Some investors cling to gold as a safe haven in a storm, but it can also be dead money if you are buying it directly via coins and bars. If you are thinking about buying gold bullion, you might want to consider some alternatives. We asked a team of Motley Fool investors to come up with some.

The trio of stocks below may seem like an odd collection for an investor looking at gold, but they all provide income, are relatively low-risk, and have a history of enhancing their businesses over time. Physical precious metals just don't match up with that. So step back and look at Verizon Communications (VZ -1.28%), MPLX LP (MPLX 0.28%), and, in case you're really set on a precious-metals play, Franco-Nevada Corp. (FNV 0.68%).

The gold standard in telecommunications

Travis Hoium (Verizon Communications): If you're looking to preserve wealth and maybe generate a little income and growth, Verizon Communications is a better pick than gold. The company sells a telecommunications product that's become a staple in the United States, and has spent billions on building a network that keeps competitors at bay by offering its customers better service.

There's a world of opportunity beyond physical gold. Image source: Getty Images

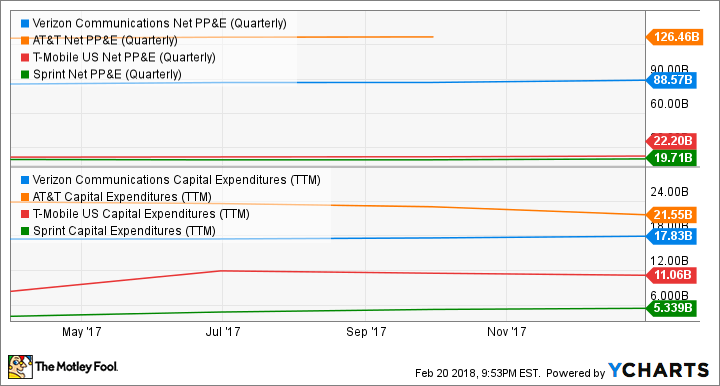

The cellular market in the U.S. is a competition between four players -- Verizon, AT&T, T-Mobile US, and Sprint -- but it's really Verizon and Sprint that have a duopoly at the top of the market. That'll be important as both companies build their 5G networks over the next few years. The scale advantage can be seen in the net property, plant, and equipment, and the capital expenditures below:

VZ Net PP&E (Quarterly) data by YCharts.

Verizon's 4.7% dividend yield is also a nice payout for investors looking for income. But it's the dividend combined with the growth potential of 5G that makes me excited about the stock. Verizon will play a big role in enabling new technologies like self-driving vehicles, virtual reality, in-home wireless streaming, and technology that we don't know of yet. As a key platform other companies can build on, Verizon is well-positioned for years to come.

All the traits you want in a well-managed MLP

Tyler Crowe (MPLX LP): MPLX is a rather young master limited partnership -- Marathon Petroleum (MPC -0.78%) spun it off in 2012. For some investors, youth isn't a desirable trait in a company because it doesn't provide much of a track record to measure the company's management team. Investors with lower risk tolerance want a long history that shows management can handle the ups and downs of the market. But tenure aside, MPLX looks like an incredibly promising prospect to consider.

There are three things you want to see from an oil and gas midstream partnership more than anything else: a manageable debt load; enough operating cash to cover distributions, with some left over to reinvest in the business; and a corporate structure where all owners' interests are in line. Since its inception, MPLX has managed the first two things well. At the end of the most recent fiscal year, the company had a net debt-to-EBITDA ratio of 3.3 -- less than 4.5 is considered conservative in this industry -- and its distribution coverage ratio was 1.28. What's more impressive is that it has been able to maintain these rather conservative metrics while increasing its payout by 122% over the past five years.

The one thing missing from the equation was the corporate structure, but that changed last quarter, when the company closed a deal with Marathon Petroleum to eliminate its general-partner stake -- and the special rights that came with that -- for a limited-partner stake in common units like those available on the open market. Getting rid of Marathon Petroleum's general-partner stake should lower the cost of capital for MPLX to grow the business. It also helps that Marathon's interests are more in line with common unitholders, so the company will look to grow the value of those units rather than its specialty units.

With shares of MPLX trading at an enterprise-value-to-EBITDA ratio of 11.2 and a distribution yield of 7%, this midstream company looks like the kind of low-risk investment that investors who seek out contrarian investments, like gold, could warm to quickly.

Gold has a place

Reuben Gregg Brewer (Franco-Nevada Corp.): Although you may not want to tie up your capital in physical gold -- coins and bullion -- you might still be interested in the diversification benefits that gold can offer. That's understandable in any phase of the market, since gold tends to go up when stocks are going down, as investors seek out safe havens for their cash.

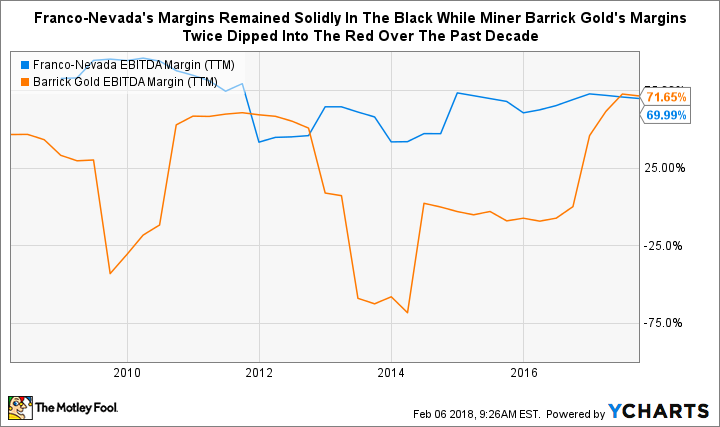

One way to get gold's benefits without having to buy gold, or even shares of a gold miner, is to pick up shares of streaming and royalty company Franco-Nevada Corp. Franco-Nevada provides cash to miners in exchange for the right to buy precious metals at reduced rates in the future. These agreements generally lock in low prices, and help the streaming company to support wide margins even during mining industry downturns.

FNV EBITDA Margin (TTM) data by YCharts.

Meanwhile, it's probably best to think of Franco-Nevada as a specialty finance company with a portfolio of mine investments. The company has roughly 340 investments, including around 80 in the oil and gas sector (it gets about 7% of its revenue from oil royalties); you won't find a miner with that level of diversification.

One more thing to like is that Franco-Nevada has increased its dividend for 10 consecutive years. Although the yield is relatively small at 1.2%, dividend hikes give you something to hold onto when gold prices are falling. So don't waste your money on gold, but do consider adding Franco-Nevada to your portfolio.

Don't get stuck on bullion

There are reasons to consider buying physical gold that make complete sense, including the collapse of the global financial system...and a zombie apocalypse. (That second one is a joke, I hope.) But the bigger picture here is that bullion is just bullion, nothing more. Beyond a small stash in case of an emergency, it doesn't do much for you unless you're trying to time the gold market, and market timing is not usually the best investment plan.

This is why you might want to consider a company like Verizon that supports vital technology while throwing off a nice dividend. Or look at MPLX, a young, high-yielding limited partnership with a supportive parent and plenty of growth opportunity in the vital energy space. And, if you really have gold on your agenda, Franco-Nevada provides a rising dividend and a unique, diversified way to invest in precious metals without actually owning them.