Cannabis is projected to be a $197.7 billion global market by 2028, according to Fortune Business Insights. The industry is expected to grow by a jaw-dropping compound annual growth rate of 32%.

Investors have several ways to potentially profit from this tremendous growth. You could invest in specific marijuana stocks, but another alternative is to invest in exchange-traded funds (ETFs) that focus on cannabis.

The main benefit of buying marijuana ETFs is that your money is spread across a basket of stocks, which can lower your risk compared to investing in only a few individual stocks. Here's what you need to know about the top marijuana ETFs on the market.

Top marijuana ETFs in 2024

Below are nine top marijuana ETFs ranked by assets under management.

| ETF | Assets Under Management | Net Expense Ratio |

|---|---|---|

| AdvisorShares Pure U.S. Cannabis ETF (NYSEMKT:MSOS) | $4343.3 million | 0.80% |

| ETFMG Alternative Harvest ETF (NYSEMKT:MJ) | $242.9 million | 0.75% |

| ETFMG U.S. Alternative Harvest ETF (NYSEMKT:MJUS) | $130.8 million | 0.75% |

| Horizons Marijuana Life Sciences Index ETF (OTC:HMLSF) | $98.5 million | 0.86% |

| AdvisorShares Pure Cannabis ETF (NYSEMKT:YOLO) | $38.5 million | 0.88% |

| Global X Cannabis ETF (NASDAQ:POTX) | $39.3 million | 0.51% |

| Amplify Seymour Cannabis ETF (NYSEMKT:CNBS) | $27 million | 0.75% |

| The Cannabis ETF (NYSEMKT:THCX) | $18.6million | 0.75% |

| Cambria Cannabis ETF (NYSEMKT:TOKE) | $11.3 million | 0.42% |

1. AdvisorShares Pure U.S. Cannabis ETF

The largest marijuana ETF based on assets under management is the AdvisorShares Pure U.S. Cannabis ETF (MSOS 6.25%). It's the first ETF to focus exclusively on the U.S. cannabis market.

AdvisorShares Pure U.S. Cannabis ETF currently owns 26 U.S. marijuana stocks. Its top holdings include Green Thumb Industries (GTBIF 5.56%), Curaleaf Holdings (CURLF 4.41%), Trulieve Cannabis (TCNNF 10.28%), Verano Holdings (VRNO.F 10.2%), and Terrascend (TRSSF 4.57%). Together, the five U.S. cannabis operators make up more than 78% of the ETF's total portfolio.

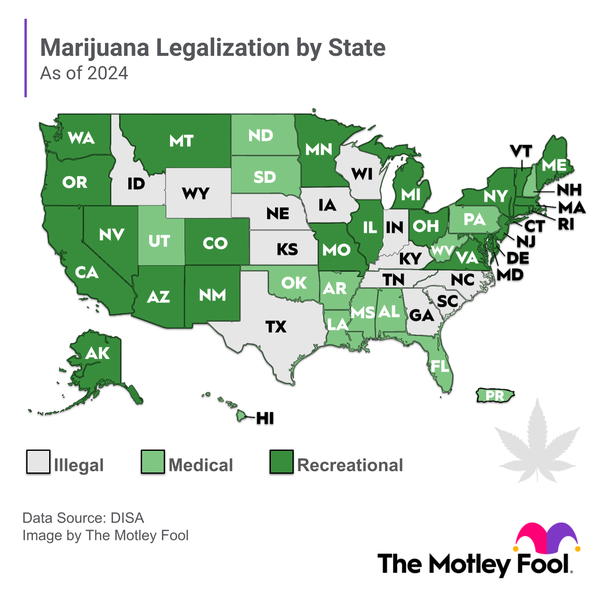

It's possible that the ETF's concentration on the U.S. market could give investors greater growth opportunities than other ETFs. Although marijuana remains illegal at the federal level in the U.S., many states have legalized marijuana for medical and/or recreational use.

2. ETFMG Alternative Harvest ETF

In 2015, ETFMG Alternative Harvest ETF (MJ 1.35%) became the first ETF to target the global cannabis market. This ETF was established even before the Canadian cannabis industry took off after the legalization of recreational marijuana in 2018.

ETFMG Alternative Harvest ETF currently owns 34 individual stocks. Its top holdings include Tilray Brands (TLRY -6.01%), Canopy Growth (CGC -3.13%), Cronos Group (CRON -0.82%), SNDL (SNDL -7.58%), and Chicago Atlantic Real Estate Finance (REFI 0.2%). The five positions combined make up close to 26% of the ETF's total assets.

Canadian cannabis producers weigh heavily in the ETF's portfolio. This could hurt the ETF's performance while current U.S. federal cannabis laws remain in effect. The Canadian companies can't enter the U.S. cannabis market and retain their listings on major U.S. stock exchanges as long as marijuana is illegal at the federal level.

3. ETFMG U.S. Alternative Harvest ETF

ETFMG U.S. Alternative Harvest ETF is one of the newest marijuana ETFs and was launched in 2021. As its name indicates, the fund focuses on U.S. cannabis companies.

The ETF currently owns 29 individual stocks. Its top holdings include Innovative Industrial Properties (IIPR -0.92%), Green Thumb Industries, Trulieve Cannabis, Curaleaf Holdings, and Verano Holdings. The positions make up almost 66% of the total portfolio.

The fund also is invested heavily in short-term U.S. Treasury bonds, which currently offer attractive yields. Treasuries make up more than 44% of its total portfolio.

4. Horizons Marijuana Life Sciences Index ETF

Although Horizons Marijuana Life Sciences Index ETF (HMLSF 0.62%) isn't listed on a major U.S. stock exchange, U.S. investors can buy the ETF on over-the-counter (OTC) markets. Its 2017 inception makes it one of the oldest marijuana ETFs.

The ETF holds positions in 27 marijuana stocks. Its top holdings include Jazz Pharmaceuticals (JAZZ -1.65%), ScottsMiracle-Gro (SMG -0.16%), Innovative Industrial Properties, Cronos Group, and Tilray. Together, these five stocks represent more than 68% of the ETF's total portfolio.

Like all marijuana ETFs, Horizons Marijuana Life S) became the first ETF to target the global cannabis market. The ETF was established even before the Canadian cannabis industry took off after the legalization of recreational marijuana in 2018.

5. AdvisorShares Pure Cannabis ETF

AdvisorShares operates two marijuana ETFs. One focuses exclusively on the U.S. cannabis market, but the AdvisorShares Pure Cannabis ETF (YOLO 1.06%) doesn't limit itself to the U.S. Instead, it focuses on the global cannabis market.

The ETF currently has 24 holdings. Almost 49% of its assets are invested in the AdvisorShares Pure U.S. Cannabis ETF. The top five individual stocks in its portfolio are Village Farms International (VFF -6.92%), Tilray, High Tide (HITI 0.45%), Jazz Pharmaceuticals, and Innovative Industrial Properties. The stocks make up more than 27% of the ETF's total holdings.

The AdvisorShares ETF could be an attractive alternative to investors who want exposure outside of the U.S. but still want a heavier weighting to U.S. stocks.

6. Global X Cannabis ETF

Global X Cannabis ETF (NASDAQ:POTX) is operated by Mirae Asset, a financial services company based in South Korea. As its name indicates, the ETF focuses on the global cannabis industry.

There are currently 16 individual stocks in the Global X Cannabis ETF portfolio. Its top holdings include Innovative Industrial Properties, Tilray Brands, Canopy Growth, Cronos Group, and AFC Gamma (AFCG -1.48%). The stocks combined make up more than 59% of the ETF's assets.

The ETF contains both U.S. and Canadian cannabis stocks, providing investors exposure to the cannabis markets in both countries.

7. Amplify Seymour Cannabis ETF

Amplify Seymour Cannabis ETF (CNBS 3.51%) bears the name of its manager, Tim Seymour. He is a well-known cannabis investor and has appeared frequently on CNBC's Fast Money TV show.

The ETF currently holds positions in 34 stocks. Its top holdings include Green Thumb Industries, Tilray Brands, Curaleaf Holdings, Jazz Pharmaceuticals, and Trulieve Cannabis. The five stocks comprise more than 40% of the ETF's total assets.

U.S. marijuana stocks make up eight of the top 10 positions held by the Amplify Seymour Cannabis ETF and 65% of its total portfolio. Most of the remaining portfolio consists of Canadian pot stocks with a small percentage invested in the stocks of cannabis companies based in Ireland and Israel.

8. The Cannabis ETF

The Cannabis ETF (THCX 0.35%) began trading in July 2019. It focuses on stocks that could benefit from growth in both the hemp and legal marijuana industries.

The ETF currently owns 23 stocks. Its top positions include Nova Cannabis (NASDAQ:NOVC), AFC Gamma, Fire & Flower Holdings (FFLW.F -44.37%), OrganiGram Holdings (OGI -2.66%), and PerkinElmer (NYSE:PKI). Together, the five stocks make up almost 33% of total assets.

Probably the biggest knock against The Cannabis ETF is its relatively high expense ratio of 0.75%.

Related Investing Topics

9. Cambria Cannabis ETF

Cambria Cannabis ETF is operated by Mebane Faber's Cambria Investment Management. Like The Cannabis ETF, it launched in July 2019.

The ETF typically owns between 20 and 50 cannabis stocks. It currently holds positions in 35 stocks. The top holdings include Constellation Brands (STZ -0.18%), Imperial Brands (OTC:IMMBY), Jazz Pharmaceuticals, ScottsMiracle-Gro, and Philip Morris International (PM 1.21%). The five stocks combined make up almost 39% of total assets.

Although Cambria Cannabis ETF provides exposure to U.S. marijuana stocks, it doesn't own any of the leading multi-state operators. However, it offers the lowest expense ratio of the top marijuana ETFs.