What happened

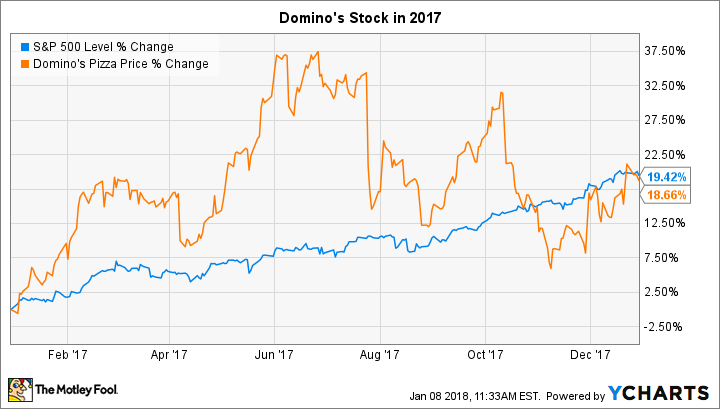

Domino's Pizza (DPZ 1.29%) stock gained 19% last year to essentially match the rally in the broader stock market, according to data provided by S&P Global Market Intelligence.

The stock had been up by as much as 35% at one point in the year, but shareholders are still likely happy with the final 2017 result, considering rival Papa John's fell 34% during the year.

So what

Domino's put up better operating results than Papa John's or Yum! Brands and its Pizza Hut franchise. The pizza delivery leader's comparable-store sales growth was a market-beating 8.4% in the most recent quarter (and 9.5% in the prior quarter), compared to Pizza Hut's 3% boost and Papa John's 1% uptick.

Image source: Getty Images.

This gap isn't a short-term phenomenon, either. Thanks to its low-cost operating model and strong digital sales infrastructure, Domino's share of the pizza delivery business recently passed 27% -- up from 19% in 2007.

Now what

Whether Domino's extends its positive stock price momentum will depend on its ability to steal more market share in a competitive industry. That's why investors will be keeping close tabs on comps, which management expects to rise by between 3% and 6% annually in the domestic segment and in an international division that's showing signs of stress. Combine that established sales growth with the 6% to 8% store unit expansion that the chain predicts, and Domino's appears set for healthy sales and profit growth over the long term.