Precious metals focused Wheaton Precious Metals (NYSE: WPM) isn't your typical gold and silver stock. It's a streaming company, which is a similar but notably different business than mining. The company used the commodity downturn to invest for the future, which is showing up now in its results. And there should be plenty more to come. Here's why there are good things ahead for Wheaton Precious Metals.

What is streaming?

The first thing you need to understand about Wheaton is that it doesn't own or operate gold and silver mines. As a streaming company, it provides cash up front to miners like Glencore and Vale SA (VALE 0.42%) in exchange for the right to buy silver and gold at reduced rates in the future. This is a good deal for miners who might have a hard time finding reasonably priced capital via other means, like bank loans or issuing stock and debt in the capital markets.

Image source: Getty Images.

But it's a great deal for Wheaton, because it leads to very low costs. To put a number on that, the streaming company's cost for silver is around $4 an ounce, and for gold, it's about $400 an ounce. The prices of both metals are much higher than that today.

Down is an opportunity

To understand the full impact of the company's business model, though, you need to step back and rethink the precious metals business. A miner suffers during a downturn and generally has to focus on cutting costs. It makes sense: The prices of the silver and gold (or other commodities) it sells are low, so it's likely to be short on cash.

Wheaton Precious Metals' top and bottom lines will fall, too. However, it isn't likely to pull back on spending. Its business is to provide cash to miners, and industry downturns are exactly when miners are most in need of cash. This helps explain why it inked $1.8 billion worth of deals with Teck and Glencore in 2015. That year was close to the worst of the commodity downturn. At that point, both of those giant miners were desperate for cash to shore up their balance sheets, and Wheaton was happy to provide it.

Not surprisingly, Wheaton posted record sales volumes and revenues in 2016, but the investments it made during the downturn aren't done paying dividends just yet. That's because its mining partners are continuing to invest in their assets, which means there's more silver and gold coming Wheaton's way.

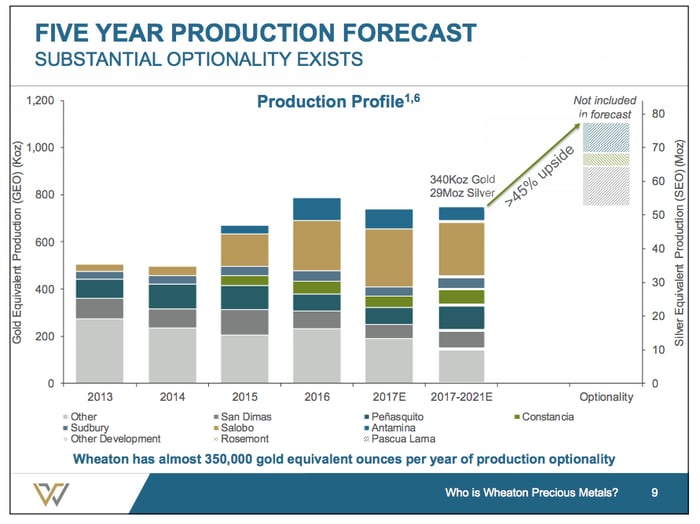

Take a look at the graph below. Production looks like it will remain fairly steady between now and 2021, but that's only if its mining partners don't complete any of the projects they have lined up. If all of Wheaton's investments work out as hoped, production could rise by as much as 45% over that span! To be honest, that's unlikely to happen...the end result is likely to be somewhere in between those two extremes.

Wheaton has upside production potential. Image source: Wheaton Precious Metals.

But here's the really exciting part: Wheaton's business model is to pay up front for the right to buy silver and gold in the future. So, its costs to benefit from those projects is minimal. It just gets to buy more silver and gold at well below market costs as the projects come to fruition.

A few good years

Wheaton opportunistically used the downturn to set itself up for higher production. We've seen that flow through to its results. But it's unlikely to be a one-time bump. As its mining partners spend to expand production at the mines in which Wheaton has invested, this streaming company will see production continue to move higher without the need for additional material investment. Those additional ounces of silver and gold are, effectively, bought and paid for. Which is why the best is still ahead for Wheaton Precious Metals.