What happened

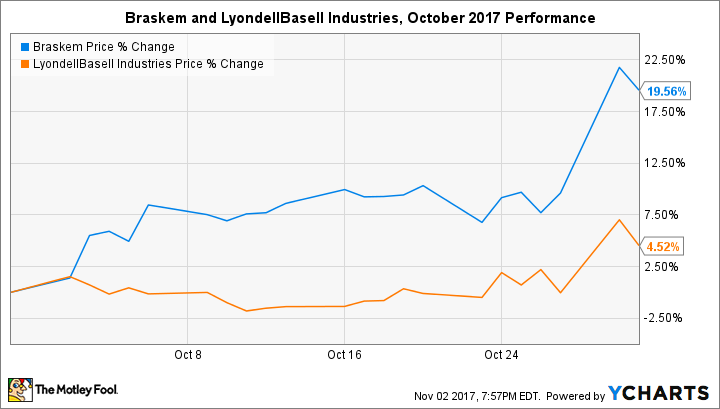

Shares of Brazil's largest chemical manufacturer soared nearly 20% last month after The Wall Street Journal reported that LyondellBasell Industries NV (LYB -1.09%) was in early talks to acquire it. Braskem (BAK -0.91%) was quick to deny the reports, but investors have yet to drain all of the added value from either company's market cap.

Let's assume the rumors are true. Any potential merger would instantly create one of the largest chemical manufacturing companies in the Americas, with a value of at least $50 billion, and would follow a wave of recent industry consolidations. However, as with any merger, the transaction would need to be approved by Braskem's shareholders -- and that's a bit more complicated when investors consider who controls one of Brazil's most valuable economic gems.

Image source: Getty Images.

So what

A combination makes sense on the surface. Both LyondellBasell and Braskem are leading North American producers of polypropylene (PP). In fact, the Brazilian chemical giant is building a 450,000-metric-ton-per-year PP facility in Texas with an expected startup date in 2020. That would be the largest PP plant in the Americas and the first built in North America since 2005 -- made possible by abundant propane found in cheap American shale.

Both companies are also leading global producers of polyethylene (PE), which will increasingly be manufactured in North America thanks to the ongoing energy revolution that is just getting underway -- again, because of cheap and abundant components found in natural gas. In addition to adding Braskem's American assets, LyondellBasell would gain a foothold in South America by acquiring that continent's largest chemical manufacturer, which just so happens to be the largest renewable chemical producer in the world.

But how the talks unfold -- and whether they occur at all -- isn't up to shareholders. Well, not unless you're Brazilian construction conglomerate Odebrecht or Brazilian oil supermajor Petrobras (PBR 1.43%), which own 97.1% of the voting rights in Braskem. The latter has reportedly included selling its stake as part of an ongoing divestiture program, but that only amounts to 47% control of the company. Interestingly, the company's shares dropped on the rumor -- and rose when the chemical manufacturer denied the reports the next day.

Why? Completing such a deal is bound to run into a few obstacles, including Odebrecht and even the Brazilian government. Plus, the value of owning a giant chunk of Braskem lies in owning it for the long haul, not in selling it at a depressed value today. Even still, a Petrobras sale could be enough to satisfy LyondellBasell shareholders and (the short-term goals of) its own shareholders, but in that scenario, the transaction is occurring between two corporations, meaning publicly traded shares wouldn't really be affected.

And even if an outright acquisition is somehow agreed to among all parties, LyondellBasell would have to acquire Braskem's relatively large debt pile, which could make its own shareholders think twice about the value provided -- or significantly reduce the final offer price.

In other words, this is complicated. Any potential merger or acquisition will be anything but straightforward.

Now what

It seems more likely that Braskem's quick dismissal of the acquisition rumors was done so it could consult its controlling shareholders, Odebrecht and Petrobras, not because initial talks never took place. After all, the Brazilian chemical leader would be a great fit for LyondellBasell and provide several long-term, high-growth opportunities.

That said, there's no way to know if Odebrecht and Petrobras -- or, spoiler alert, the Brazilian government -- would welcome or allow such a deal to take place. It's much too early to get excited.