What happened

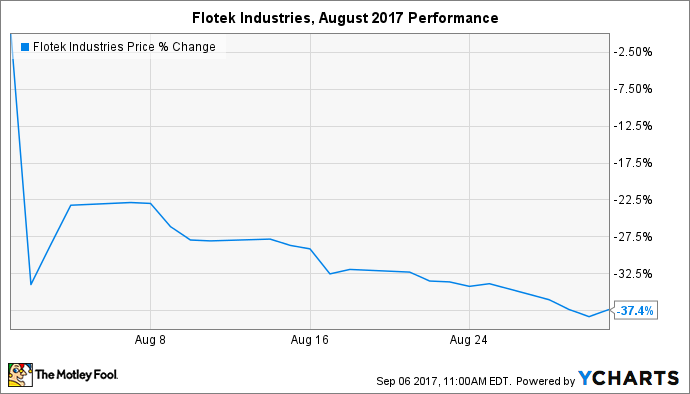

Shares of oil and gas chemistry company Flotek Industries (FTK 0.58%) fell over 37% last month after the announcement of disappointing second-quarter 2017 earnings. While revenue grew both sequentially and year over year, the top and bottom lines missed Wall Street expectations. Worse, many other oil-field services companies have turned in steadily improving operations and share prices, which makes the fact that this company cannot seem to capture the rising tide all the more painful for shareholders.

That said, there was some good news as well. Flotek Industries continued to make progress selling off low-margin businesses as part of management's strategy to refocus on higher-value core offerings. Additionally, later in the month the company announced that an ongoing Securities and Exchange Commission inquiry into its claims about its FracMax software and the efficacy of its Complex nano-Fluid (CnF) chemistry products was closed without further action being taken.

Nonetheless, shares maintained a steady slide throughout the entire month.

Image source: Getty Images.

So what

Flotek Industries reports two business segments: energy chemistry technologies and consumer and industrial chemistry technologies. The former is the bread-and-butter business, which is targeted at oil and gas well drilling applications and comprised 77% of all revenue during the last quarter. The latter is supposed to be a high-margin business selling flavors, fragrances, and solvents for various applications.

Both segments struggled from higher costs during the period compared to the year-ago quarter.

|

Metric |

Q2 2017 |

Q2 2016 |

% Change |

|---|---|---|---|

|

Revenue, energy chemistries |

$65.9 million |

$43.4 million |

51.8% |

|

Revenue, consumer and industrial chemistries |

$19.3 million |

$20.7 million |

(6.7%) |

|

EBITDA margin, energy chemistries |

24.1% |

26.3% |

(225 bps) |

|

EBITDA margin, consumer and industrial chemistries |

10.9% |

16.7% |

(579 bps) |

|

Operating margin, energy chemistries |

14.1% |

17.5% |

(340 bps) |

|

Operating margin, consumer and industrial chemistries |

6.2% |

13% |

(680 bps) |

Data source: Flotek Industries press release.

The segments may seem unrelated, but they're tied together by the source of raw materials: citrus oils. While it's easy to see the connection with flavors and fragrances, the company's CnF technology for oil and gas well drilling fluid is based on citrus compounds such as terpene and limonene. Flotek Industries is one of the world's largest processors of citrus oils as a result.

Unfortunately, the company has been unable to leverage its industry leadership position to create shareholder value recently.

One big reason has been the devastating loss of citrus crops to citrus greening disease, which has put pressure on citrus oil prices for Flotek Industries in recent years. Although management has promised to corral pricing volatility with new product formulations and pricing options, those efforts have yet to show any signs of a payoff for shareholders. Worse, since the citrus industry has largely resisted the potential of biotech genetic traits to ease the impact of citrus greening disease, the industry's problems -- and the company's margins -- may only get worse from here.

Now what

The finer details of how and where Flotek Industries sources its raw materials explains why the stock has suffered even as others in the oil and gas services industry have benefited from increased investment in drilling across the continent. Given the seriousness of citrus greening disease, and a lack of viable options to address it, margins will probably continue to be pressured for the foreseeable future. Simply put, Flotek Industries may not return to historical levels of profitability, even once product volumes recover. Investors should probably sit this one out.