American Water Works (AWK 1.69%), one of the largest publicly traded water utilities in the United States, is a boring company. And that's a good thing when it comes to trying to figure out what the future holds for this key provider of water and wastewater services. In 2018 you should basically be expecting more of the same from American Water Works, and that includes continued capital spending, solid earning growth, and yet another dividend hike. Here's a quick primer on what you need to know.

The keys to growth

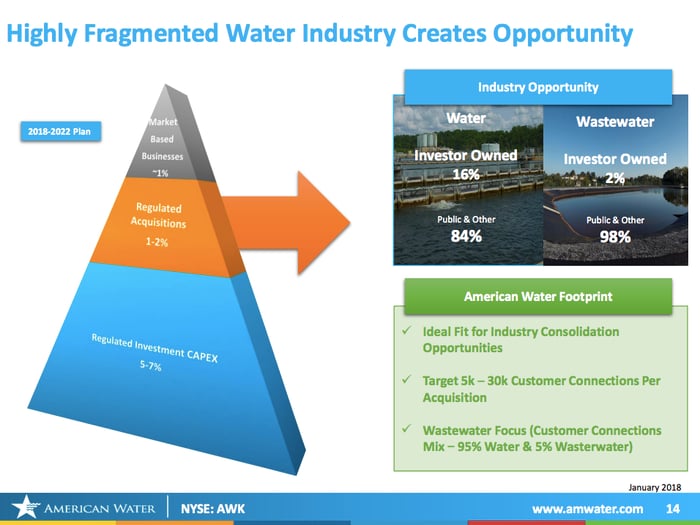

American Water Works grows in two very distinct ways. Acquisitions in the highly fragmented water sector are one key avenue for growth, and the other is capital investment in its current collection of assets. Together these two elements are expected to support up to 9% annualized earnings growth over the next five years. Another percentage point of growth is expected to come from non-regulated businesses, bringing the total to 10% a year, on average.

Image source: Getty Images

Acquisitions are a pivotal factor, but hard to predict. However, as one of the largest industry players with operations spread across 16 states, American Water Works has a broader reach than peers that only operate in a small handful of states. For comparison, Aqua America (WTRG 1.88%), the next largest water utility by market cap, has operations in half as many states.

This scale should translate into more opportunities to buy assets. It currently has three acquisitions pending, which will add roughly 23,000 new customers. Although it's impossible to predict what will happen with these deals, it's reasonable to expect notable progress on the purchases in 2018. More customers, of course, means more revenue.

You should also be on the lookout for additional deals. Roughly 85% of all water systems are publicly owned (that number is 98% in the wastewater space, a smaller part of American Water Works' business). As cash-strapped local governments look at the money needed to upgrade their water systems, they are likely to consider selling them. That not only raises cash for the municipality, but unloads the future cost burden of upgrading aging systems. That's a very big issue, especially considering the U.S. water system earned a frightening grade of D from the American Society of Civil Engineers -- remember that fact the next time you drink a glass of tap water!

American Water Works operates in a highly fragmented market. Image source: American Water Works

The benefit of a bad grade

Not only does the poor state of the U.S. water system bode well for American Water Works' deal-making, it also provides the backdrop for the company's capital spending plans. As a largely regulated utility, it has to get approval from the government if it wants to raise rates. The easiest way to justify price hikes is by spending to upgrade its systems. That grade of D suggests that regulators will be very receptive when American Water Works requests approval to increase what it is charging its customers.

In fact, capital spending is the single most important element in the company's growth plan. Such investment is expected to drive up to seven percentage points of the 10% annual growth the company expects in 2018 and each year through 2022. Over those five years American Water Works expects to spend around $7 billion to upgrade its systems. So not only should you expect solid growth in 2018, but in the following years as well. Look for around $1 billion (or so) in capital spending this year to support price increases across the company's water systems. And just for reference, it has five rate cases in the works right now.

The U.S. water system is in rough shape, which is good news for American Water Works and its shareholders. Image source: American Water Works

And all of that will support American Water Works' ability to raise its dividend. It's increased the payment annually for a decade, and you should look for another hike in 2018. The annualized dividend growth rate over the past three- and five-years was roughly 10%, so it's reasonable to expect a similar increase this year.

Another good year

American Water Works literally provides its customers with something they can't live without. And it has huge opportunities to grow via acquisition and capital investment in 2018 and beyond. That should support earnings and dividend growth of around 10% (or so) this year. It's the same story that's been playing out for years, and that will likely play out for years into the future. It's kind of a boring, repetitive story at this point, but sometimes boring can be very financially rewarding.

The only problem is that investors are well aware of this story by now, and the shares are trading near all-time highs despite a recent pullback. If you are already a shareholder it's likely you'll be pleased with the financial results American Water Works puts up in 2018. If you aren't a shareholder, you should wait for a larger pullback before jumping aboard.