If you are a dividend investor, oil and gas midstream giant Kinder Morgan's (KMI -0.88%) 2.5% yield might not pop up on your radar screen. But over the next couple of years that's likely to change. Here's what you need to know now about Kinder Morgan's huge dividend potential... just don't let the dividend prospects blind you to the risks.

Heading higher

Dividend investors should be checking Kinder Morgan out right now. The company just recently announced that it will increase its dividend 60% in 2018. That will pull it up from $0.50 a share per year to $0.80. Based on today's prices, the yield will jump from 2.5% to nearly 4%, a much more enticing number given that it's around twice the yield available from the S&P 500 today.

Image source: Getty Images

But that's not the end of the story. Kinder is expecting to increase the dividend to $1.00 per share per year in 2019, taking the yield to roughly 5%. And then another $0.25 increase in 2020 will bring the annual dividend per share to $1.25. Using today's prices, that equates to a roughly 6% yield... and a 150% increase in the dividend in just three years!

The company's dividend potential is one of the big reasons why Motley Fool's Matthew DiLallo called Kinder Morgan "the perfect stock for any investor." If dividends are your thing, you really do need to take a moment and contemplate the dividend potential at Kinder Morgan.

A grain of salt

You also need to take what you read about the future of the company with a grain of salt. As the saying goes, a bird in the hand is worth two in the bush -- and until Kinder Morgan actually increases its dividend payments, those fat yields are just hypothetical. And when it comes to Kinder Morgan, that's a big deal.

In October 2015, the company announced plans to increase its dividend by 6% to 10% in 2016. Management specifically said, "As a company, we remain focused on our goals to continue to return cash to our shareholders in increasing amounts..." Yet in December 2015, less than two months later, it announced that it would cut the dividend by a painful 75% 2016. In fact, even if Kinder Morgan follows through on its current plan, the dividend won't be back to its pre-cut levels until 2019, after two dividend hikes.

KMI Dividend Per Share (Quarterly) data by YCharts

To be fair, cutting the dividend in 2016 was probably the right move for the company. It needed cash to reduce the debt on its balance sheet and pay for growth projects. But for income investors, that quick about-face cut deeply (figuratively and literally), and it means that you can't assume that Kinder Morgan will live up to what it says. Note that peers like Enterprise Products Partners L.P. (EPD -1.86%) didn't trim distributions.

Better place

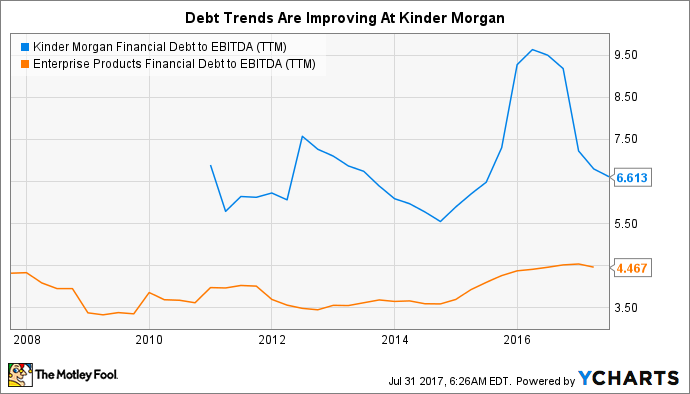

That said, Kinder Morgan is in a better financial place today than it was just a couple of years ago. For example, long-term debt peaked in 2016 and has now begun to head lower. Perhaps more important, however, is that the company's debt to EBITDA has fallen from over 9 in 2016 to around 6.5 -- a figure more in line with its historical trends. But that's still well above Enterprise's debt to EBITDA level of around 4.5. The more conservatively financed Enterprise has increased its distribution for 20 consecutive years and yields around 6% today.

KMI Financial Debt to EBITDA (TTM) data by YCharts

So, at the moment, I believe the company will be able to hit its dividend targets. But no investor should go in blind to the history here. If the debt to EBITDA number starts to creep higher again management has shown it is willing to sacrifice the dividend. In other words, if you are enticed by Kinder Morgan's dividend potential, make sure you also keep a close eye on its debt levels. If you don't you might end up with an unwanted surprise and a dividend that doesn't live up to your expectations.