The Federal Reserve is widely expected to raise the benchmark federal funds rate target range by 0.25% when it announces its decision on Wednesday. So far during this rate hike cycle, however, this hasn't translated to more money for savings account customers. Will this time be different?

Do Fed rate hikes affect savings account rates?

The short answer is "sort of." While savings account interest rates tend to increase in response to Federal Reserve monetary policy, the two aren't directly related.

Image Source: Getty Images.

Some interest rates are directly tied to the federal funds rate. For example, credit card interest rates are based on the federal funds rate, and therefore Fed rate hikes are passed onto consumers. On the other hand, there is no direct correlation between the interest rates paid by savings accounts and the federal funds rate. Simply put, there's no rule that says that your bank has to pay you more interest simply because the Fed raises rates.

It's not a perfect relationship

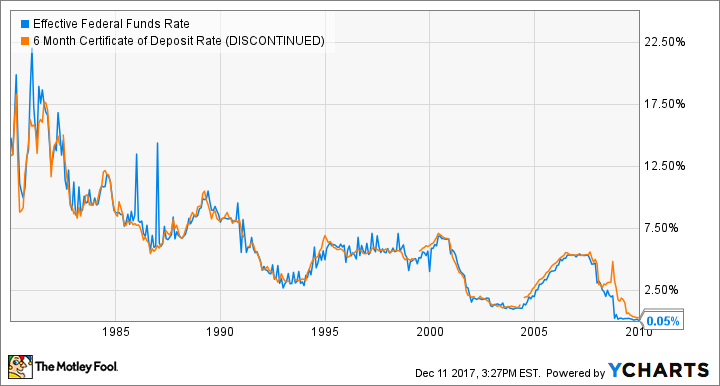

Having said that, interest rates paid on deposit accounts tend to move in the same direction as the Federal Funds Rate. That is, when the Fed raises rates, savings rates tend to rise as well. When the Fed cuts rates, the opposite is generally true.

Effective Federal Funds Rate data by YCharts

It's also worth pointing out that savings interest rates generally don't move up as much as loan interest rates. For example, if the Fed raises rates by 25 basis points (0.25%), as it's expected to do on Wednesday, a bank may increase its auto loan rates by 0.25%, but only increase its savings account interest rates by 15 basis points (0.15%). This is standard practice, and is why banks generally achieve higher profit margins in higher-rate environments.

How did the June rate hike affect savings account rates?

As I wrote in June, shortly before the Fed raised rates last time, consumers haven't really benefited from the current cycle of interest rate hikes. At the time, the Fed had raised rates by 75 basis points over the prior two years, while savings account interest rates had barely budged. In fact, the biggest move in deposit account interest rates occurred in 36-month CDs, whose rates increased by just five basis points.

Let's take a look at what's happened since then. Here's a look at average savings, money market, and CD rates shortly before the June rate hike, and the average rates now.

|

Deposit Product |

June 12, 2017 |

December 11, 2017 |

|---|---|---|

|

Savings Account |

0.06% |

0.06% |

|

Money Market |

0.08% |

0.09% |

|

Three-month CD |

0.08% |

0.10% |

|

Six-Month CD |

0.12% |

0.17% |

|

12-Month CD |

0.20% |

0.28% |

|

36-Month CD |

0.47% |

0.58% |

|

60-Month CD |

0.78% |

0.88% |

Data Source: FDIC. Rates are based on non-jumbo deposits of less than $100,000.

It appears that while savings account interest rates have remained flat, some of the Fed's rate hikes are starting to be passed to CD account holders. Even so, the largest increase was 11 basis points, so it's fair to say that consumers haven't been big beneficiaries of the Fed's rate hikes so far.

It's tough to gauge the effect

The bottom line is that there's no way to know for sure how much savings interest rates will be impacted by a Fed rate hike. Generally speaking, a rate hike should push savings and CD rates higher, but by a margin less than 0.25%, which is consistent with the chart of rates since the last rate hike. However, given that since the Fed started raising rates in 2015 and savings account interest rates haven't budged, I wouldn't bet on a substantial increase this time either.