If you've overlooked the boring old pulp and paper industry on your wealth-building journey through the stock market, you can be forgiven. There's not much excitement to growing trees in sustainable farms, chipping the wood, shipping it to a centralized facility, processing it into pulp, and then turning it into a valuable consumable product that's most likely an afterthought for most consumers. Cotton swabs, cardboard boxes, envelopes, and the like all serve a purpose, but are quickly discarded after that.

Despite being mostly ignored in our daily lives, consumable paper products present a lucrative opportunity for companies that can efficiently manufacture them. International Paper (IP 0.31%) serves as a great example. Among other things, it's best known for being one of the lowest-cost producers of cardboard in North America, which has helped to propel it to the upper echelon of reliable dividend stocks.

Never considered it for your portfolio? Well, here are three great reasons to buy International Paper stock after another strong year of operations in 2017.

Image source: Getty Images.

1. Downstream play on e-commerce

It may seem counterintuitive, but throughout history, the rise of digital technologies has almost always amplified the demand for paper products. The latest example: International Paper's business has piggybacked on the incredible rise of e-commerce and online shopping. Think about it: Most of the things you order from Amazon.com have to be packaged and shipped to you in one piece, and the cheapest way to do that for most items is usually with a cardboard box.

International Paper is one of the largest and lowest-cost producers of containerboard (which includes cardboard) in the world. Its industrial packaging unit -- the segment that reports cardboard sales -- comprised 69% of total revenue and 75% of total operating income last year. It reported record volumes in the fourth quarter of 2017. It could get better. The North American containerboard market has some strong tailwinds right now.

The industry is expected to grow total shipments each year for the foreseeable future, a trend that began in 2013. After pumping out 376 billion square feet of cardboard in 2016, shipments are forecast to reach a new all-time high of 408 billion square feet in 2020 and continue growing from there.

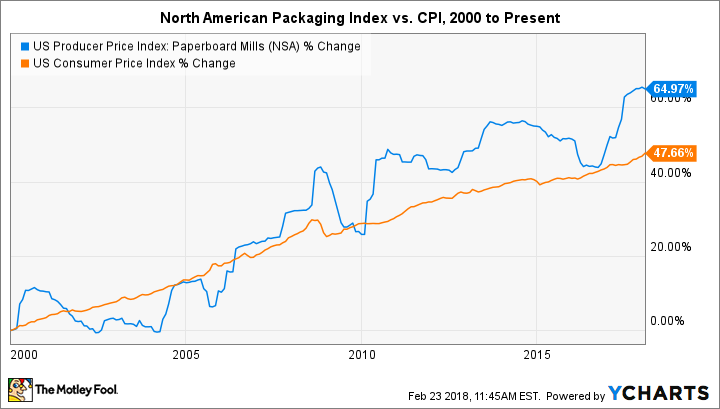

More important for investors is that containerboard demand is soaring as prices remain at all-time highs. Both trends are reflected in the North American Packaging Price Index, which essentially tracks all the things you call "cardboard," and its relationship to the Consumer Price Index. Historically, CPI has outpaced the packaging benchmark, but that has been flipped on its head with the emergence and domination of online shopping. That also hints that demand and prices will remain strong for the foreseeable future.

U.S. Producer Price Index: Paperboard Mills data by YCharts.

In other words, we're living in a golden age for cardboard. I'll admit that's not exactly the most exciting rallying cry, but it remains a critical driver for International Paper stock.

Image source: Getty Images.

2. Free cash flow galore

Looks can be deceiving. International Paper has taken a scalpel to operations in recent years, offloading noncore businesses and assets to focus on the best performers or those with the best growth prospects. So although total revenue and cash flow appear to have been in decline, that's not the case when looking only at continuing operations.

Case in point: If you only look at the totals, then it may seem as if International Paper's operating cash flow has fallen for three consecutive years. That's simply not the case, nor is it really the metric to focus on. The business delivered a whopping $2 billion in free cash flow in 2017 and has averaged $1.9 billion for the last five years.

That's an important consideration for any income investor, but doubly true for those interested in International Paper. Why? Management has committed to returning 40% to 50% of free cash flow to shareholders in the form of dividend distributions and share buybacks. The result: $769 million in dividends were paid last year, a 24% increase from the amount distributed in 2014. Given the maturity and stability of the business, and the trends in its largest market, investors should feel pretty comfortable with the current 3.2% yield -- and the company's ability to grow that over time.

Image source: Getty Images.

3. Aggressive pursuit of growth opportunities

Aggressive is a relative term, but for a pulp and paper company, International Paper has been just that in recent years. It owns half of a 50-50 joint venture called Ilim Group, which is the largest foreign-domestic alliance in the Russian forest sector. That's saying something, considering Russia has a lot of forests.

As far as investors are concerned, Ilim has been a success despite some early struggles. It's the largest producer of both pulp and paper in Russia, which is proving quite valuable thanks to its geographic proximity to the world's fastest-growing pulp market: China. In 2017, it posted total sales of $2.1 billion, and although revenue is not consolidated on International Paper's income statement, the joint venture did contribute $183 million in equity earnings for the year.

Things are about to get a lot better. First-quarter 2018 equity earnings are expected to be $80 million to $90 million. Continued strength in regional markets promise to deliver a record year for the joint venture, while growth in China and vast potential in Russia's largely untapped forests hint at above-average growth contributions for years to come.

Throw in a new growth project coming on line in Spain, as well as expanding and strengthening operations in Brazil, and International Paper's "aggressive" global growth and diversification strategy appears to be paying off.

The case for buying this boring stock

While it's easy to chase shiny objects as an investor, there's a lot of value in an investing strategy that focuses on mature cash cows. The problem is those businesses are often boring, or at least no-nonsense, which rarely grabs headlines. International Paper certainly doesn't run the flashiest business, but it does own a well-run fleet of operations in an important and growing industry. If you like stable dividends over 3%, then you should strongly consider buying this stock.