JD.com (JD 2.08%) is the second largest e-commerce company by market share in China. Therefore, it's often compared to the market leader, Alibaba (BABA 2.59%), which owns the Taobao and Tmall marketplaces.

However, many investors misunderstand the differences between JD and Alibaba, and jump to the conclusion that the former can't compete against the latter. So today I'll dispel three common misconceptions about JD's ability to compete against Alibaba.

Image source: JD.com

Misconception #1: "It directly competes against Alibaba"

JD.com owns an integrated B2C (business-to-consumer) platform. This means that JD sells its goods directly to consumers. Its products are split between two categories -- products which it buys and resells to consumers, and products it lets businesses directly sell to consumers.

Either way, JD takes possession of the inventories and fulfills the orders with its own first-party logistics network. This business model is similar to Amazon's (AMZN 1.30%) -- it racks up high expenses, but it filters out questionable merchants and products while ensuring that orders are quickly fulfilled.

Alibaba owns two platforms -- its C2C (consumer-to-consumer) marketplace Taobao, and its B2C marketplace, Tmall. Taobao runs a business model similar to that of eBay (EBAY 0.61%), wherein consumers sell products to each other and are responsible for fulfilling orders. This business model has lower overhead costs, but it's harder to oversee the quality of the vendors and goods.

Tmall lets businesses, instead of individuals, sell products directly to consumers. It's more tightly regulated than Taobao, but Alibaba still doesn't take possession of the goods as JD does. It also outsources the logistics to third-party courier services.

That's why Alibaba has much higher operating margins than JD -- not because it runs a superior business, but because it has a lower-cost model with less control and accountability.

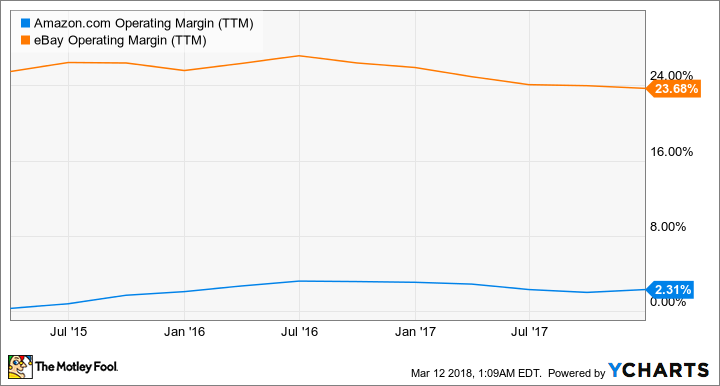

Source: YCharts

We can see a similar difference between eBay and Amazon's margins. But this apples-to-oranges comparison doesn't indicate that eBay has a superior business model to Amazon.

Source: YCharts

Misconception #2: "Margins will drop due to a price war with Alibaba"

The bears often point to Alibaba's margins and claim that JD can't survive a "price war" against Tmall. Pricing pressure is certainly a headwind for both companies, but most of the pressure on JD's bottom line doesn't come from matching Tmall's prices -- it comes from rising investments in logistics, marketing, and new technologies.

These investments include unmanned shops, similar to Amazon Go, drone deliveries to rural areas, and the use of blockchain to streamline its supply chain. All these moves should reduce its operating expenses over the long term as its marketplace expands.

Image source: Getty Images.

Alibaba is investing more in logistics and new technologies like blockchain, but it's also distracted by investments in movies, music, streaming media, cloud services, mobile payments, online-to-offline services, online search, and big investments in brick-and-mortar retailers.

Alibaba's feverish evolution into a jack of all trades (but master of none) could inadvertently benefit JD as the latter strengthens its e-commerce platform.

Tencent (TCEHY 3.56%) -- which owns WeChat, the most popular messaging app in China -- is also JD's biggest investor. Tencent already pools its WeChat user data with JD's shopper data, integrates JD's marketplace into its app, and lets JD shoppers check out with WeChat Pay. Tencent and JD also co-invested in other retailers, and Tencent focuses on countering Alibaba's ecosystem expansion so JD doesn't have to.

3. Misconception #3: "It's losing market share to Alibaba"

If Alibaba had JD on the ropes, its market share should have expanded over the past few years. Yet the opposite has happened.

Between 2014 and 2017, Tmall's share of China's B2C market fell from 55% to 51%, according to Analysys International Enfodesk. During the same period, JD's share surged from 18% to 33%.

JD's growth was fueled by Tencent's support and the collapse of smaller B2C marketplaces. Moreover, JD became the ideal partner for any company that wanted to halt Alibaba's advance -- including Baidu, which shares its user data with JD and integrates its marketplace into its app; and Walmart, which is partnered with JD in food deliveries, order fulfillments, and online payments.

The bottom line: Don't be scared of Alibaba

Alibaba is the big bad wolf of this story, but I believe that JD's brick house -- which is reinforced by steel pillars from Tencent, Baidu, Walmart, and other companies -- can't be blown over.

That's why Wall Street still expects JD's revenue and earnings to rise 30% and 50%, respectively, this year. Once the market realizes that JD, not Alibaba, is actually the "Amazon of China", the stock could skyrocket over the next few years.