Verizon Communications (VZ 2.85%) remains the nation's largest wireless carrier, but increasingly competitive offers from AT&T (T 1.17%) and T-Mobile (TMUS 0.55%) took a slice out of the company's wireless subscribership numbers last year. And that more intense competition has forced the company to look elsewhere for growth.

The company is still struggling to recover its momentum and adapt to the latest shifts in telecom landscape, and 2017 showed that Verizon still has a ways to go. Let's take a look at what happened with the telecom giant last year and what the company's looking forward to in 2018.

Image source: Getty Images.

Verizon failed to keep up with the market

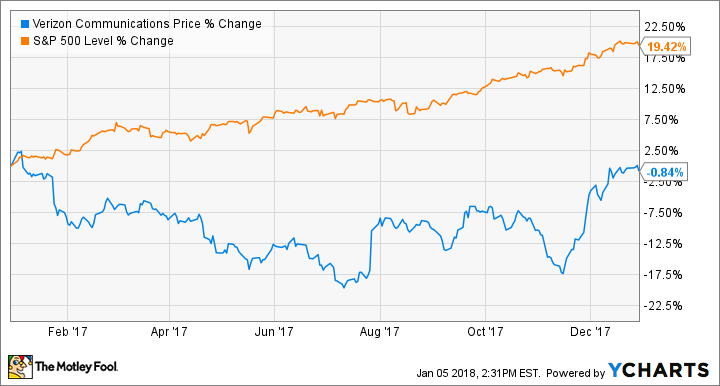

One of the first things Verizon shareholders will likely remember about last year was its stock's failure to keep pace with the market. Here's how far Verizon fell short of the S&P 500 last year:

Image source: YCharts.

The S&P 500 gained more than 19%, while Verizon's share price stumbled, and only recovered to an essentially flat result for the year.

Some big losses and rising competition

Verizon started the year on the wrong foot when it reported its first-ever postpaid wireless customer losses in April. The company shed 307,000 postpaid wireless subscribers in the first quarter 2017. The losses came as AT&T and T-Mobile rolled out unlimited plans much earlier than Verizon did.

The company reversed those losses in the second quarter by launching its own unlimited plans, and it continued that growth into the third quarter, when it added 603,000 retail postpaid net additions.

But that good news was tempered a bit in the fall when it announced it would slice $10 billion from its cumulative budgets by 2021. That financial trimming came as Verizon had to reduce the prices of some of its wireless plans (which ate into revenue) and offer unlimited data plans to keep pace with its rivals.

Verizon's revenues tumbled 7.3% in Q1, were flat in Q2, and grew by just 2.5% in Q3, all on a year over year basis.

The company makes the majority of its money from its wireless business, and as revenues have slid Verizon has started looking elsewhere for other revenue streams, namely online and content.

Verizon closed on its acquisition of Yahoo!'s content sites and merged them with its AOL unit last year to form a new company, called Oath. Oath created $2 billion in revenue for Verizon in the third quarter, but Verizon is facing huge competition in the content space from AT&T, which owns DirecTV and is trying to acquire Time Warner. If the Time Warner deal goes through, it will turn AT&T into a dominant player in video content, and leave Verizon playing a huge game of catch-up.

A few things to look forward this year

While 2017 wasn't all that great, there are signs that things are turning around for Verizon. It appears to have stopped its subscriber losses and is now competing more aggressively with its rivals on pricing and unlimited data. This strategy already helped the company toward the end of 2017, and it should help it add customers again this year.

Additionally, the company is in the process of rolling out its new 5G wireless broadband in a handful of cities this year. 5G represents a long-term possibility for the company and it's quickly becoming a leader in that emerging technology.

If the company can figure out its video content strategy and build out a strong 5G offering, it could emerge from 2018 stronger than ever. But investors should remain patient as the telecom giant is in the middle of a big transition. If you're having problems stomaching the stock price ride, just remember that Verizon has a trailing dividend yield of 4.4% and has raised its dividend for 11 consecutive years.