One of the biggest draws to bank stocks for many investors is an often-generous and growing dividend. If this describes you, then one of the first screens you should do is for the dividend yield.

I've done that in the table below, which shows the five stocks on the KBW Bank Index with the highest dividend yields.

|

Name |

Dividend Yield |

Payout Ratio |

1-Year Stock Return |

|---|---|---|---|

|

New York Community Bancorp (NYCB -0.67%) |

5.3% |

74.1% |

-8.2% |

|

People's United (PBCT) |

3.8% |

77% |

14.9% |

|

Wells Fargo (WFC 2.73%) |

2.8% |

40.8% |

23% |

|

BB&T (TFC 0.14%) |

2.6% |

48.2% |

22.4% |

|

Huntington Bancshares (HBAN 0.23%) |

2.3% |

43.9% |

36.8% |

|

Average big bank |

1.9% |

34.3% |

36.5% |

Data source: YCharts.com.

There are two things to keep in mind when you peruse this list. The first is that many of the banks with the highest yields also have the highest payout ratios, which is the percent of earnings a bank pays out in dividends.

Take New York Community Bancorp, Wells Fargo, and BB&T as examples. They all have above-average dividend yields, but also all pay out more of their earnings.

This makes sense, but it also means that these banks have less upside insofar as dividends are concerned. They're good for investors that want yield today, as opposed to a growing stream 10 years from now.

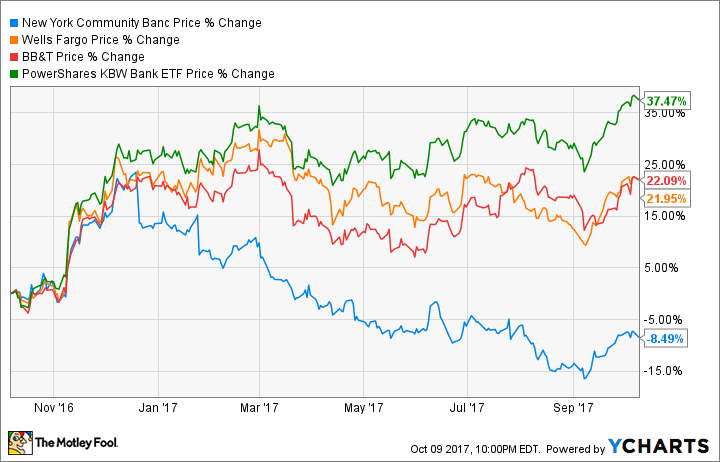

Another relationship is evident in the table above: With the exception of Huntington Bancshares, all of the banks with the highest yields all saw their stocks underperform their peer group average over the past year.

Image source: Getty Images.

Despite the boost to bank stocks after the election, New York Community Bancorp's stock has floundered since this time last year, declining more than 8%. Its stock dropped as the bank slashed its dividend by a third in order to consummate a merger, which ultimately never passed regulatory muster.

Wells Fargo and BB&T have also seen their stocks lag behind their peers. In the case of Wells Fargo, it has spent the past year digesting revelations that employees in the branches spent years opening millions of accounts for customers without the customers' approval to do so. The revelations tarnished the bank's reputation and has been reflected in its lagging bank stock.

The point being, there's a reason that these banks have made their way to the top when it comes to dividend yield. All of them pay out more of their earnings than their peers, and most of them (all but one) have seen their stock prices lag the industry over the past 12 months.

This doesn't necessarily mean that these stocks aren't attractive. If you're looking for a high yield today among big bank stocks, a screen like this is a good place to start. But if you're looking instead for future dividend growth, you'll want to look on the other side of the payout spectrum.