Oil prices peaked at over $100 a barrel in mid-2014 and then fell sharply to around $30 a barrel in January of 2016. Although prices have rebounded since that low, they remain range bound at about half the previous highs. ExxonMobil Corporation (XOM 0.02%) has rolled with the punches, though, continuing to reward shareholders with annual dividend hikes. That's a testament to its conservative culture and diversified business. If volatile energy prices have you wondering how risky ExxonMobil is, well, here are some key facts you'll want to know.

Diversification

Exxon is an integrated energy company. That means it has operations across the industry, including drilling, refining, and chemicals. This is notable because oil prices affect each of these business differently. Specifically, downstream businesses like refining and chemicals can actually benefit from lower input costs (essentially falling oil prices).

Image source: Getty Images.

This dynamic was on clear display in 2015 when the drilling business saw earnings decline roughly 75% as oil prices fell. That same year, though, earnings in the downstream businesses more than doubled, largely because oil prices were declining. The improvement in the downstream business' earnings wasn't enough to offset all of the pain from falling oil prices, but it certainly helped to soften the blow.

Exxon isn't the only energy company with a mix of upstream and downstream assets. But this diversification sets the stage for a very stable business.

Low on debt

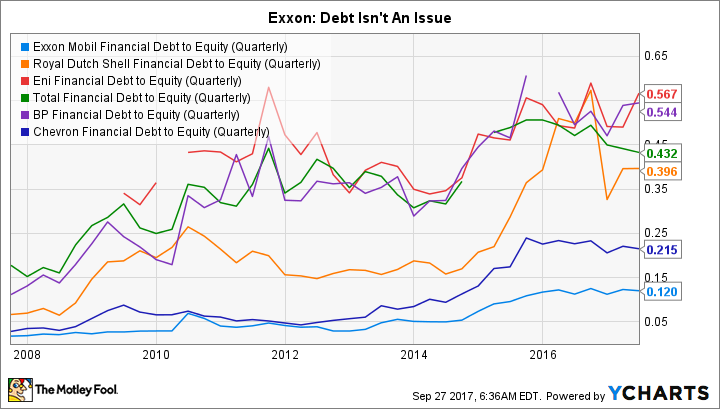

The next important fact is that Exxon is one of the least leveraged energy majors. That said, if you read the news, you'll know that Exxon added a lot of debt during the energy downturn. There's no denying that fact; between 2013 and 2016, long-term debt increased from roughly $7 billion to almost $29 billion. That's a massive increase.

XOM Financial Debt to Equity (Quarterly) data by YCharts.

But step back for a second. During the downturn, all of the energy majors cut costs and added debt to support their businesses. Exxon was no different in this regard. However, Exxon happens to have one of the strongest balance sheets in the industry, with debt making up only about 15% of its capital structure at the end of 2016, even after adding all of that debt. And Exxon is already starting to pay its debt off, cutting long-term debt by over $4 billion through the first six months of 2017.

The thing is, this is exactly what you want to see management do -- use its rock-solid balance sheet to smooth out the ups and downs of the volatile energy industry. Clearly, adding that much debt isn't good, but the fact that Exxon has the flexibility to do so is a very good thing.

Rewarding you

The last fact up is Exxon's dividend, which has been increased every year for 35 consecutive years. That's a streak unrivaled in the volatile energy business and shows that Exxon believes in rewarding shareholders in good years and bad. But there's a little more to this story, too.

For example, you can argue that Chevron Corp (CVX 0.44%) has an equally impressive streak of 29 years going. But during the oil downturn, Chevron's dividend stood at $1.07 a share for 10 consecutive quarters. That's two and a half years. The annual increase streak only stayed alive because Chevron traditionally increases its dividend in the middle of the year. In other words, it was a timing issue. (Some of the other oil majors ended up cutting their dividends, by the way.)

XOM Dividend Per Share (Quarterly) data by YCharts.

Exxon actually increased its dividend every single year. This doesn't necessarily make the business any safer, but it certainly makes it easier for investors to stick around through the hard times.

A rock in a turbulent sea

The oil and natural gas business is an inherently volatile one, driven by often swift and dramatic commodity price moves. That's not likely to change anytime soon. However, Exxon's diversified business helps to offset that volatility as some divisions will benefit when others are likely to be suffering. That's layered on top of a balance sheet that provides a foundation solid enough to weather even the strongest gales. And investors, like me, get to benefit as the company continues to reward us with a steadily rising dividend -- a statement that management believes this company is set to thrive in any market. How risky is ExxonMobil? Not nearly as risky as you might think for a company in the oil business.