Investing over a multidecade time frame can be incredibly difficult because we don't know what the future holds. Need proof? Three of the market's beloved FANG stocks weren't even public companies in 2000. While there is a pretty good chance all of these stocks will be great wealth-generating stocks over the long haul, there is no guarantee that some company five to seven years from now won't completely disrupt them just like they did to so many others on their ascent.

If you want to find investments that are likely to last for a decade or more, a great place is to look at those boring, simple businesses that do something incredibly difficult to replace or disrupt. Three companies that fit this description well are uniform rental company Cintas (CTAS -0.12%), household product manufacturer WD-40 Company (WDFC -0.59%), and trash handler Waste Management (WM 0.85%). Here's why these three stocks have what it takes to succeed over the long haul.

Image source: Getty Images.

The benefits of the business model

Cintas, WD-40, and Waste Management don't seem like they would have a lot in common. Renting and cleaning uniforms, marketing and distributing lubricants and cleaners, and handling trash aren't exactly businesses with a lot of overlapping interest. At their core, though, these companies products and services all have this in common: They are repeat purchases for something essential that isn't easily replicated or replaced.

In the case of Cintas, the company's suite of business services provide something that few companies want to do on their own like laundry and deep cleaning for facilities. Uniforms and buildings get dirty on a rather regular schedule, which creates a customer base that routinely employs the company's services. This business benefits immensely from economies of scale as few other service providers have the logistics network of Cintas to deliver on these services.

Like Cintas, Waste Management's trash collection fleet and its landfills have a captive customer base. When it comes to removing waste, a company has to have some place to dispose of it properly, and the regulations for landfills give existing landfills a near geographic monopoly. So, in most markets, Waste Management can sign up customers for long-term service contracts that provide predictable revenue and cash flow streams.

WD-40 may sell products versus a recurring service that Cintas or Waste Management provides, but these products are both ubiquitous and repurchased at regular intervals. Management estimates that more than 80% of households in the U.S. have that iconic blue and gold can on a shelf, and higher-use customers like maintenance specialists tend to go through a lot of it. Add that to the company's suite of cleaning products, and you have a large product base with lots of recurring revenue. There are plenty of other lubricant and maintenance products out there, but that WD-40 brand carries a lot of cachet.

Turning steady revenues into high rates of return

These three companies are nowhere near the only businesses that benefit from recurring sources of income. What sets these three apart, though, is the ability of their respective management teams to turn these revenue streams into high rates of return for investors.

The first element that makes this possible is controlling costs. Cintas and Waste Management have a bigger challenge here because they own and operate large logistics networks with lots of capital tied up in fleet vehicles and facilities, but both have managed to produce consistent EBIT margins for decades. WD-40 has the immense benefit of having little to no capital tied up in manufacturing. Rather, the company contracts all production to third parties to keep costs down and to focus on marketing and distribution.

CTAS EBIT Margin (TTM) data by YCharts.

One thing that you may have also noticed is that these aren't exactly what you would call high-growth industries, so spending a lot on organic growth is likely going to result in diminishing returns. Operating in mature markets like these either mean a company has to grow through acquisitions or by returning high amounts of cash to shareholders. In this case, both Cintas and Waste Management will acquire smaller competitors from time to time to grow their respective customer base. Cintas' recent acquisition of competitor G&K Services is a great example.

Beyond these kinds of acquisitions, however, these companies take their free cash flow and return it to shareholders through either increasing dividends or share repurchases.

CTAS Dividend data by YCharts.

What a Fool believes

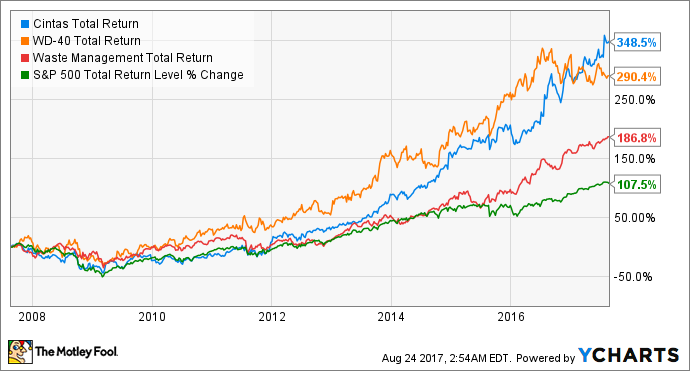

Cintas, WD-40, and Waste Management aren't companies that are going to blow you away with double-digit growth every quarter, but what they will do is provide slow and steady growth that translates to high rates of return, a slowly declining share count, and reliable dividend increases. Those are the kinds of traits that lead to compounding wealth over time.

CTAS Total Return Price data by YCharts.

Imagining what the world will look like a decade from now is incredibly hard. Just think back to 2007 and think how different things are today. These three businesses, though -- uniforms, maintenance and cleaning products, and handling trash -- probably aren't going to change much in that time frame. So if you are looking for stocks to hang on to for a decade or more, these look like great options.