Check Point Software Technologies (CHKP 0.53%) has been on a roll this year, winning over investors with its laser-like focus on enhancing earnings by boosting its subscription business. But fellow cybersecurity provider Palo Alto Networks (PANW 1.43%) has remained out of favor so far in 2017, underperforming the broader market thanks to a big setback earlier in the year.

However, Check Point's rally came to an abrupt halt in July due to light third-quarter guidance, while Palo Alto seems to be moving in the right direction as its fiscal fourth-quarter report indicated improvements in the company's sales performance.

But does this make Palo Alto the better buy over Check Point? The answer to this question is far from settled despite the performance discrepancy, as both stocks could appeal to investors with different risk appetites.

Image Source: Getty Images

The case for Palo Alto Networks

Palo Alto Networks' sales reorganization has worked wonders in recent quarters. The company's top-line growth has hit a higher gear as customers are purchasing more subscription services. The average customer lifetime of Palo Alto's top 25 customers increased 56% from the prior-year quarter to $21.9 million.

So, Palo Alto's relationship with its top customers has become more valuable thanks to regular product updates that are driving subscription sales. In fact, the subscription business now supplies close to 60% of the company's revenue, having shot up 54% during the recently concluded fiscal year.

Palo Alto has managed to achieve such stupendous subscription growth thanks to its strategy of capitalizing on hot cybersecurity trends. The company equipped its security platform with ransomware protection in the previous quarter in a bid to protect customers against the WannaCry cyber attack that affected several computers across the world.

Not surprisingly, Palo Alto added 3,000 clients in the previous quarter. Additionally, ransomware protection is going to open up a huge opportunity as this market is estimated to hit $17 billion in the next four years.

The company's focus on increasing subscription revenue will help it keep a tab on costs as repeat purchases by existing customers will lower customer acquisition costs.

Palo Alto now must focus on reducing costs and increasing margins on the back of a stronger subscription business to strengthen its long-term investment case.

The case for Check Point Software Technologies

Check Point Software Technologies has been an investor favorite this year, as its 30%-plus gains suggest. The stock recovered remarkably since its July 20 report as investors sensed that the post-earnings drop could be an opportunity to buy since its weak third-quarter guidance was a result of a calendar event.

Check Point Software's sales will be affected by the Yom Kippur holiday in Israel, which will fall on the last day of the third quarter. The company pulled in $30 million worth of business toward the end of the second quarter, so the one-off guidance miss seems justified. Not surprisingly, investors jumped at the opportunity to buy more shares, since Check Point's subscription business growth and strong balance sheet could be long-term catalysts.

The company now gets a quarter of its revenue from subscriptions. This is positively impacting its margin profile as the cost of selling subscriptions is just 4.5% of the segment's revenue, much lower than the 19% outlay in the products and licensing business. Additionally, Check Point management is conservative when it comes to spending money on marketing.

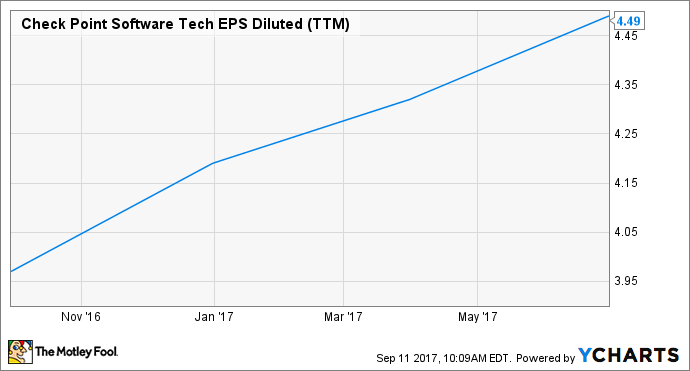

The company spent less than 25% of its revenue on sales and marketing last quarter, which is almost half of Palo Alto's spending. Not surprisingly, Check Point has delivered steady earnings growth in recent quarters, as shown below:

CHKP EPS Diluted (TTM) data by YCharts

What's more, Check Point management's focus on keeping costs low and improving the bottom line on the back of steady top-line growth has helped the company maintain a debt-free balance sheet. It also has a substantial cash pile of $1.6 billion, which can be put to good use to attract more customers through research and development, marketing spend, or even acquisitions.

Therefore, Check Point Software could be a good long-term bet if it continues to execute well on growing its subscription business.

The verdict

Investors looking for a value play in the cybersecurity space will definitely be more inclined toward Check Point. The company's price-to-earnings ratio of 25 is slightly lower than the industry median of 26.

The profitable Check Point could be a good choice for investors seeking a safe bet in the industry. But those having a higher risk appetite and looking for aggressive growth will be inclined toward Palo Alto. Its revenue grew almost 28% last fiscal year, but at the same time, the generally accepted accounting principles (GAAP) net loss had also jumped over 35% to $216.6 million.

However, Palo Alto is trying to chart a path toward profitability. It has started getting a lid on costs by building a recurring revenue stream, which should lead to improved margins in the long run. Still, Palo Alto investors should be open to volatile swings in the stock price as it might experience growing pains.