Warren Buffett is famously known for having said his "favorite holding period is forever." We tend to agree, with so much evidence supporting long-term buy-and-hold generally leading to the best returns for most people. But isn't forever unrealistic? As the legendary economist John Maynard Keynes once wrote, "in the long run, we're all dead."

But 50 years from now, many of us -- and many of our children -- will still be alive. Investing in companies that can still play an important role in the economy of the future could lead to wonderful wealth. So we put the question to some of our long-term investing contributors, and they offered up compelling arguments for Sherwin-Williams Co. (SHW -1.10%), Hormel Foods Corp. (HRL 1.05%), and Mastercard Inc. (MA 0.15%).

Surprised there's not a single alternative=energy or flying-car company in the mix? The funny thing about investing is that often, the best investments are the companies that have already built something important that's likely to remain important for decades to come. Keep reading to learn why these three stalwarts are just as likely to be household names in a half-century as they are today.

Image source: Getty Images.

A 150-year old stalwart to consider

Neha Chamaria (Sherwin-Williams): Fifty years down the line, the world will be a different place. However, chances are we'll still be driving cars, building and rebuilding homes, airports, and bridges, and turning to Sherwin-Williams' paints and coatings for that finishing touch.

Sherwin-Williams has been in business since 1866, building an unparalleled brand image over the decades, so much so that the company has been able to pass on higher prices to consumers over the years without losing sales volumes. In fact, Sherwin-Williams' strategy of setting up its own stores instead of relying on other retailers to sell its wares has proved its trump card. It's a key reason the company is the leading paint manufacturer in the world today, popular for its namesake brand, plus Dutch Boy and Pratt & Lambert brands, among others.

With its recent Valspar acquisition, Sherwin-Williams has sealed its spot as the world's largest paint and coatings company for years to come. Thanks to organic growth and accretive earnings from Valspar, Sherwin-Williams is projecting a sharp jump in dividends, which should make the stock even more attractive for long-term investors. The stock is already part of the coveted Dividend Aristocrat group, having increased its dividends for 38 consecutive years.

Aside from an incredible dividend track record, Sherwin-Williams has a strong history of free cash flows and has generated returns on equity of at least 30% in each of the past 10 years. When you combine that with the company's leadership position in the industry, the stock packs a punch for really long-term investing.

A timely chance to buy a timeless business

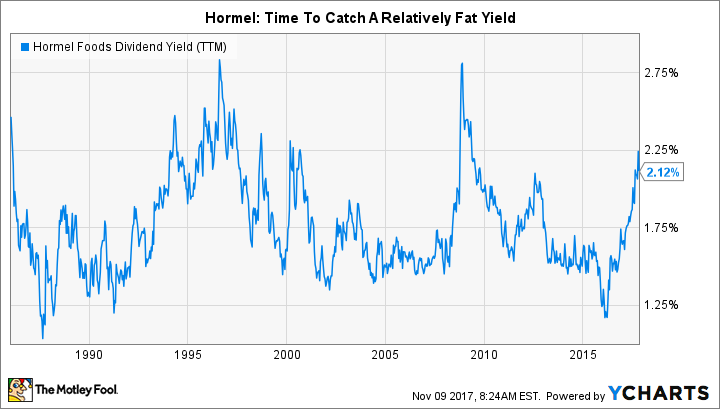

Reuben Gregg Brewer (Hormel Foods): I bought Hormel Food when its dividend yield got up to around 2%, toward the end of its historical range. (It's 2.1% now.) And I plan to hold on to this Dividend Aristocrat for a very long time. In fact, with any luck I'll pass the shares on to my daughter when I kick the bucket.

Why? Because Hormel is a conservatively run company. For example, long-term debt made up just 5% of the capital structure as of July 2017. I expect that figure to tick higher because of recent acquisitions, but from that low level Hormel has more financial flexibility than most of its peers. The dividend yield, meanwhile, is backed up by 51 years of annual dividend increases -- a clear dedication to returning value to me, the shareholder.

HRL Dividend Yield (TTM) data by YCharts

The recent acquisitions I mentioned speak to Hormel's active portfolio management, another of the company's positive attributes. In the past few months it has added two strategic domestic meat businesses and expanded its reach into South America. That continues a long trend of shifting its business with changing consumer tastes and its own business needs. In recent years, that's included selling a stagnant salt business and buying assets such as Skippy peanut butter and Wholly Guacamole. It's also big on innovation, bringing to market things like Skippy PB Bites that make peanut butter a carry-along snack.

Fiscally conservative, active portfolio management, innovative products, a focus on returning value to shareholders, and a yield that's at the high end of its historical range. In my eyes, Hormel isn't just a stock to hold for the next 50 years. It's one to consider buying today.

Global commerce means decades of growth

Jason Hall (Mastercard): Over the next half-century, plenty of things will change. One that will almost certainly remain important is being able to easily and securely pay for things. That bodes well for Mastercard.

Today, cash is still king. More than 80% of global transactions are still cash-based, though that's quickly changing as mobile technology and a fast-growing middle class expand the demand for electronic payments and credit. And while there is also expanding competition as the payments pie gets bigger, Mastercard is in an enviable position as a premier partner for merchants, lenders, financial companies, and consumers.

People want their payment method to work everywhere. Merchants, lenders, and banks want access to as many customers as possible. We all want our money to be secure, and for payments to happen quickly and predictably. Mastercard has a serious network effect benefit, since more users make it attractive for more users, which makes it more attractive for more merchants and financial partners.

Looking ahead 50 years, electronic payments are set to be much bigger than they are now, and Mastercard will surely still be connecting spenders to sellers and lenders. There'll be far more people spending far more money electronically than they do today, and that's likely to make Mastercard an ideal stock to hold for decades to come.