really is right around the corner. As such, Scheppmann's statement here is a $300 million vote of confidence in a successful transition to subscription-driven sales growth.

So all things considered, Teradata cleared up some confusion around its evolving business model in this quarterly report. Sales are slow right now but for good reason, and a big bounce is coming. That was all it took to trigger a quick share price jump on Thursday.