We Fools believe that the best way to make money in the markets is to buy high-quality companies and hold them for the long term. But which companies, in particular, do we think are worth owning for an extended period of time? We asked that very question to a team of investors and they picked Waste Management (WM 0.79%), Magellan Midstream Partners (MMP), and Verisk Analytics (VRSK).

Image source: Getty Images.

One man's trash...

Keith Noonan (Waste Management): Trash collection and disposal probably isn't the most exciting industry to invest in, but when you're looking for stocks that can be held for decade-plus durations, "boring" companies that pay dividends often make for great portfolio additions. As America's largest garbage hauler, Waste Management has the type of boring, dependable business that likely will make its stock a treasure for long-term investors.

With regard to returned income, the company boasts a solid 2.2% yield that's comfortably above the S&P 500's 1.9% yield and has raised its payout annually for 14 years running. It's 53% payout ratio and predictably profitable business also suggest that the company is in good shape to continue delivering regular dividend growth.

As the nation's population continues to rise, it's a safe bet that consumption will continue to climb, as well, and Waste Management's ability to continue reducing its operating costs and leveraging pricing power -- which stems from having a virtual monopoly in its areas of operation -- points to a sturdy, low-risk business that's primed to reward investors for years to come.

For a company that operates in a low-growth space, Waste Management might look expensive trading at roughly 26 times forward earnings estimates. However, its hold on its markets and reliable income generation do a lot to offset those concerns, and the company is also steadily growing through acquisitions that are strengthening its industry dominance.

With nearly guaranteed demand for its services, little in the way of competition, and income generation, Waste Management is a safe stock that you can hold to 2030 and beyond.

Slow, steady, and plenty of yield

Reuben Gregg Brewer (Magellan Midstream Partners, L.P.): U.S. midstream oil and gas partnership Magellan Midstream Partners is unlikely to be an exciting investment between now and 2030. But if history is any guide, it's a company you can safely own while expecting regular distribution increases along the way.

For starters, Magellan's business is largely fee based. That means that oil and natural gas prices are less important than demand for these key global feedstocks to Magellan's business. As long as the world is still using oil and natural gas for everything from gasoline to electric power to chemicals, Magellan's assets will have customers.

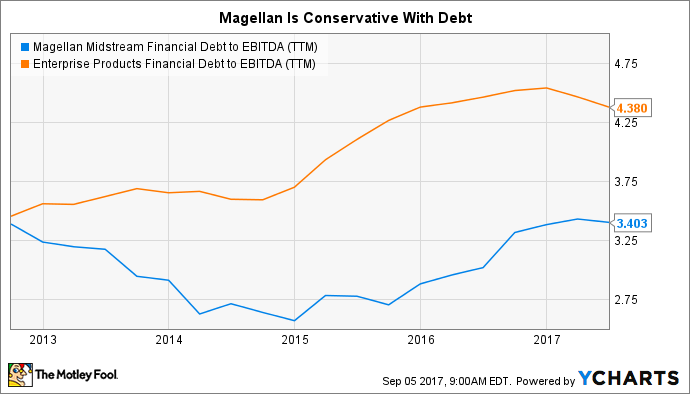

Then there's the fact that Magellan is conservatively financed, with debt-to-EBITDA (earnings before interest, taxes, depreciation, and amortization) below that of even industry bellwether Enterprise Products Partners. So the balance sheet shouldn't cause you any alarm, either.

MMP Financial Debt to EBITDA (TTM) data by YCharts.

Add in the fact that Magellan has increased its distribution every year since it came public in late 2001, a roughly 17-year streak. The average annualized rate of increase over the past decade, meanwhile, was roughly 11%, well above the historical growth rate of inflation -- another thing you don't have to worry much about.

Management is always on the lookout for growth opportunities, too. Right now, it has plans for around $1 billion in spending. But there's another $500 million on the drawing board that could soon get the green light. That means Magellan should continue to grow its business and, in turn, its distribution over time at a slow and steady rate.

Magellan is unlikely to excite you, but it won't likely keep you up at night, either. It'll just keep rewarding you for owning it while you collect the over 5.2% distribution yield, backed by regular distribution increases.

The insurance industry's go-to data provider

Brian Feroldi (Verisk Analytics): Predicting what the world is going to look like in 2030 is difficult, if not impossible, but I'm fairly certain that the insurance industry will still be around. If true, then insurers everywhere still will be willing to pay up to get their hands on tools and data that allow them to measure and manage risk. That's why I believe that Verisk Analytics is a company that can continue to thrive from here.

What sets Verisk apart from other data providers is that it was founded by a consortium of insurance companies way back in 1971. At the time, the leading insurers of the day decided to pool their data together so they could more effectively price their policies. This fact provided Verisk with a unique database that isn't available anywhere else.

Fast forward to today, and all different kinds of companies look to Verisk for risk-management solutions. What's more, those customers pay Verisk a hefty subscription fee in order to gain access to the company's tools and data. This makes its financial statements highly predictable.

In addition, since it doesn't cost the company much to add one more customer to its platform, Verisk's profits tend to grow at a much faster rate than revenue.

VRSK Revenue (TTM) data by YCharts.

Between Verisk's price increases, acquisitions, and continued margin improvement, I think the odds are very favorable that the company's revenue and profits will continue to grow at a robust rate from here. That makes this a wonderful stock for long-term investors to get to know.