Kinder Morgan Inc. (KMI 2.08%) just announced a 60% dividend increase coming in 2018, with 25% growth for 2019 as well. That's the type of news that should catch your attention, but it will only get the dividend back to where it was before a dividend cut in 2016. So ignore Kinder Morgan and its "big" dividend news and check out Enterprise Products Partners L.P. (EPD 0.51%), Magellan Midstream Partners, L.P. (MMP), and Buckeye Partners, L.P. (BPL) instead.

1. If size matters

Kinder Morgan is one of the largest and most diversified midstream players in the energy industry. Enterprise is bigger and equally diversified, if not more so. Either one will get you broad exposure to the midstream space. The big difference is how investors have been rewarded.

Image source: Getty Images

One of the key reasons Kinder cut its dividend was so that it could use the freed-up cash to invest in growth projects. It was probably the right move for the company, but it was a painful blow for dividend investors. Enterprise, on the other hand, has managed to continue to grow without resorting to a distribution cut. To put some numbers on that, since the partnership's IPO in 1998 it has spent $38 billion on organic growth projects and $26 billion on acquisitions. It currently has $8.6 billion worth of projects being built right now.

The distribution, meanwhile, has been increased every single quarter for 52 consecutive quarters. The annual streak is up to 20 years. Clearly, Enterprise knows how to grow its business without resorting to distribution cuts. And Enterprise's yield is roughly 6%, more than what you'd get from Kinder even after the dividend is returned to its former level in 2019.

2. Growth on tap

Magellan Midstream Partners' yield is "only" 5% right now -- roughly the yield you'd get from Kinder after the 2019 hike based on current prices. But Magellan has a 17-year history of annual increases under its belt, with increases in each of the past 30 quarters. And the annualized growth rate of the distribution has been a robust 11% over the past decade, Enterprise's distribution grew at just under 6% over the same span.

Magellan has invested heavily, but it's looking to spend even more. Image source: Magellan Midstream Partners.

Magellan is no slouch when it comes to investing, either. The $16 billion-market-cap company (Kinder's market cap is $45 billion) has spent $5 billion on growth projects and acquisitions over the last 10 years. It has roughly $1 billion in projects under construction today. And it's preparing for even more growth in the future.

Although management doesn't expect to sell stock right away, since it believes there's still room on the balance sheet for more debt, it's setting up an at-the-market equity program that will allow it to sell units when it's ready. The cash from those sales will help fund future growth. This move isn't based on hope: Management is looking at projects that could more than double the $350 million of growth spending Magellan has planned for 2018 today. It's nice to see the partnership planning ahead for growth, so it shouldn't have to find other sources of cash, like a distribution cut.

3. More risk, more yield

Last up on this list is probably the most risky, Buckeye Partners. This partnership's business is focused on storage with a mix of domestic and foreign assets, making it much more focused than Kinder, Enterprise, or Magellan. However, its current distribution yield is 7.7%, more than Kinder's yield will be in 2020 based on its current price and its recently reported dividend growth plans.

But don't stop there: Buckeye has more impressive stats than just its yield. For example, it's increased its dividend annually for 22 years, better than Enterprise and Magellan. Even when times were a little tough, with the coverage ratio dropping below 1, management didn't resort to a cut. Distribution coverage, for reference, has been back above 1 for the past three years.

A look at the changes Buckeye has made. Image source: Buckeye Partners

The thing is, the company has been making a lot of changes lately. Since 2010 it has spent $8 billion on acquisitions and internal growth projects in an effort to diversify its business. The change has been material, taking the company from relying on the domestic storage business for 96% of adjusted EBITDA to a split of 55% domestic and 43% foreign. ("Other" made up the difference.)

All that change without a distribution cut despite a distribution coverage that dipped below 1 -- clearly, Buckeye has proved its commitment to unitholders. There's more risk here, but with more than a 7% yield, more aggressive investors are getting paid well for taking it on.

Getting back to zero

Sure, if you buy Kinder Morgan today, you're in line for huge dividend increases -- assuming management lives up to what it has promised. But it needs to make big increases just to get the dividend back to where it was before the 2016 dividend cut was made so it could afford its growth plans. I'd much rather own companies that have managed to invest in their businesses without resorting to giving investors a distribution haircut.

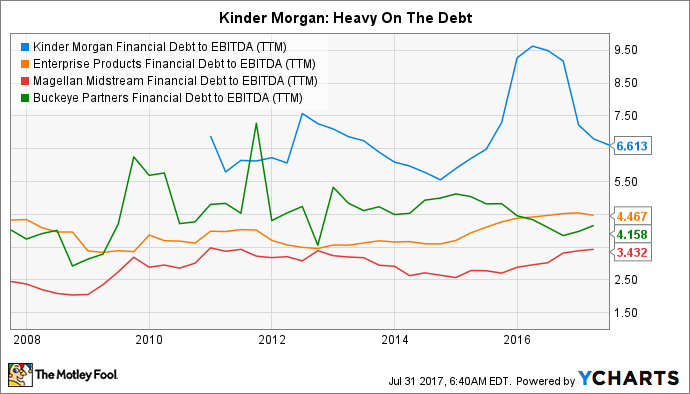

KMI Financial Debt to EBITDA (TTM) data by YCharts

A picture may be worth 1,000 words here. Enterprise, Magellan, and Buckeye are all more conservatively financed than Kinder Morgan. Debt to EBITDA was below 5 at this trio in 2016 but over 9 at Kinder. No wonder it had to resort to a dividend cut. And while that metric has improved notably at Kinder, its debt to EBITDA figure is still well above the partnerships I've highlighted here, making them better alternatives in my eyes.

Enterprise is every bit as large and diversified as Kinder if that's important to you. Smaller Magellan is prepping for growth so it doesn't need to worry about finding cash down the line, and it has been rewarding investors with double-digit distribution growth. Buckeye is a bit more risky, but it easily has the highest distribution yield here, if high yields are your focus. All three, however, should be on your radar if you're considering Kinder Morgan.