Dr Pepper Snapple (DPS) stock trounced the market in 2014 and 2015, but has left shareholders feeling flat recently. It is underperforming the market (and rival Coca-Cola (KO -0.04%)) so far in 2017 and over the past full year.

Below, we'll look at a few catalysts that could shift momentum back into the beverage specialist's favor.

More marketing wins

There's a good reason why Coca-Cola spends $4 billion a year on advertising: It works.

Image source: Getty Images.

The right promotional message can drive sales growth, protect market share, and boost profitability while lifting the value of the beverage brand.

Dr Pepper's smaller global sales base requires a lot less in ad spending. But marketing is still critical to the business, and a good promotion plan has the power to turn things around for its drink brands.

Take 7UP for a recent example. The original "un-cola" has been around since 1929, but a new advertising campaign is helping the brand resonate deeply with today's consumers. Volume jumped 5% in the core U.S. geography last quarter to mark the third straight quarter of growth for the franchise. That success played a key role in the company achieving surprisingly strong sales growth in the fiscal second quarter .

Continued branding gains in the 7UP segment -- or similar success in the company's other core franchises of Dr Pepper, Canada Dry, A&W, and Sunkist -- would spark market share growth and boost confidence in this business.

Acquisitions pay off

You don't get a corporate name like Dr Pepper Snapple Group unless you have a history of major acquisitions. In fact, this company was assembled in several stages over the last three decades. After starting out with the Schweppes business and then adding Mott's, Canada Dry, A&W, and Sunkist, the company tacked on Dr Pepper and 7UP.

Its acquisition of Snapple in 2000 significantly boosted its share of the U.S. non-carbonated beverage market and helped establish the prime industry foothold that Dr Pepper Snapple Group maintains today.

Image source: Dr Pepper Snapple Group.

Management hopes its next big purchase will add even more value to that positioning. The $1.7 billion purchase of Bai Brands that it accomplished late last year brought a mix of popular water, tea, and carbonated beverages into its portfolio. It's hard to overstate how optimistic executives are about the long-term growth potential of these products. "We are not going to be shortsighted here," Chief Financial Officer Martin Ellen told investors in mid-August. "We have an opportunity to do something we haven't had the opportunity to do before," he continued.

The opportunity Ellen mentioned has to do with scaling up a hit niche brand into a national beverage powerhouse. Whether it can succeed at this aggressive goal or not, this process will require major investments, especially in marketing support aimed at convincing people to give the products a try.

Profitabilty improves

The Bai Brands purchase has the potential to elevate profit margins thanks to the higher sales prices of many of the products. Dr Pepper Snapple Group has a few more immediate ways it can boost earnings, too.

Management is currently working to reduce costs, and operations benefited from reduced discounts to retailers in core brands last quarter.

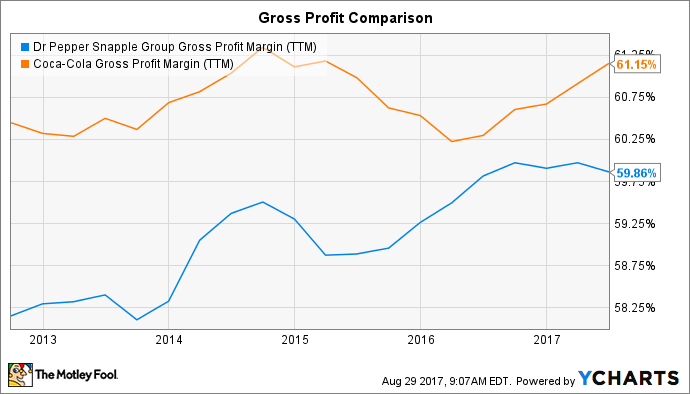

DPS Gross Profit Margin (TTM) data by YCharts.

Executives are projecting that gross profit margin will tick higher by 0.5 percentage points for the full year to close the gap a bit with Coca-Cola. Whether Dr Pepper Snapple hits that goal, and whether the modest improvement continues into 2018 and beyond, will depend on the company's success at building on its recent positive sales momentum.