2017 may very well go down in history as the year of the cryptocurrency. Since the year began, through Oct. 16, the aggregate value of cryptocurrencies as measured by market cap is up 876%! It's taken the stock market more than two decades to generate the type of returns that digital currencies have given their investors in a matter of months.

Despite "underperforming" relative to the aggregate gain in cryptocurrencies in 2017, bitcoin is still leading the charge higher. The world's most popular digital currency is up by nearly 500% year to date, and its market cap recently touched $97 billion after teetering at roughly $3 billion back in 2015. Given the momentum currently pushing bitcoin higher, it seems plausible that bitcoin could soon barrel forward to a $100 billion market cap.

Image source: Getty Images.

Seven reasons behind bitcoin's massive rally

You might be wondering what on Earth has been behind the incredible run higher in digital currencies, like bitcoin. While some of the catalysts are far more tangible than others, it essentially boils down to seven factors.

1. The potential for blockchain technology

The most logical and tangible reason bitcoin has rallied in recent years is the potential behind the blockchain technology that underlies its coins. Blockchain is nothing more than the digital and decentralized ledger that records transactions without the need for a financial intermediary.

Blockchain usually is an open-source network, which means it's nearly impossible for data to be altered without someone finding out. This security aspect is what makes blockchain's future as a possible peer-to-peer and business-to-business payment platform all the more exciting.

2. An upgrade to bitcoin's blockchain that's geared at bigger fish

Along those same lines, investors in bitcoin have to be excited about a software upgrade enacted a little over two months ago after bitcoin forked into two separate currencies -- bitcoin and bitcoin cash. This software upgrade wound up taking some data off of bitcoin's blockchain in order to boost capacity, as well as lowered transaction settlement costs and quickened settlement times. The entire purpose of this upgrade was to appeal to enterprise customers looking to test blockchain applications in pilot and small-scale projects.

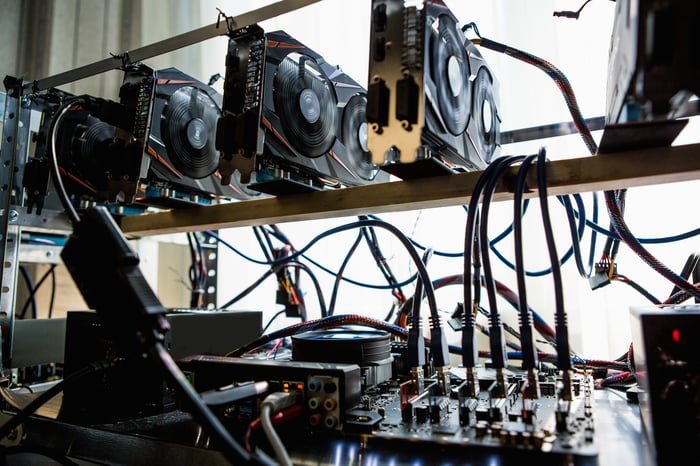

Image source: Getty Images.

3. The falling U.S. dollar

The U.S. dollar fell to multi-year lows against the euro earlier this year, which tends to be great news for U.S. exports, but not such great news for investors holding cash. Typically, when the dollar falls, investors seek the safety of gold, since it's a finite resource and a store of value. However, bitcoin is also viewed as a "finite" resource, since its protocols limit the number of mined coins to 21 million. Thusly, bitcoin has benefited from being perceived as a safe-haven investment as the dollar has weakened.

4. Institutional investors beginning to show interest

Fourthly, we're beginning to see some interest in bitcoin from institutional investment firms, including Fidelity and Goldman Sachs (GS 1.59%). Fidelity's CEO Abigail Johnson recently announced that her company has been successfully mining bitcoin and Ethereum for a profit. Fidelity has also given its customers access to their cryptocurrency holdings through Fidelity's website.

Similarly, Goldman Sachs is tinkering with the idea of trading bitcoin, given growing liquidity and interest in cryptocurrencies. While it might seem like a no-brainer for Goldman to get involved, it's not a cut-and-dried decision, given that the bulk of its clients are businesses and not retail investors.

5. Payment-platform excitement

Another reason investors are excited about bitcoin is its potential as a payment platform. Blockchain technology aside, a handful of brand-name companies have been accepting bitcoin as payment since 2014, while some smaller merchants are currently accepting, or tinkering with the idea of accepting, bitcoin in the future. Updates to bitcoin's blockchain technology should help quicken transaction settlements and attract new merchants.

Image source: Getty Images.

6. Speculation of a regulation reversal in China

Probably the most short-term catalyst of all has been the recent speculation that China could change its tune on cryptocurrencies. Last month, China announced that it was putting a stop to initial coin offerings, calling them an avenue for fraud, and also noted that it would be cracking down on domestic cryptocurrency exchanges. With a lot of trading occurring in China, this created big worries among digital-currency investors. However, rumors are swirling that China's crackdown on the exchanges may prove to be only temporary.

7. "Don't miss the boat"-mania

Last but not least, emotions have been responsible for pushing bitcoin higher. I call it "don't miss the boat"-mania, which is a fancy way of saying that some people have been blindly buying bitcoin without truly understanding what it, or blockchain, actually are. They've simply witnessed the massive gains in bitcoin over the past couple of years and don't want to miss the boat if it continues to move higher.

There are three big risks to keep in mind

Though bitcoin has been mostly unstoppable of late, that doesn't mean it's without risks. There are, in particular, three speed bumps that could easily upend the largest cryptocurrency by market cap.

The first is the ultimate success of blockchain technology. No one is denying that blockchain has potential, or that it could one day play a key role in securing transactions. However, no one has any clue just how quickly blockchain technology could be integrated by business, or, for that matter, whether bitcoin has the preferred blockchain technology.

There are more than 1,100 cryptocurrencies, and quite many run on blockchain technology. What's more, the barrier to entry in created blockchain is relatively low, meaning there's an endless sea of competition on the horizon.

Image source: Getty Images.

The second factor to consider is that regulation is a double-edged sword for bitcoin. Some see regulation as a good thing, since it would validate bitcoin as a legitimate form of currency. While true, increased regulation can also deny bitcoin access to certain markets. South Korea and China have ended initial coin offerings, and tougher regulations could discourage investors from buying into bitcoin.

Lastly, emotions can only push an asset so far. Investments based on emotion rather than logic tend to overshoot to the upside and downside, which is a scary thought. In recent months, the number of roadside signs, online ads, and emails catering to teach people about trading bitcoin, investing in bitcoin, and mining bitcoin, is all the evidence this investor personally needs to believe a bubble could be present.

Catalysts aside, I consider this a very dangerous time to be a bitcoin investor.