Royal Gold, Inc. (RGLD -1.09%) and Wheaton Precious Metals (NYSE: WPM) are both gold and silver streaming companies. In fact, they offer a very similar approach to gaining exposure to the precious metals industry. However, they differ in two important ways: diversification and dividend policy. It's the latter issue that's going to be the biggest differentiator for most income investors.

What's streaming?

Royal Gold and Wheaton make money by providing miners cash up front for the right to buy gold and silver, and sometimes other metals, at reduced rates in the future. They don't own or operate mines themselves. There's a number of implications, here. First, since they don't own and operate mines, they avoid all of the risks and complications that miners like Newmont Mining and Barrick Gold (GOLD 1.68%) face.

Image source: Getty Images.

Second, and perhaps most important, Royal Gold and Wheaton lock in low prices. To give you an example, Wheaton's average price for silver is around $4 an ounce, and its average price for gold is about $400 an ounce. Both are materially below current prices for the metals and contractually locked in. The streaming model leads to high margins for these precious metals companies.

And those margins are fairly resilient, even in the face of falling commodity prices. Take a look at the graph below. Over the past decade, EBITDA margins for Royal Gold and Wheaton have remained solidly in positive territory despite the period including a deep commodity downturn. Miner Barrick, on the other hand, has seen its EBITDA margin fall into the red a couple of times over the same 10-year period, partially because of the vagaries of physically operating mines.

WPM EBITDA Margin (TTM) data by YCharts.

That said, there is a notable difference between Royal Gold and Wheaton: diversification. Wheaton's approach has been to focus on fewer, larger deals. It has investments in 29 projects, 21 of which are operating mines, and eight that are in some stage of development. Wheaton has an $8.5 billion market cap.

Royal Gold, on the other hand, has over 180 investments, 38 operating mines, 24 development projects, and 130 mines that are in the evaluation and exploration stage. It has a $5.8 billion market cap. Neither one is inherently a better approach, but if you like to spread your eggs over as many baskets as possible, then Royal Gold gets the nod, here. Just note that its deals are, generally speaking, going to be smaller.

The big one

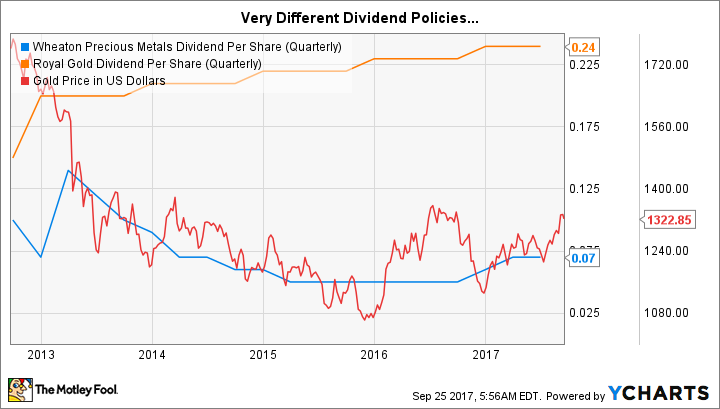

All of that said, the most notable difference between Royal Gold and Wheaton is probably their choice of dividend policies. Royal Gold has focused on returning value to investors via a slowly growing dividend payment. It's increased that disbursement annually for 16 consecutive years. The average annualized increase over the past decade was 15%, an impressive number. Over the trailing-three-year period, though, annualized dividend growth dipped to about 5%. But that makes sense being that commodity markets only started to pull out of their downturn in early 2016.

That's a unique and impressive dividend record in an industry that's driven by often swift and dramatic commodity price moves. If you like collecting a steadily rising dividend check, Royal Gold is the better choice, here, because Wheaton's approach to dividends is a bit more volatile. Since peaking at $0.14 per share in the first quarter of 2013, Wheaton's dividend has been cut six times and increased three times.

WPM Dividend Per Share (Quarterly) data by YCharts.

Those changes are driven by the fact that Wheaton's "quarterly dividend per common share will be equal to 20% of the average cash generated by operating activities in the previous four quarters divided by the Company's outstanding common shares at the time the dividend is approved, all rounded to the nearest cent." In other words, you get more when Wheaton is doing well, and less when Wheaton's results are weak.

That's not a bad approach, but it is very different from the dividend policy Royal Gold has taken. However, there is a reason you might like Wheaton's dividend. Gold and silver generally perform well when the stock market is underperforming. So, right when other investments are suffering, you are likely to see Wheaton's stock doing better and be in line for a larger dividend payment. It's kind of like having an extra layer of diversification.

Slow and steady is my choice

Summing it up, both Royal Gold and Wheaton Precious Metals provide roughly similar exposure to silver and gold. But they have some subtle differences worth noting, like diversification and their dividend policies. My preference is for slow and steady dividend increases, so I prefer Royal Gold because of its history of regular annual dividend hikes. But if you are looking to precious metals for diversification, Wheaton's variable policy could work for you.