The U.S. natural gas business has historically been a regional affair, but the move to create liquefied natural gas (LNG) export terminals has started to change that situation. Cheniere Energy, Inc. (LNG 2.31%) has been at the forefront of this effort. However, it has gone about the business in a somewhat complex manner, using partnerships to facilitate its building plans. That's where Cheniere Energy Partners LP (CQP 4.48%) comes into play. Here's what you need to know to decide which Cheniere you'd be better off owning.

Hard to handle

The basic idea behind exporting LNG is pretty easy to understand: You use pipelines to move gas to a facility that can liquefy it and then put it on a ship for export. But Cheniere itself isn't nearly as simple to get your head around.

Image source: Getty Images

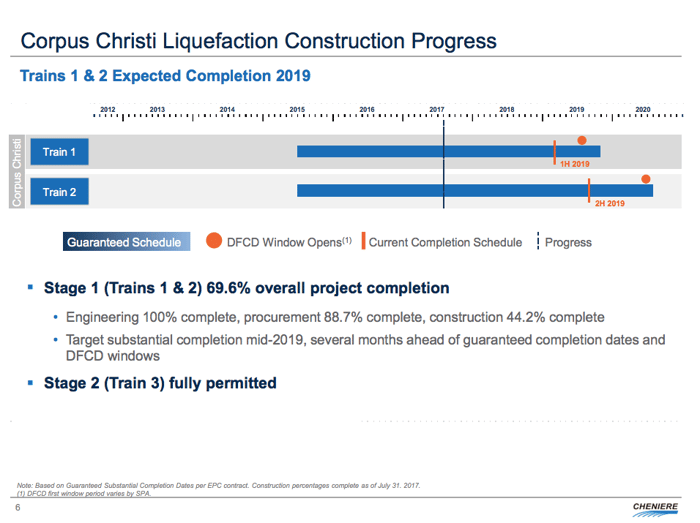

The parent company is Cheniere Energy. First, the easy stuff. Cheniere Energy owns a marketing business, some smaller assets, and an investment in a Corpus Christi, Texas, LNG project that it's building out. The Corpus Christi asset is a big growth opportunity.

Now for the harder stuff. Cheniere Energy also owns an 80% interest in Cheniere Energy Partners LP Holdings (NYSEMKT: CQH) and a 2% general-partner interest in Cheniere Energy Partners LP.

We're not done yet. Cheniere Energy Partners LP Holdings' primary asset is its roughly 56% stake in Cheniere Energy Partners. Cheniere Energy Partners, meanwhile, owns a 100% stake in the Sabine Pass terminal, the Sabine Pass liquefaction business, and the Creole Trail Pipeline.

If you're having a difficult time getting your head around all of this, don't be too hard on yourself -- it's a very complex set-up.

If you're looking for income

Cheniere Energy Partners LP makes money by operating the Sabine Pass LNG export facility and the Creole Trail pipeline. Now that Sabine Pass is up and running, it's a fairly stable business driven by long-term contracts. There are growth opportunities, too, since there's additional liquefaction capacity being built.

More growth ahead for Sabine Pass. Image source: Cheniere Energy.

Sabine Pass only started shipping LNG last year, and more of the project has been completed since it opened its port to the world. As you might expect, results have been pretty impressive. Cheniere Energy Partners had $992 million in revenue in the second quarter, compared with just $151 million in the second quarter of 2016. Adjusted EBITDA was $283 million in the 2017 quarter, compared with $51 million in the prior-year period.

The partnership has paid a $0.43 quarterly distribution ($1.72 annually) through most of the construction phase of Sabine Pass. The current yield is roughly 6%. But management provided high-end distribution guidance of $1.90 a share annually when it reported second-quarter earnings. That suggests that a distribution increase could be in the cards.

A distribution increase makes sense given the strength of year-over-year results. And don't forget that there's more opportunity for growth as the Sabine Pass facility expands. If you're an income investor, Cheniere Energy Partners is worth a deep dive.

If you're looking for growth

Cheniere Energy, meanwhile, primarily makes money from fees and incentives for operating Cheniere Energy Partners (the general-partner interest) and from distributions collected from its ownership interest in Cheniere Energy Partners LP Holdings (which has an ownership stake in Cheniere Energy Partners). Results have been good at Cheniere Energy, too, as you might expect.

In the second quarter, Cheniere Energy had revenue of $1.241 billion, compared with just $177 million in the same quarter last year. Adjusted EBITDA, meanwhile, was $371 million, compared with negative-$4 million.

More growth ahead for Sabine Pass. Image source: Cheniere Energy.

That said, the big story at Cheniere Energy is the Corpus Christi project. Cheniere will be spending most of its cash on the first two LNG facilities there until 2020. In other words, Cheniere Energy is a growth story, not an income story. If you're looking to benefit from the expanding role of the United States in the global LNG trade and don't particularly care about income, Cheniere Energy is worth a look.

What are you looking for?

To be honest, I find the corporate relationships here unnecessarily complex. For that reason alone, I wouldn't buy any of the Cheniere names. However, if you're looking specifically for exposure to LNG, Cheniere Energy and Cheniere Energy Partners are both worth a look. Which one you decide on will probably boil down to your desire for income or growth. For the former, Cheniere Energy Partners is your pick. For the latter, Cheniere Energy.