I've written previously about how I believe that shrinking oil inventories and rising crude oil prices could spark a rally in energy service shares, and after seeing this company's fourth-quarter financial results, I'm increasingly convinced that now is the perfect time to add Core Laboratories (CLB) to portfolios. One of the best managed and most profitable energy service companies in the world, Core Labs is perfectly positioned for sales and profit growth because of increased spending on oil and gas exploration and production.

What's the backstory

Soaring crude and natural gas production in the U.S. shale market took a toll on commodity prices between 2014 and 2016; however, OPEC production cuts and global GDP growth has caused a tightening in inventory, and that's got prices rebounding.

IMAGE SOURCE: GETTY IMAGES.

The increase in oil prices is particularly good news for Core Lab investors because Core Labs' asset-light strategy and technology-oriented focus give it leverage to increase profit margins as oil companies spend more to maximize well production and increase reserves.

This isn't mere speculation, either. In Q4 2017, Core Labs earnings growth outpaced its revenue growth by a lot -- a trend I expect will continue in 2018.

Specifically, Core Labs' fourth-quarter revenue increased 14.9% year over year to $171.8 million, but its operating expenses only increased by 8.9%, and as a result, its operating margin swelled 4% to 19%, and its net income soared 41% to $21.7 million.

What caused Core Labs' margin to expand so much? The company says it was due to "higher-technology services and products being requested by Core's technologically sophisticated client base and improved utilization of our facilities."

In short, its profitability benefited from operating leverage. Importantly, I don't see any reason why that can't continue, because Core Labs' operating margins were about 30% prior to oil peaking in 2014.

Market leading metrics

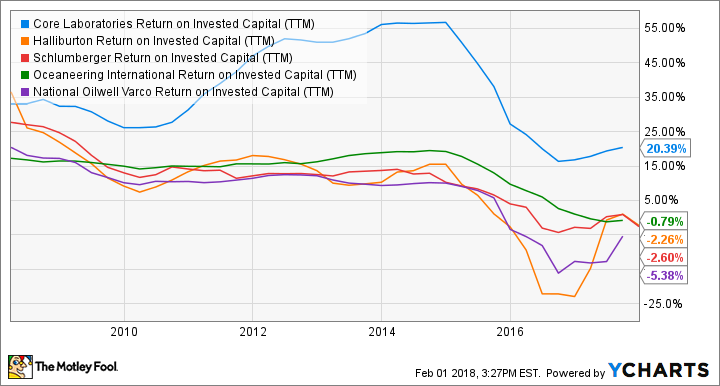

I'm a fan of companies that squeeze as much profit out of every dollar as possible, so I applaud the company's decision to focus heavily on maximizing its return on invested capital, or ROIC.

High ROIC companies tend to outperform low-ROIC companies, and according to Core Labs, it's got the highest ROIC in its peer group. As you can see in the following chart, that isn't new news, either. Over time, Core Labs has consistently outperformed other energy services companies on this metric.

CLB Return on Invested Capital (TTM) data by YCharts.

I also tend to favor companies with lots of free cash flow, and that's another area in which Core Labs excels. As a refresher, free cash flow represents cash from operations, in excess of capital expenditures, that's available to run a business and fund its non-discretionary obligations.

Core Labs' free cash flow was $41.4 million in Q4, and that means management is converting roughly 24% of every revenue dollar into free cash. That's better than most major oilfield service companies.

IMAGE SOURCE: GETTY IMAGES.

Why buy it now?

The big driver of Core Labs' success last quarter was the company's "production enhancement" business. That segment sells technology solutions for reservoir well completions, perforations, stimulations, and production. Demand from shale oil and gas producers has been strong, but shale sales accelerated last quarter as more wells were completed to take advantage of higher oil prices. As a result, that segment's sales shot up 51% year over year to $67.3 million, and operating income surged 480% year over year.

Shale wasn't the only reason Core Labs grew in Q4, though. The company is also beginning to benefit from an early-stage recovery in offshore demand. Historically, offshore exploration and production have cost more than land-based projects, so spending on offshore programs fell sharply when oil prices collapsed. Now that prices are increasing, companies are beginning to dust off their deepwater playbooks and that's got management predicting better times ahead. CEO David Demshur commented (emphasis mine):

One other trend that is beneficial to Core is the successful return to deepwater exploration and exploitation of reserves. With the recently announced Chevron Total Ballymore discovery in Mississippi Canyon, which cut 670 feet of net pay ... and Shell's potentially giant discovery in Alaminos Canyon, cutting over 1,600 feet of net pay -- this prospect was appropriately named the Whale prospect -- Core will benefit from increased activity in the offshore and deepwater activities throughout and into 2018 and 2019.

If shale production remains robust, and offshore markets start humming again, then I think Core Labs could end up growing its earnings substantially. Sure, anything can happen in the short term, but long term, I believe energy companies will need to embrace solutions that boost well production and extend the life of wells, both on land and offshore. If I'm right, then adding Core Labs to portfolios now could be a very profit-friendly decision.