Investors are a bit down on Kimberly-Clark (KMB 1.28%) these days. Shares are trailing the market as the consumer goods giant struggles through a period of slowing growth. Step back and take a bigger picture view of the business, though, and you'll see that there's plenty to like about the stock.

Below I'll highlight three of the biggest reasons to remain bullish on an investment in Kimberly-Clark.

Image source: Getty Images.

Steady growth

Kimberly-Clark's operating momentum is headed the wrong way right now. Organic sales are running flat so far this year, compared to a 2% increase in 2016 and a 5% spike in 2015. But while it's always disappointing to see revenue shrinking, Kimberly-Clark isn't alone in this challenge. Procter & Gamble (PG 0.68%) is targeting only a slight sales uptick this year and Unilever recently told shareholders that sales volumes in the industry slowed down to "virtually flat."

Given that this is an industrywide issue, it's reasonable to assume Kimberly-Clark's operating results will begin rebounding toward its historical average once selling conditions improve.

And that long-run average is impressive. Thanks to its deep portfolio of consumer staple brands like Huggies diapers, Scott paper towels, and Kleenex tissues, the company has maintained a compound annual growth rate of between 3% and 4% over the last decade, with adjusted earnings rising by about 6% per year in that time.

Financial strength

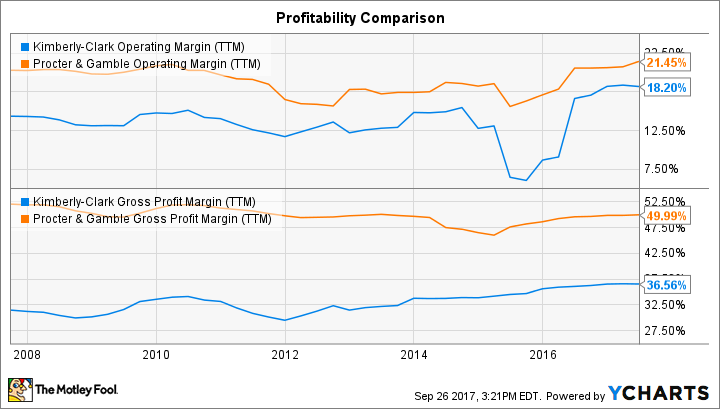

The company's healthy pricing power is evident in its results, too. Even after a slight decline this year gross profit margin is at 37% of sales, up from 33% five years ago. Operating margin has seen a similar bump, rising to 18% of sales from 14% in 2012.

KMB Operating Margin (TTM) data by YCharts

Sure, Kimberly-Clark still has its work cut out for it in catching up to Procter & Gamble. P&G has, after all, sliced billions out of its cost infrastructure in an initiative that helped operating margin pass 21% of sales. Yet Kimberly-Clark has closed the gap in recent years and is targeting further gains as it generates as much as $450 million of savings in 2017.

These financial wins should help the company continue generating modest earnings growth despite flat sales. And once the industry starts expanding again there should be room for even more robust profit growth.

Healthy cash returns

Kimberly-Clark's dividend record doesn't approach the 61-year growth streak that Procter & Gamble shareholders can claim. But its 45 years of consecutive annual raises is still a long enough period to include many economic booms and busts -- all of which failed to knock the company from its commitment to a steadily increasing payout.

Kimberly-Clark investors have also received bigger raises over the past few years, with the dividend rising at a 5% pace in both fiscal 2016 and 2015, compared to P&G's 3% boost this year and its 1% uptick in 2016. The company is spending heavily on stock repurchases, too, with the outstanding share count down by 30% since 2003.

Kimberly-Clark's stock is valued at a significant discount to P&G's today. Investors are paying 2.3 times sales for shares, or 19 times expected profits, compared to 3.9 times sales and 22 times earnings for P&G. It makes sense that Wall Street would assign a higher value to the market leader, especially given its higher profitability and faster growth rate.

But Kimberly-Clark enjoys many of the operating and financial assets that have made P&G such a great long-term investment, just at a cheaper price. That's why I think it deserves a spot on any income investor's watch list.