Procter & Gamble (PG 1.52%) is one of the most profitable -- and dominant -- businesses on the market. Its tight grip on global consumer staple niches including diapers, paper towels, and detergent has led to an amazing streak of earnings growth. Those steady profits have in turn supported one of the longest-running dividends investors can buy today.

Yet P&G recently closed another year of weak sales growth, and the latest operating trends disappointed shareholders enough that they chose to reject management's advice and elevate a new voice to the board of directors.

Image source: P&G.

Let's take a look at the prospects for this stock as its executive team welcomes activist investor Nelson Peltz into P&G's boardroom.

Sluggish sales results

Market share is the metric that makes the biggest difference to P&G's long-term earnings gains. As management explains in the 10-K report, the company requires "organic sales growth above market growth rates" to power the mid-to-high single-digit profit boost shareholders have come to expect from the consumer products giant.

The problem is, it hasn't achieved that goal for several years now. In fact, P&G shed market share across each of its five core product divisions in 2017, led by a 0.7% decline in the grooming segment. Organic sales ended up inching higher by 2%, and while that beat rival Kimberly Clark (KMB 1.66%), it still translated into lower overall market share.

Image source: Getty Images.

The good news is that the pace of decline has moderated. According to executives, P&G is holding or expanding market share in about half of its top product segments, up from one-third in mid-2016. As a result, the company is calling for its third straight (minor) improvement in growth as organic sales rise by between 2% and 3% this fiscal year.

Healthy profits

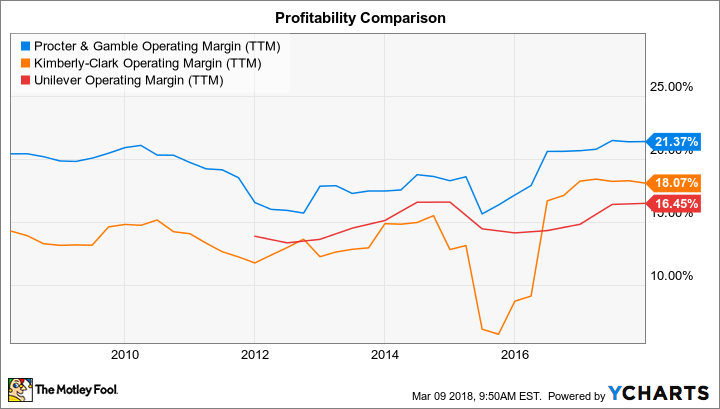

P&G's new board of directors will have less to debate when it comes to cost-cutting strategies. After all, thanks to an aggressive savings initiative that's cleaved over $10 billion from its expense infrastructure, P&G already enjoys some of the best profit margins in the business. Operating margin improved to 22.1% of sales last year, up from 19.6% in fiscal 2015. Rivals Kimberly Clark and Unilever have been busy slashing costs, too, but they each trail that result by a wide margin.

PG Operating Margin (TTM) data by YCharts.

These wins have helped keep P&G among the most financially sturdy businesses around. It routinely turns over 90% of its net earnings into free cash flow, which gives management tons of flexibility to invest in the business while sending plenty of excess cash to shareholders.

Looking ahead

Its prime market position and healthy profits mean a P&G investment should deliver modest returns to shareholders, with little risk of a plunging stock price. However, market-beating growth won't happen until the company accelerates its expansion pace to the point that it is finally winning market share again. Fiscal 2017 was P&G's first year with its new, more focused portfolio, and that transformation didn't quite deliver on management's growth expectations.

The difference today is that executives know investors aren't giving the team much slack. "There is broad shareholder support for P&G's strategies," P&G said in December, but "at the same time, shareholders indicated that P&G needs to move faster to deliver improved results."

Investors will find out over the next few quarters whether P&G's current growth strategies are good enough, or whether continued sluggishness gives the new board of directors ammunition to push for more aggressive strategic moves.