Gold and silver are commodities subject to swift and often severe price swings. That volatility can make owning precious metals miners like Barrick Gold (GOLD 1.70%) and Newmont Mining (NEM 0.77%) a vexing affair at times, which is why investors looking at the precious metals mining industry should step back and consider a company like Wheaton Precious Metals (NYSE: WPM). It's a streaming company, and there's a lot to love about the way it approaches the precious metals space.

The model

Miners try to find a good location for digging up commodities like silver and gold. Then they build a mine, run it, and, eventually shut the mine down. It's a labor intensive, time consuming, expensive, and sometimes uncertain process. Now layer on top of all of that the fact that silver and gold are volatile commodities.

However, Wheaton Precious Metals doesn't work like a miner.

Image source: Getty Images

Wheaton is what's known as a streaming company. It provides cash up front to miners in exchange for the right to buy silver and gold in the future at reduced rates. Miners use the cash for paying down debt, building new mines, and expanding existing mines. It provides them an alternative source of financing when other options, like banks and capital markets, aren't desirable -- like during industry downturns.

Wheaton, meanwhile, locks in low prices. And that's the first reason I love this company. To put a number on that, Wheaton's average price for silver is around $4 an ounce, and for gold it's around $400 an ounce. That's well below the current prices of each of these metals, and leads to wide margins.

WPM EBITDA Margin (TTM) data by YCharts

Those wide margins provide a fair amount of protection during the lean years. A quick comparison to industry giants Newmont and Barrick shows the benefits: over the last decade, both of these miners watched their EBITDA margins fall into the red a couple of times. Wheaton's EBITDA margins, on the other hand, remained in positive territory throughout the 10-year span, which included a deep precious metals downturn.

Some other lovable stuff

There's something else about the streaming model that's pretty enticing: it tends to be a little counter-cyclical. In 2015, for example, roughly the worst of the gold and silver downturn, Wheaton inked $1.8 billion worth of deals. That led to record production in 2016 when precious metals prices were starting to recover. To put it simply, Wheaton opportunistically uses downturns to improve its business for the long term.

And not all of its deals are for operating mines. Many are for development projects. Of Wheaton's 29 investments, 21 are currently operating and eight are in some phase of development. That means that there's built in growth in the portfolio as development projects get completed. So even when big deals are scarce because miners are flush with cash, Wheaton still has growth opportunities.

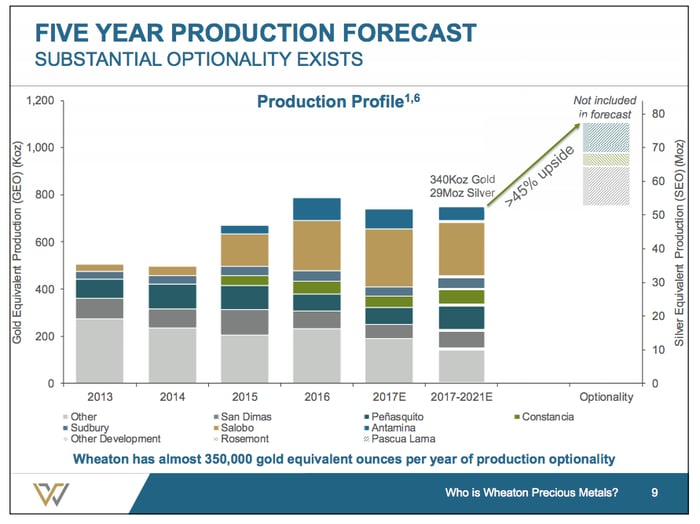

Wheaton has upside production potential. Image source: Wheaton Precious Metals

Wheaton calls this optionality. It estimates that production could be as much as 45% higher than it currently projects between now and 2021 if all of its projects work out as hoped. So even without inking a single new deal, it has a lot of opportunity to grow production.

A different kind of diversification

One last reason to love Wheaton is its variable dividend policy. I prefer steadily increasing dividends, but precious metals are generally looked at as a way to diversify your portfolio. Wheaton's dividend will go up when it's making more money and down when it's making less. But think about that for one second.

Precious metals tend to do well when the market is doing poorly. That means that Wheaton's dividend is likely to go up right when you most want a little extra income to assuage your market-frayed nerves. Wide margins, the ability to benefit in good years and bad, and a dividend that will likely give you a bit of good news when the sky feels like it's falling... It's easy to see how investors could fall in love with this stock.