Finding a pure-play miner in the platinum metals group traded on a major U.S. exchange is actually rather difficult since Stillwater Mining Company was bought by Sibanye Gold Ltd in early 2017 to become Sibanye-Stillwater. But that doesn't mean you can't work the precious metal into your portfolio -- including direct exposure. Here's a quick primer on platinum, who mines for it, and the easiest way to buy into the platinum metals group if you are a platinum-group bull.

The other precious metal

Most people are well aware that gold and silver are precious metals. Platinum falls into this category as well. Indeed, you can buy jewelry made of the material just as easily as you can gold or silver. In fact, you might have some platinum group metals in your jewelry drawer and not even know it.

Image source: Getty Images.

Note that I use the term "platinum group." Gold and silver are distinct elements, as is platinum. However, when you talk about platinum, it's usually looked at as a group of six metals: platinum, palladium, rhodium, ruthenium, iridium, and osmium. The metals are found together in nature and are produced from the same ore. Thus they are looked at as a single group. You might have some platinum group metals in your jewelry collection even if you don't own platinum jewelry because white gold is often coated with rhodium to help it look more "white."

Jewelry, though, is only one use of the platinum group metals. You'll also find them in computers, mobile phones, fuel cells, airplanes, and glass, as well as throughout the medical industry. The largest use is in catalytic converters, which are put into automobiles and trucks to reduce emissions. That use accounts for around 50% of world demand for platinum, palladium, and rhodium combined, according to the International Platinum Group Metals Association (IPA).

The list of major platinum group miners that are members of the IPA include broadly diversified miners like Vale SA, where platinum group metals are just a small portion of the overall business, and more-focused names like Anglo American Platinum Ltd., which exclusively produces platinum group metals. Anglo American Platinum sounds like a great way to get exposure to the platinum group, but there are some wrinkles you'll want to know about before you jump in.

Who mines platinum?

That said, here are some of the notable platinum group metals producers:

| Company | Ticker |

| Anglo American Platinum Ltd (ADR) | (VALE 0.16%) |

| Impala Platinum Holdings Limited (ADR) | (IMPUY -3.79%) |

| Lonmin Plc (ADR) | (LNMIY) |

| Vale SA | (VALE 0.16%) |

| Sibanye-Stillwater | (SBSW -2.73%) |

Chart by author.

There are more names that I could have included, but the list starts to get obscure pretty quickly. And five is really enough to get the gist of why buying a miner focused on the platinum group is easier said than done. The first three names are all foreign companies traded over the counter. It's not that any of these companies are bad, but they can be harder to trade and find information on. Vale, as noted above, makes most of its money from other mining endeavors (notably producing iron ore). And Sibanye-Stillwater, which is traded on the New York Stock Exchange, is no longer a pure play, though it certainly offers broader exposure to the full precious metals space than many gold and silver miners would.

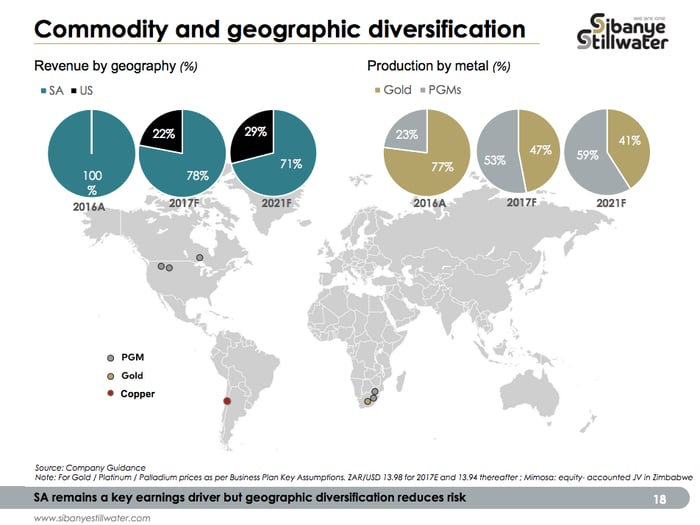

That's why, for most investors, Sibanye-Stillwater is probably still the best platinum group option if you are looking to own a miner. The company's production is split around 50/50 between platinum group metals and silver and gold. However, a key corporate goal is to increasingly shift that mix toward the platinum group, most recently with the proposed acquisition of Lonmin (which is why the relatively small miner was included in the list above). About 80% of the company's revenues are derived from South Africa, with the Americas accounting for the rest. That's a notable shift, since 100% of revenues were generated from South Africa as recently as 2016. Diversifying geographically is another corporate goal. Although not a pure play on platinum group metals, Sibanye-Stillwater provides notable and increasing exposure to the space from a company that is listed on the New York Stock Exchange.

A quick overview of Sibanye-Stillwater's changing portfolio. Image source: Sibanye-Stillwater.

If you are willing to delve into the over-the-counter market, then you might want to consider Anglo American Platinum. This is a reasonably large company, with a market cap of roughly $8 billion. However, know going in that liquidity and access to information can be an issue when you are dealing with over-the-counter names. That said, the miner generates virtually all of its revenue from the platinum group.

There's some good news here, with Anglo American Platinum increasing production by 4% in the first half of 2017 (like many foreign companies, it reports results only semiannually) and it was able to trim debt by nearly 20%. Its costs have been heading higher, which is not something unique to the miner or the platinum group. But the most interesting thing about the company's midyear update was the different directions in which platinum and palladium prices have been going. Which brings us to another option for investors.

Picking a metal

Although platinum prices have seen a nice rally since mid-December 2017, the metal's performance over the past year hasn't exactly been impressive. There have been several notable ups and downs, with the end result simply a modest gain of around 2%. Nothing to write home about. Palladium, on the other hand, has seen its price head steadily higher over the past 12 months. The gain over that span was nearly 40%.

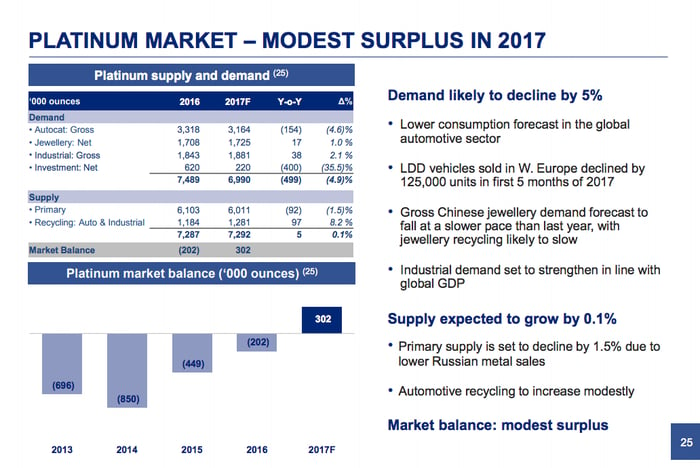

A midyear 2017 look at the platinum market. Image source: Anglo American Platinum.

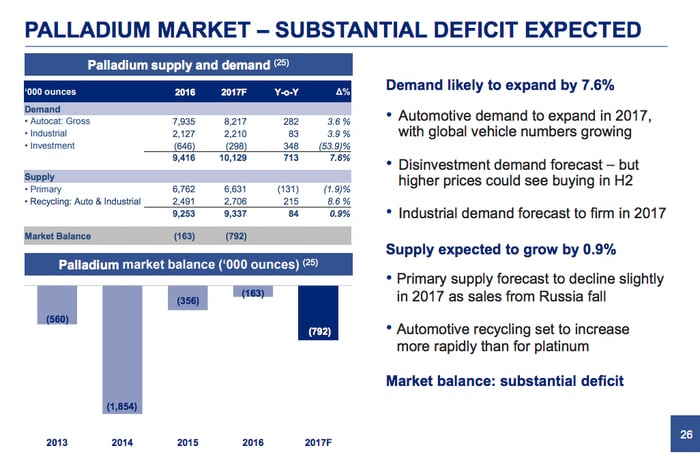

That's largely a result of supply and demand. There's too much supply in platinum, which is seeing reduced demand from the auto industry. Palladium, on the other hand, is currently dealing with a supply shortfall. Demand for this metal has been increasing in the auto and industrial sectors.

The big problem is that there's no easy fix for the imbalances now hitting the market. That's because platinum group metals all come from the same ore. When you mine for one, you are inherently mining for the other five members of the group. Fixing a shortfall in one and surplus in another isn't as easy as increasing or decreasing production of a single metal. And while auto manufacturers can substitute platinum for palladium, that requires a lot more than just switching the metals in and out of the production process. The price imbalance would need to be material enough to justify retooling the manufacturing. Looking at the big picture, there could be a palladium deficit of 1 million ounces each year between 2018 and 2020, according to Citigroup analysts.

A midyear 2017 look at the palladium market. Image source: Anglo American Platinum.

Which is why investors interested in the platinum group metals might prefer the option of buying exchange-traded funds (ETFs) that provide direct exposure to specific metals within the group. For example, ETFS Physical Platinum Shares (PPLT -1.27%) has been around since early 2010 and owns over 590,000 troy ounces of platinum stored in Switzerland and London. The fund's expense ratio is 0.60% per year. Of course, based on the supply/demand information above, you might not want to own this particular ETF unless you expect a notable upturn in demand and/or pricing for platinum.

That's where ETFS Physical Palladium Shares (PALL -1.29%) comes in. This ETF was started at roughly the same time as the platinum version above and has the same fee structure. But as the name implies, it owns nearly 230,000 troy ounces of palladium, also stored in Switzerland and London. This could be the ETF for you if you think the supply/demand imbalance that has led to notable price increases for palladium is going to persist and support further gains for this metal.

The big story here, however, is that a miner is inherently going to leave you investing in the entire platinum group. There may be some variance in how much of any one metal gets produced compared to the others on a company-by-company basis, but you can't pick and choose the individual metals. If that's what you prefer, look at an ETF like ETFS Physical Platinum or ETFS Physical Palladium.

The takeaway

There aren't nearly as many options for investing in the platinum group of metals as there are for investing in gold and silver. That doesn't mean you can't find a way to invest. You just need to be a little more open-minded about it. For most investors, Sibanye-Stillwater is probably the best option, as this New York listed precious metals miner looks to increase its exposure to the platinum group. For investors willing to venture over the counter, Anglo American Platinum is worth a look.

That said, if you'd rather have direct exposure to a single metal rather than broad exposure to the platinum metals group, then ETFs are the way to go. ETFS Physical Platinum and ETFS Physical Palladium are good options to examine here.