Diversified Canadian miner Teck Resources Ltd (TECK -1.24%) made a big financial commitment in 2013, one that left it with a huge financial obligation right when the commodity downturn was starting to get really bad. Investors were worried that it couldn't cover both its current debts and its spending plans, but with a lot of hard work and an assist from improving commodity markets, Teck made it through the abyss -- and in a few short months the big commitment will start paying off.

A little background

Teck's business today is centered around three commodities: metelurcial coal, copper, and zinc. These three segments wax and wane over time, like all commodities, but steelmaking coal has been the real driving force on the top- and bottom-lines lately. For example, in 2012 coal provided around 45% of revenues and nearly 55% of gross profit before depreciation and amortization. In 2015, just before commodities started to trend higher in 2016, coal's contribution had fallen to 37% of revenues and 34% of gross profit because of a mix of slack demand and weak met coal prices.

Image source: Getty Images

Looking at that a different way, revenues from the coal segment fell nearly 35% between 2012 and 2015. Gross profit in the coal business, meanwhile, declined an even more painful 62%. Copper was weak too, with the smaller business seeing a nearly 42% drop in gross profit. But here's where it gets interesting: the zinc business actually increased gross profit over that period by nearly 40%.

Ups and downs

The fact that the zinc business improved even as coal and copper were struggling shows the value of diversification. Unfortunately, that business wasn't enough to assure the markets that Teck could afford its financial obligations.

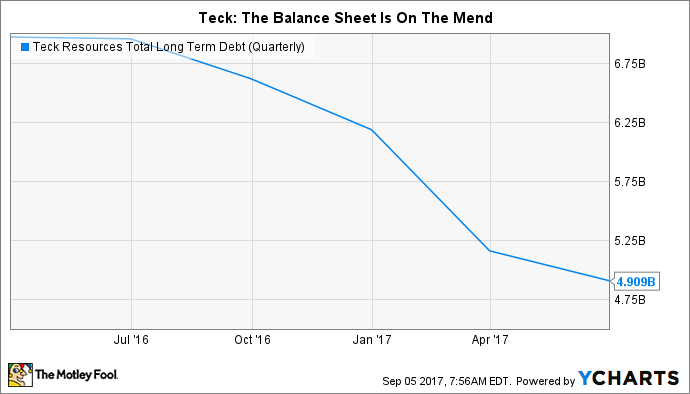

A big part of the concern stemmed from the fact that Teck's debt levels increases 44% between 2012 and 2015 -- right when two of its three core businesses were struggling. A portion of that debt overhang was driven by the late-2013 decision to expand into the energy business with a 20% investment in the Fort Hills Oil Sands project. The full cost of the project is expected to be roughly $13 billion. Its partners in this project are oil sands expert Suncor Energy (SU 1.29%), which owns around 51% of Fort Hills, and France's Total, which owns the remaining share. With commodity markets on the mend since early 2016, Teck has been able to reduce its debt load, and the worries about its balance sheet have largely passed.

TECK Total Long Term Debt (Quarterly) data by YCharts

But what hasn't changed is the fact that the Fort Hills project is set to come online at the end of 2017. It's currently over 90% complete. That's going to add a fourth major commodity to the portfolio, substantially increasing Teck's diversification. The interplay between zinc, copper, and coal between 2012 and 2015 shows how valuable diversification can be to Teck's business, which is the first reason I love Teck -- and once the oil starts flowing it will be a fundamentally better company because it will be more diversified.

However, there's more to like here than just adding another commodity to the mix. The spending associated with the investment will suddenly turn into revenues as it ramps up to near its full capacity of 194,000 barrels of oil a day in the 12 months after first oil. Lower spending and more revenue will be a big plus for Teck's top- and bottom-lines. The project, meanwhile, has a 50-year life expectancy, so it will be contributing for a very long time.

The biggest thing to like about Fort Hills, however, is that the market may not fully appreciate how profitable it will be once it's up and running. Oil sands are often viewed as very expensive, but Teck expects Fort Hills to be a net benefit even if oil prices remain range bound in the $40 to $50 a barrel area.

How does expensive oil work at relatively low prices? Motley Fool's Tyler Crowe recently highlighted Suncor's efforts during its second quarter conference call to explain this. It's actually pretty simple: once an oil sands project is built it is relatively cheap to operate. In other words, Teck has already paid the big upfront bill for Fort Hills, and now it's about to benefit from the project's low ongoing costs for the next 50 years.

Counting the days until first oil

Teck is benefiting from a commodity recovery, a fact most investors are aware of. And at the end of the year it will materially improve its business by adding a fourth commodity to the mix. But many investors don't fully understand the dynamics of the oil sands, which means the company is not just increasing diversification, but is doing so with an underappreciated asset. Despite a material price advance off its lows, there's still a lot to love about Teck as Fort Hills inches closer and closer to completion.