FireEye (MNDT) shareholders have enjoyed eye-popping gains so far in 2017, with investors bidding up the stock on signs of an operating rebound. There are good reasons for the spike, considering the cybersecurity specialist just logged a growth uptick and made strides toward reaching profitability.

FireEye is set to add to that positive momentum with an improving sales pace for the second half of the year, if you believe CEO Kevin Mandia's latest forecast.

Still, a few important caution signs warrant a conservative approach by investors who are hoping for a quick rebound.

Image source: Getty Images.

No history of profits

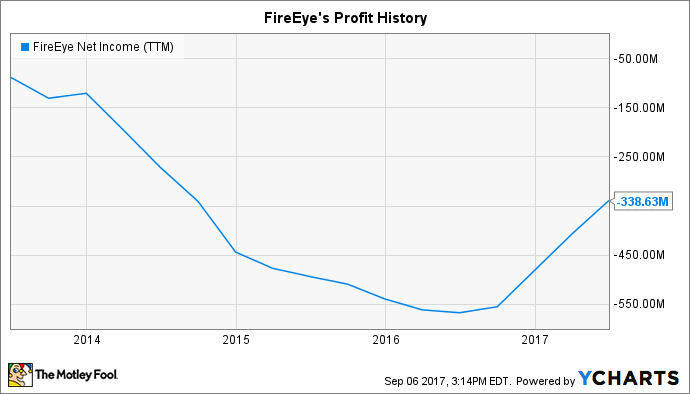

For one, FireEye remains deeply unprofitable despite its recent progress at cutting costs. Sure, operating profit margin improved last quarter. But we're still talking about a business that's strapped with a hefty expense burden.

Operating costs were $178 million in the most recent quarter, compared to $235 million in the year-ago period. The improvement was highlighted by the management team as part of a long-term goal of syncing expenses up with revenue. "We have made great progress at rationalizing our cost structure," Mandia said in an early August press release, "and reduced our operating losses by more than $100 million in the first six months of the year."

FEYE Net Income (TTM) data by YCharts.

Executives are confident that they'll reach a positive non-GAAP operating profit margin by the end of this year. The company should squeeze out a slightly positive cash flow figure, too. However, net operating profit will almost certainly be negative for all of 2017 to mark the 13th consecutive year of operating losses for FireEye.

Sluggish growth

Revenue growth ticked higher last quarter to a 6% pace from 3% in the fiscal first quarter. Yet billings showed a 12% decline to remain weak. Investors traditionally want to see healthy growth in billings because that's the best indicator of robust revenue gains in the future.

A few other metrics point to general softness in the sales base. FireEye last quarter posted its lowest number of new high-value contracts, those totaling over $1 million, in over two years. It also added just 221 new customers to its footprint, compared to 287 in the prior year. Finally, the average length of contracts dipped to 22 months from 28 months.

Looking forward

Executives expect customer growth to improve over the next few quarters due to a surge in subscription renewals on the calendar and the popularity of its Helix platform. They believe the Helix launch will drive increased subscription and support revenue as well. That optimism led Mandia and his team to increase their full-year revenue guidance to between $745 million and $775 million, up from the prior target of between $734 million and $746 million.

They still see billings dropping for the full year, though, compared to a huge spike in both 2014 and 2015. And investors will have to be patient, given that most of the growth is set to come in the fiscal fourth quarter.

Altogether, these trends describe a business that's inching toward non-GAAP profitability and likely to book slight annual revenue gains. Both those trends would mark solid improvements over the prior year. They would also leave plenty of work ahead for FireEye to achieve the consistent earnings strength that Mandia and his team are targeting.