Strength in the auto industry has lifted key companies in the sector for a long time, but technological innovation has also played a key role in driving the industry forward. Tesla (TSLA 2.33%) has taken the electric vehicle niche by storm, putting together a lineup that could eventually go from roadsters to semi-tractor trailer trucks for commercial purposes. Meanwhile, Ford Motor (F 0.62%) has stuck to its guns, combining its existing domination of vital parts of the automotive product spectrum with efforts to modernize and keep up with the pace of innovation throughout the industry.

Investors have been so excited about CEO Elon Musk and his vision for the future that they've rewarded Tesla with a market capitalization that's well higher than Ford's. Yet there's still controversy among investors about which stock is a better choice right now. Let's look more closely at both Tesla and Ford for clues as to which one deserves a spot in your portfolio.

Image source: Tesla.

Stock performance and valuation

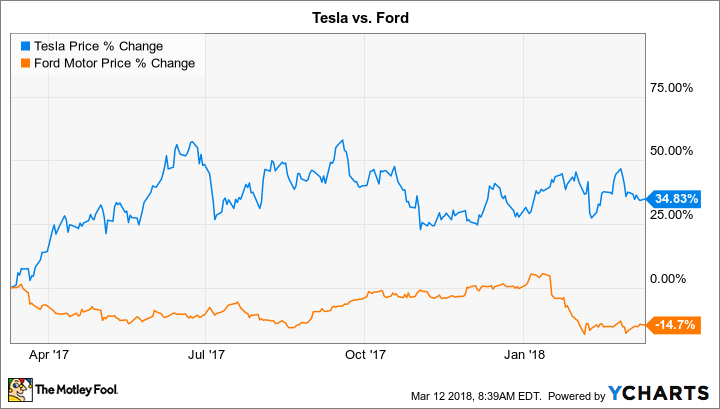

Tesla and Ford have been going in opposite directions lately. The up-and-coming electric car specialist is up 35% over the past year. Ford is down 15% since March 2017.

With well-established automakers, valuation metrics like price-to-earnings ratios can be handy. Yet using such analysis with Tesla quickly becomes fruitless, because the electric vehicle company hasn't been consistently profitable and is unlikely to start making money on a regular basis until 2019. Ford, on the other hand, has extremely low earnings-based valuations, reflecting in part many of the legacy obligations it has on its balance sheet. Tesla trades at nearly five times sales, compared to just 0.25 times sales for Ford, and disparities in other measures like price-to-book are similarly wide. Traditional value investors would say that Tesla is incredibly expensive right now, while others would point to disparities in potential growth rates, as we'll see in greater detail below.

Dividends

If you want a dividend, Ford's your only choice between these two companies. Tesla doesn't pay a dividend and isn't likely to anytime in the near future. Ford has a high yield of 5.6% and has made dividend payouts even with the turbulence in the auto industry over the past decade.

Ford never declared bankruptcy in the aftermath of the financial crisis and recession of 2008, but there was a period of more than five years in which it chose to suspend dividend payouts. Yet in 2012, the automaker came back with a dividend, and over the past several years, it has gradually made increases that eventually led to a tripling of its regular quarterly payout as well as a number of additional special dividend payments.

Investors shouldn't expect Tesla to pay a dividend even once it becomes profitable, because the company constantly reinvests into new innovation. For those for whom income is a necessity, Ford is the better stock of the two.

Growth prospects and risks

Both Tesla and Ford have had opportunities and challenges lately. Much of the focus on Tesla has centered on its ability to ramp up production, especially given strong demand for the mass-market Model 3 sedan and the continued interest in the higher-end Model X. Yet one area many casual investors have largely ignored is the energy storage industry, where Tesla is trying to use the expertise it has developed in battery technology to broaden its scope beyond the auto industry toward providing efficient solutions for a wider variety of problems. With the SolarCity business having been integrated into Tesla, solar power generation offers opportunities to build out more localized power infrastructure, and in the long run, coming up with alternatives to the conventional wide-scale power grid could be an even bigger growth prospect for Tesla than its vehicles.

Ford has had more mixed experiences lately, with consistently solid profitability but lackluster stock performance. The past year has seen Ford bring a new CEO on board and start to make transitional moves to bring the automaker more firmly onto the cutting edge of the industry. An emphasis on integrating electric-vehicle concepts into its line of cars and trucks, working on self-driving vehicles, and fleshing out wireless internet access and all of the capabilities it can bring should help Ford accelerate. Yet those initiatives will cost money, and investors are rightly nervous about whether and how quickly the massive automaker can pivot to take advantage of new areas for growth.

Whether Tesla or Ford is a better buy right now really depends on your temperament as an investor. Value investors with a need for dividend income will see Ford as a low-price bargain opportunity, although some who've owned the stock will complain that it's been a value trap in recent years. Tesla offers growth investors plenty of opportunity for huge future gains, but the risks involved with the upstart are arguably greater -- or at least harder to pin down -- than what Ford faces right now.