Disney (DIS -0.83%) shares recently dipped below $100 for the first time this year, after the House of Mouse warned that its full-year earnings would be roughly flat and miss analyst estimates for 3% growth. Meanwhile, Hurricane Irma's approach forced Disney to close Disney World in Orlando, which generates about $30 million in revenue daily.

Jefferies analyst John Janedis projected a three-day closure, which would result in $90 million in lost revenue excluding storm-related damages. All that bad news caused Disney to drop to fresh lows for the year, causing many investors to wonder if the stock has lost its magic.

Shanghai Disney Resort. Image source: Disney.

What happened to Disney?

Disney's ongoing problems are mostly attributed to its struggling media division, which houses cable networks like ESPN and Disney Channel, and over-the-air networks like ABC. The problem plaguing that business, along with many of Disney's media peers, is cord-cutting -- consumers replacing their bulky cable subscriptions with streaming OTT platforms like Netflix.

That's why Disney's ESPN subscribers dropped from 98 million in 2012 to just 90 million at the end of 2016. Domestic Disney Channel subscribers fell from 98 million to 93 million. Other channels, like ABC Family (now known as Freeform), posted similar declines.

This paradigm shift is throttling Disney's earnings growth. The media business' operating income dropped 11% annually during the first nine months of 2017, but still accounted for 45% of its total operating profits. The unit's revenue growth stayed flat during that period.

Disney traditionally offsets those losses with the stronger growth of its theme park and movie businesses. However, Disney's profit warning indicates that strategy might be unsustainable.

What's Disney's game plan?

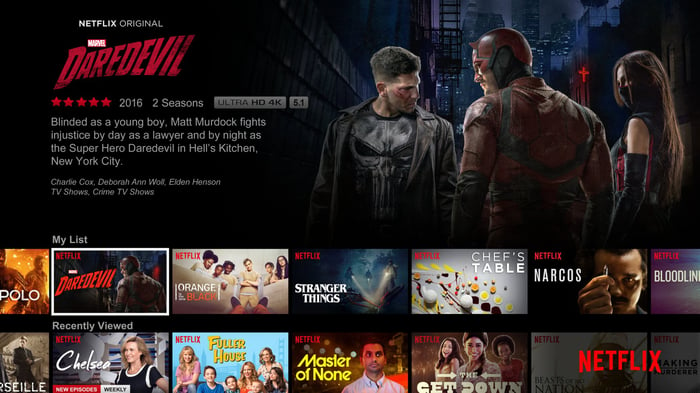

Disney's plan is to pivot those media businesses toward two main streaming platforms -- one for its core Disney properties and the latter for ESPN. Disney's namesake platform will include Disney's first-party content, Star Wars, and Marvel titles. This marks a clear break with Netflix (NFLX -0.62%), which licenses Disney content and co-produces Marvel shows like Daredevil. Disney previously announced that it would end its distribution agreement with Netflix in 2019.

Image source: Netflix.

As for ESPN, Disney recently boosted its investment in streaming technology company BAMTech from 33% to 75%. Disney has declared that the platform, which was spun off the MLB's digital arm, would serve as the foundation of ESPN's over-the-top service. Turning ESPN into a live-streaming platform could be a wise move, since it's a market Netflix has failed to touch.

But can Disney really launch a successful streaming platform?

Disney is leveraging its massive portfolio of first-party, Pixar, Marvel, Star Wars, and ESPN content to lure users to its upcoming OTT services. However, many companies have tried the same strategy with limited success.

Time Warner's (TWX) HBO Now is backed by Game of Thrones, but the service only reaches about 3.5 million subscribers. CBS (PARA 3.64%) expects its All Access and Showtime OTT platforms to exceed 4 million subscribers by the end of the year. Those are puny figures compared to Netflix's 99 million paid subscribers worldwide.

HBO Now. Image source: Google Play.

Netflix clearly has the first mover's advantage, while HBO and CBS are distant laggards. Since Disney is arriving even later to the game, it could reach an even smaller audience -- even with the backing of its blockbuster franchises. CBS has also proven that live sports isn't necessarily Netflix's Achilles' heel, since its All Access service already offers live streams of NFL games.

I'm also not convinced that Disney's divorce from Netflix was the right call for two reasons. First, Netflix was reportedly paying Disney $300 million annually for access to 10 movies per year. Second, Netflix's Marvel shows were among its biggest hits, and supported the growth of Disney's MCU (Marvel Cinematic Universe) in theaters and on TV. Disney could have strengthened those bonds and used them as leverage against Netflix to negotiate even higher rates in the future.

I'm not giving up on Disney yet...

Disney's stock performance this year has been disappointing, but I don't think that the company has completely lost its magic. Disney is approaching the streaming business with a lot more hit franchises than Time Warner or CBS, and it has plenty of cross-promotional opportunities with its theme parks and films.

Therefore, Disney might finally give Netflix a black eye. I'll give Disney some more time to prove itself, but I'm still concerned that its theme park and film businesses won't prop up its media business long enough for its streaming plans to bear fruit.