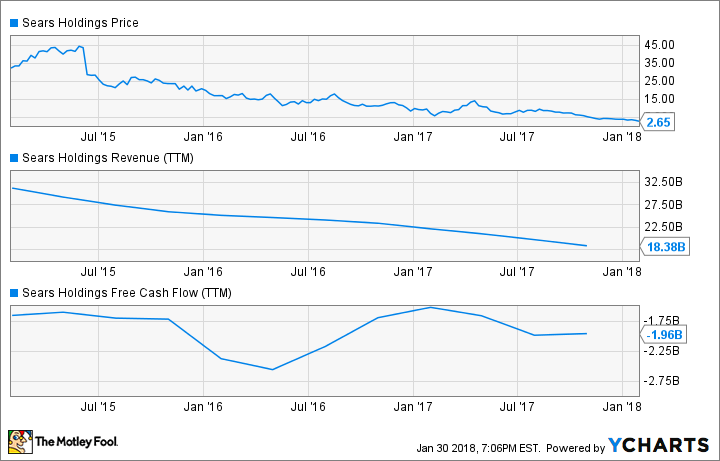

Shares of fallen retail titan Sears Holdings (SHLDQ) have lost more than 90% of their value just in the past three years. Virtually every department-store operator has been struggling, but not to the same extent as Sears.

Indeed, Sears Holdings' revenue has plunged by more than 40% during this period. Store closures account for some of this decline, but the company is also paying the price for failing to invest in its stores, with comp sales plunging at an alarming rate. Meanwhile, Sears has been burning about $2 billion of cash annually.

Sears Holdings stock price, revenue, and free cash flow:data by YCharts.

Despite these horrendous trends, some investors remain bullish about Sears Holdings. Most of these bulls recognize that the company's retail empire is doomed, but they argue that Sears still has lots of valuable assets that can be monetized. However, this is a dated view that may have been true five years ago but doesn't reflect the company's current situation.

The real estate is almost all gone

Real estate sales have been Sears Holdings' biggest source of funding in recent years. Between fiscal 2014 and fiscal 2016, the company received nearly $4 billion of proceeds from selling real estate. Sears Holdings brought in another $867 million from real estate sales in the first three quarters of fiscal 2017, plus an additional $167 million in November.

This situation puts the company on pace to comfortably exceed its goal of selling $1 billion of real estate in fiscal 2017. However, the result is that there isn't much real estate left to sell in future years.

As of a year ago, Sears Holdings owned 293 Sears full-line stores, 67 Kmart stores, and 20 smaller specialty shops. The rest of its stores were leased. In April, the company stated that it was already evaluating bids totaling upwards of $700 million for more than 60 stores. Given that Sears Holdings is set to end the year with more than $1 billion of real estate proceeds, it probably sold significantly more than 60 stores, leaving it with ownership of 300 or fewer stores.

Earlier this month, the company disclosed that 138 of its remaining properties -- nearly half of the total -- have an aggregate appraised value of just $985 million. If that average value of about $7 million per property holds for the rest of the company's owned store portfolio, the aggregate value of the stores that Sears Holdings still owns would be around $2 billion.

Sears has already sold off its best real estate. Image source: Sears Holdings.

Sears Holdings also owns its headquarters complex and 12 distribution centers, and some of its store leases have value. Nevertheless, it's unlikely that the company has more than $3 billion of real estate left -- and even that could be a generous estimate.

The brands have lost value

Sears Holdings' brands are its other major asset. Last year, the company sold its Craftsman tool brand to Stanley Black & Decker (SWK -0.52%) for total consideration of about $900 million. The agreement allowed Sears to continue sourcing and selling Craftsman-branded tools in its own stores without paying royalties to Stanley Black & Decker for 15 years.

Kenmore and DieHard are the company's other two prestige brands. However, it's doubtful that either one is worth as much as Craftsman. For example, just before Craftsman went on the market, it held 28.5% of the hand tools and accessories market, plus about 9% of the power-tools market. For comparison, Kenmore's market share fell below 13% in 2016, and probably plunged again last year.

Furthermore, Stanley Black & Decker's market cap is nearly twice that of top appliance maker Whirlpool. At a high level, this suggests (but doesn't prove) that the tool business is more attractive than the appliance business.

Sears Holdings also has a large services business, which is probably still profitable. However, this revenue stream is quickly drying up as the company shrinks. In Sears' most recent quarter, services revenue plunged by 19% year over year to $435 million. Since services contracts are often attached at the time a product is purchased, this services business is likely to continue eroding rapidly as Sears Holdings shrinks its store base. This severely compromises its value.

Not enough assets to offset the liabilities

At the end of the third quarter, Sears had a negative book value to the tune of $4 billion. Assets on the books included $1.9 billion of property and $1.5 billion of goodwill and other intangible assets. The company expects to post another loss of at least $200 million for the fourth quarter, which will further reduce its book value.

In addition, even if management moved to wind down the company's retail operations as soon as possible -- which it has shown no sign of doing -- Sears Holdings would probably lose at least another $1 billion to $2 billion during that process. Severance pay, the cost of exiting leases, and inventory writedowns would all take a toll.

In total, the company's remaining real estate, brands, and ancillary businesses may be worth $5 billion or more. But they would probably need to be worth $10 billion for Sears Holdings shares to have any value. Based on the valuations realized for Sears Holdings' asset sales of the past few years, it seems very unlikely that Sears still has $10 billion of assets.